BPKBPK

Jurnal Tata Kelola dan Akuntabilitas Keuangan NegaraJurnal Tata Kelola dan Akuntabilitas Keuangan NegaraStrengthening local taxing power is a crucial element in addressing the insufficient capacity of regional governments to manage their regional assets effectively. This study seeks to identify approaches for strengthening local taxing authority within local administrations. Employing a case study methodology, the research focused on the Jombang regional government, which has a regional tax ratio of 0.6%, significantly lower than the 3% benchmark established by the Ministry of Finance. A content analysis of the data was performed to identify the Strengths, Weaknesses, Opportunities, and Threats (SWOT) in strategy development. The findings suggest that the advised strategy falls within Quadrant I, representing the Strengths–Opportunities (S-O) combination, indicating an aggressive and proactive approach. The S-O strategy refers to leveraging strengths or advantages to seize and capitalize on available opportunities. The suggested operational steps include (1) intensification and extensification; (2) adding tax payment channels; (3) integration/data exchange with other government agencies; (4) intensification of law enforcement cooperation; (5) strengthening regional tax regulations; and (6) improving the quality of human resources. While numerous studies have addressed regional tax management, this research is novel in its focus on developing regional tax enhancement strategies through a comprehensive SWOT analysis.

Based on the SWOT analysis conducted, the most suitable strategy for the Jombang Regional Revenue Agency is a combination of strengths and opportunities (S-O).This indicates an aggressive and proactive position, allowing the agency to leverage its strengths to capitalize on existing opportunities.The recommended operational steps include intensifying and extending tax collection efforts, adding more tax payment channels, integrating data with other government agencies, strengthening law enforcement cooperation, reinforcing regional tax regulations, and improving the quality of human resources.This approach is expected to enhance local taxing power and improve regional tax management in Jombang Regency.

Penelitian lanjutan perlu dilakukan untuk mengeksplorasi efektivitas implementasi strategi S-O yang direkomendasikan, dengan fokus pada pengukuran dampak peningkatan intensifikasi dan ekstensifikasi terhadap penerimaan pajak daerah. Selain itu, studi komparatif antara Jombang dengan daerah lain yang berhasil meningkatkan rasio pajak daerah dapat memberikan wawasan berharga mengenai praktik terbaik dan faktor-faktor kunci keberhasilan. Lebih lanjut, penelitian perlu menginvestigasi potensi penerapan teknologi digital, seperti kecerdasan buatan dan analisis data besar, untuk meningkatkan efisiensi dan efektivitas administrasi pajak daerah, termasuk deteksi dini potensi kecurangan dan optimalisasi penagihan pajak. Penelitian ini harus mempertimbangkan aspek keamanan data dan privasi wajib pajak. Terakhir, studi mendalam mengenai pengaruh budaya organisasi dan motivasi kerja terhadap kinerja petugas pajak di Jombang dapat membantu mengidentifikasi area-area yang memerlukan peningkatan untuk mencapai hasil yang optimal.

- Business Perspectives - The institutional model of tax administration and aspects of its development.... businessperspectives.org/journals/investment-management-and-financial-innovations/issue-290/the-institutional-model-of-tax-administration-and-aspects-of-its-developmentBusiness Perspectives The institutional model of tax administration and aspects of its development businessperspectives journals investment management and financial innovations issue 290 the institutional model of tax administration and aspects of its development

- Taxation in the Digital Economy | New Models in Asia and the Pacific |. taxation digital economy models... doi.org/10.4324/9781003196020Taxation in the Digital Economy New Models in Asia and the Pacific taxation digital economy models doi 10 4324 9781003196020

- SWOT Analysis - Handbook of Improving Performance in the Workplace: Volumes 1â3 - Wiley Online... onlinelibrary.wiley.com/doi/10.1002/9780470592663.ch24SWOT Analysis Handbook of Improving Performance in the Workplace Volumes 1yAAAa3 Wiley Online onlinelibrary wiley doi 10 1002 9780470592663 ch24

| File size | 591.7 KB |

| Pages | 17 |

| Short Link | https://juris.id/p-1cn |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

ISI YogyakartaISI Yogyakarta Karakteristik musikal ini secara kolektif menegaskan peran Lagu Rakyat Pingxian sebagai media untuk memelihara identitas etnis dan keberlanjutan budaya.Karakteristik musikal ini secara kolektif menegaskan peran Lagu Rakyat Pingxian sebagai media untuk memelihara identitas etnis dan keberlanjutan budaya.

