POLSRIPOLSRI

International Journal of Advanced Research in Social StudiesInternational Journal of Advanced Research in Social StudiesThis research was motivated by customer interest in mobile banking which is continues to increase, especially during the pandemic Covid 19. The purpose of this research is to find out how the influence of each variable of convenience, benefit and risk either partially or simultaneously on customers interest by using mobile banking. The sample in this research was customers of Bank BNI 46 Musi Palembang, there were totally 100 peoples during took for research samples. This research methods use multiple linear regression. The datas quality testing was done by Validity and Reability tests. The hypothesis tested was done by t test, f test and determinant (R2). The results of this research has indicate that the variables of convenience, benefits and risks either partially or simultaneously affect customer interest by using mobile banking. Based on the validity tested obtained the value of Signifacant (2-tailed) 0.000 is smaller than 0.05, its mean valid, and r count (person correlation) is greater than r tabel (0.1966) so that the item or question was valid. While based on reability, Cronbachs Alpha > 0.60 mean tha the datas was realiabled. The coefficient of Determination (R2) obtained 1s 0.719 mean that 71.9 percent of customer interest was influenced such as convience, benefits and risk variables, while remaining 28.1 percent was explained by other variables. And the R value (correlation coefficient) of 0.848 mean that there were a strong relation between variables.

The research concludes that convenience, benefit, and risk variables significantly and positively influence customer interest in using mobile banking.Simultaneously, these three variables also have a significant positive effect on customer interest.The study highlights the importance of these factors in driving customer adoption and usage of mobile banking services at BNI 46 Musi Palembang Branch.

Penelitian lebih lanjut dapat dilakukan untuk mengeksplorasi faktor-faktor lain yang mungkin memengaruhi minat nasabah dalam menggunakan mobile banking, seperti tingkat literasi digital, kepercayaan terhadap keamanan sistem perbankan, dan pengaruh norma sosial. Selain itu, studi komparatif dapat dilakukan dengan membandingkan minat nasabah di berbagai cabang BNI 46 atau bahkan dengan bank lain untuk mengidentifikasi praktik terbaik dan perbedaan regional. Terakhir, penelitian kualitatif, seperti wawancara mendalam dengan nasabah, dapat memberikan wawasan yang lebih mendalam tentang pengalaman dan persepsi mereka terhadap mobile banking, sehingga membantu bank dalam merancang layanan yang lebih sesuai dengan kebutuhan dan harapan nasabah. Penelitian-penelitian ini diharapkan dapat memberikan kontribusi signifikan bagi pengembangan strategi pemasaran dan peningkatan kualitas layanan mobile banking di masa depan, serta memperluas pemahaman tentang perilaku konsumen dalam konteks perbankan digital.

| File size | 472.62 KB |

| Pages | 16 |

| Short Link | https://juris.id/p-2CZ |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

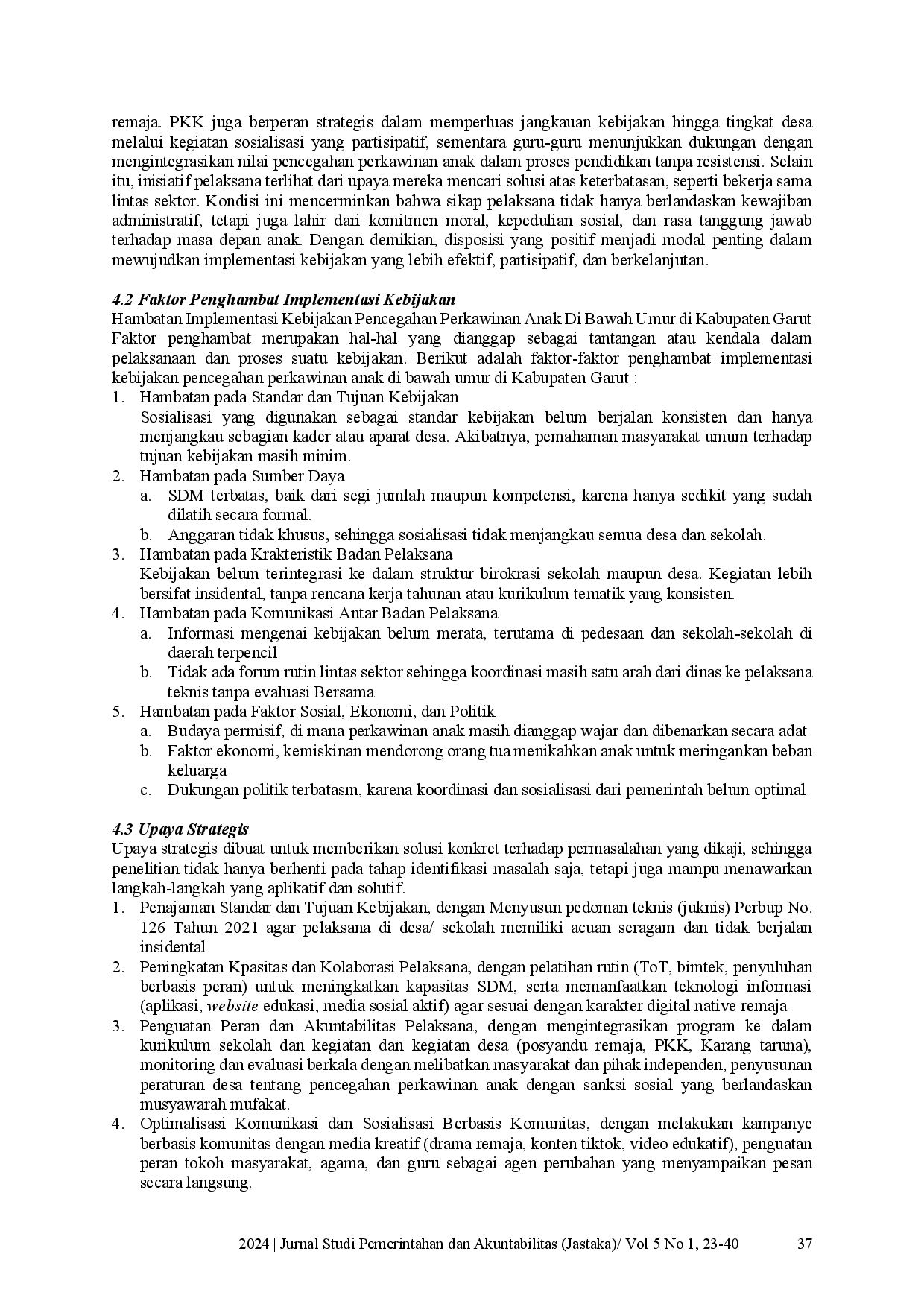

PENERBITGOODWOODPENERBITGOODWOOD Penelitian ini bertujuan untuk menganalisis implementasi kebijakan pencegahan pernikahan anak di bawah umur di Kabupaten Garut, mengidentifikasi faktorPenelitian ini bertujuan untuk menganalisis implementasi kebijakan pencegahan pernikahan anak di bawah umur di Kabupaten Garut, mengidentifikasi faktor