UNUKALTIMUNUKALTIM Berdasarkan hasil penelitian dan pengolahan data-data yang diperoleh, maka dapat disimpulkan bahwa penerapan nilai-nilai kepemimpinan yang melayani memilikiBerdasarkan hasil penelitian dan pengolahan data-data yang diperoleh, maka dapat disimpulkan bahwa penerapan nilai-nilai kepemimpinan yang melayani memiliki

UNUKALTIMUNUKALTIM Penelitian ini membahas strategi kepemimpinan perubahan yang efektif dalam sebuah lembaga pendidikan. Dengan pendekatan kualitatif, studi ini mengeksplorasiPenelitian ini membahas strategi kepemimpinan perubahan yang efektif dalam sebuah lembaga pendidikan. Dengan pendekatan kualitatif, studi ini mengeksplorasi

UNUKALTIMUNUKALTIM Hasil penelitian menunjukkan bahwa SMP Negeri 39 Samarinda telah melakukan strategi perencanaan berdasarkan analisis SWOT untuk mengidentifikasi kebutuhanHasil penelitian menunjukkan bahwa SMP Negeri 39 Samarinda telah melakukan strategi perencanaan berdasarkan analisis SWOT untuk mengidentifikasi kebutuhan

UNUKALTIMUNUKALTIM Hasil ini menunjukan peningkatan kinerja guru secara langsung membawa kualitas pendidikan di SD Negeri 011 Samarinda Seberang meningkat. Kepemimpinan yangHasil ini menunjukan peningkatan kinerja guru secara langsung membawa kualitas pendidikan di SD Negeri 011 Samarinda Seberang meningkat. Kepemimpinan yang

UNUKALTIMUNUKALTIM Hasil penelitian menunjukkan bahwa Kepala MTs Al Mujahidin 2 Samarinda menerapkan berbagai gaya kepemimpinan seperti mengarahkan, melatihi, berpartisipasi,Hasil penelitian menunjukkan bahwa Kepala MTs Al Mujahidin 2 Samarinda menerapkan berbagai gaya kepemimpinan seperti mengarahkan, melatihi, berpartisipasi,

UNUKALTIMUNUKALTIM Untuk mengumpulkan informasi yang diperlukan, peneliti menerapkan berbagai teknik, termasuk wawancara, observasi, dan dokumentasi. Dari hasil penelitianUntuk mengumpulkan informasi yang diperlukan, peneliti menerapkan berbagai teknik, termasuk wawancara, observasi, dan dokumentasi. Dari hasil penelitian

STKIP PERSADASTKIP PERSADA Dengan demikian, model pembelajaran Picture and picture merupakan solusi yang efektif untuk mengatasi masalah pembelajaran yang kurang optimal dan hasilDengan demikian, model pembelajaran Picture and picture merupakan solusi yang efektif untuk mengatasi masalah pembelajaran yang kurang optimal dan hasil

Useful /

RESEARCHSYNERGYPRESSRESEARCHSYNERGYPRESS Desain deskriptif-korelasi digunakan dengan survei melalui Google Forms kepada 100 investor anggota grup trading pribadi di suatu provinsi. Analisis dataDesain deskriptif-korelasi digunakan dengan survei melalui Google Forms kepada 100 investor anggota grup trading pribadi di suatu provinsi. Analisis data

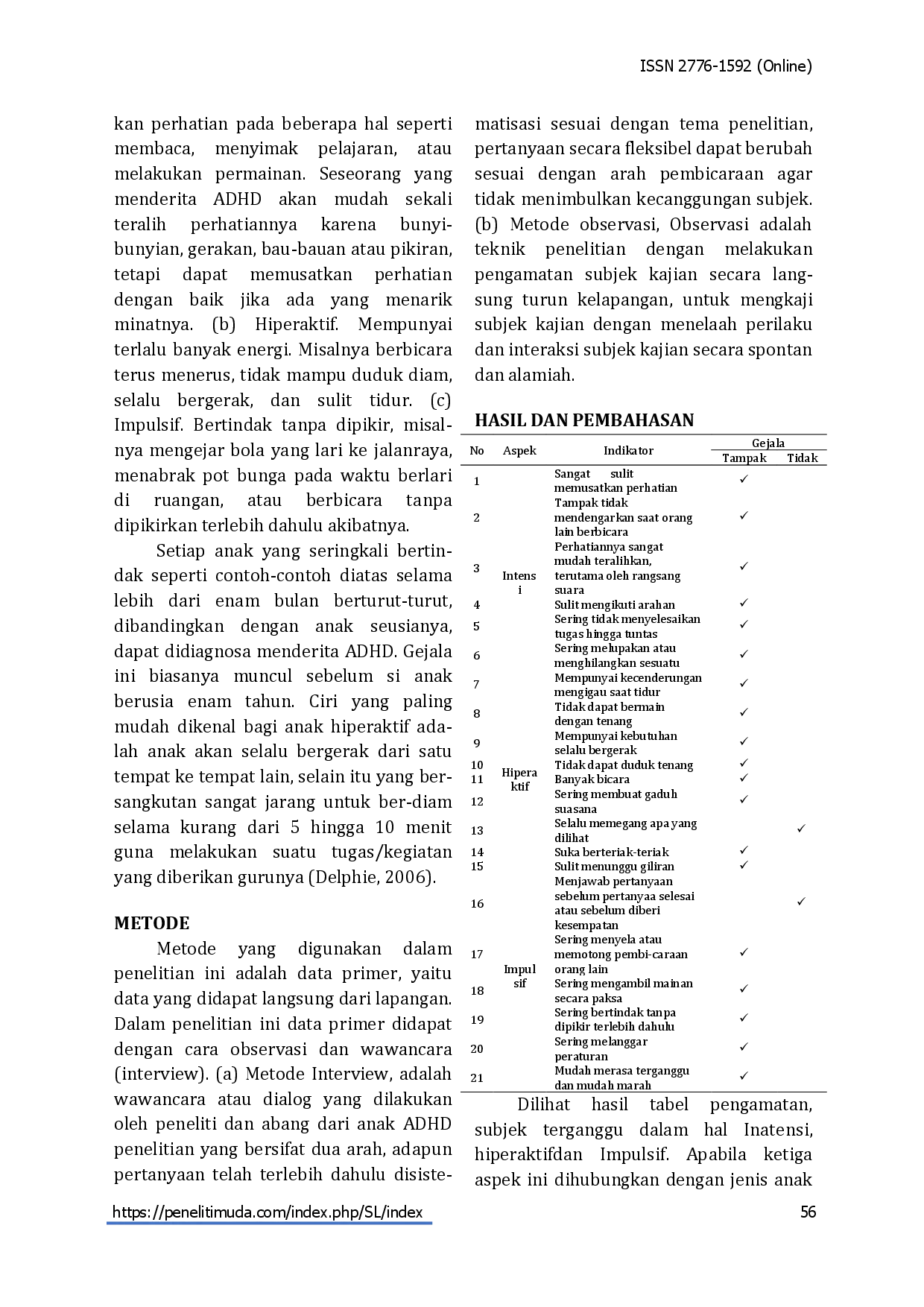

PENELITIMUDAPENELITIMUDA Anak ADHD sangat mudah terganggu oleh rangsangan yang tiba-tiba diterima oleh panca inderanya atau oleh perasaan yang muncul saat itu. Hal ini akan mempengaruhiAnak ADHD sangat mudah terganggu oleh rangsangan yang tiba-tiba diterima oleh panca inderanya atau oleh perasaan yang muncul saat itu. Hal ini akan mempengaruhi

ILOMATAILOMATA Dengan dukungan TI, usaha mikro, kecil, dan menengah (UMKM) dapat memperluas jangkauan pasar, mempercepat aliran dana dari penjualan, dan meningkatkanDengan dukungan TI, usaha mikro, kecil, dan menengah (UMKM) dapat memperluas jangkauan pasar, mempercepat aliran dana dari penjualan, dan meningkatkan

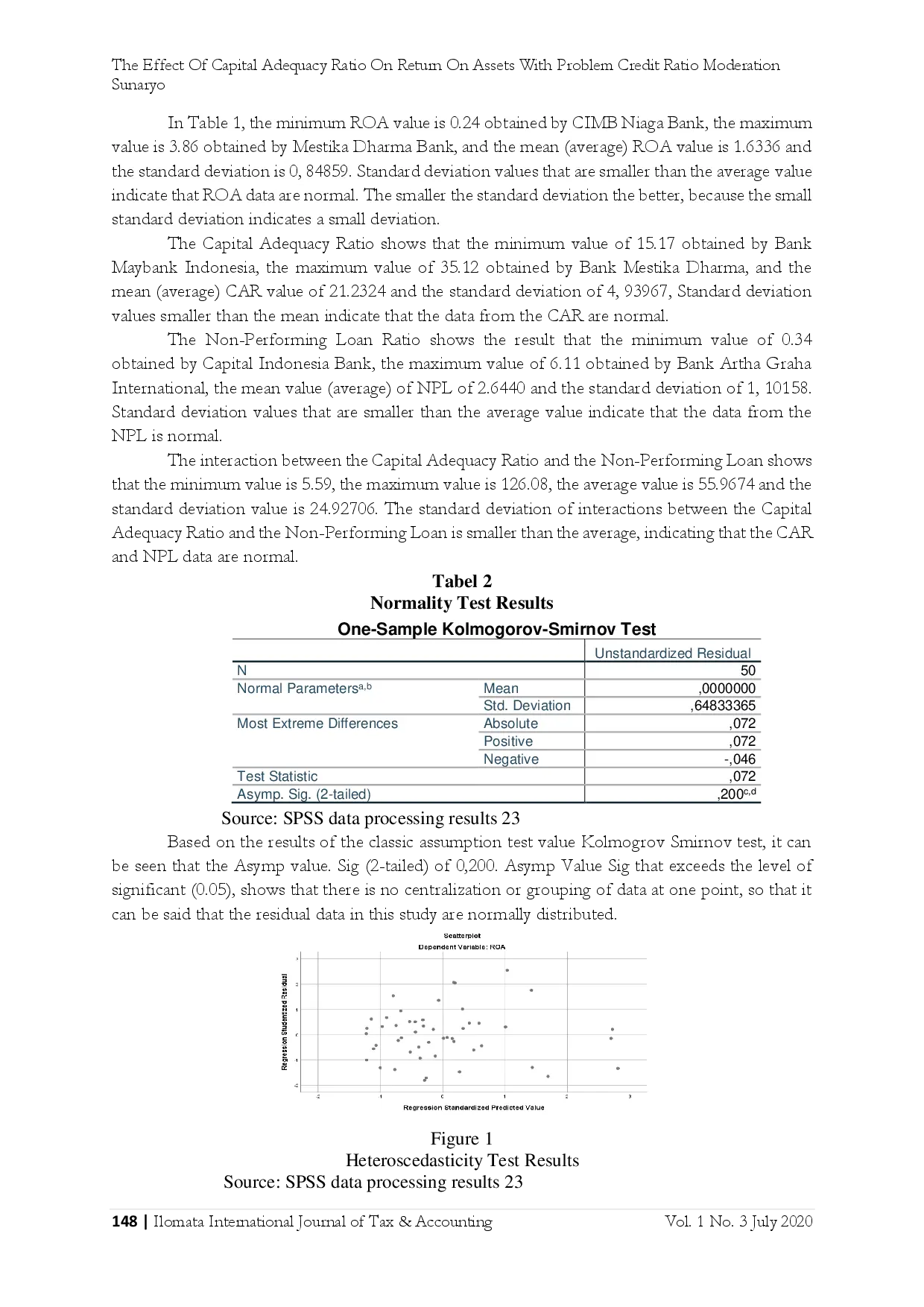

ILOMATAILOMATA Penelitian ini bertujuan menentukan pengaruh Rasio Kecukupan Modal (CAR) terhadap Return On Assets (ROA) dengan pemoderasi Rasio Kredit Bermasalah (NPL)Penelitian ini bertujuan menentukan pengaruh Rasio Kecukupan Modal (CAR) terhadap Return On Assets (ROA) dengan pemoderasi Rasio Kredit Bermasalah (NPL)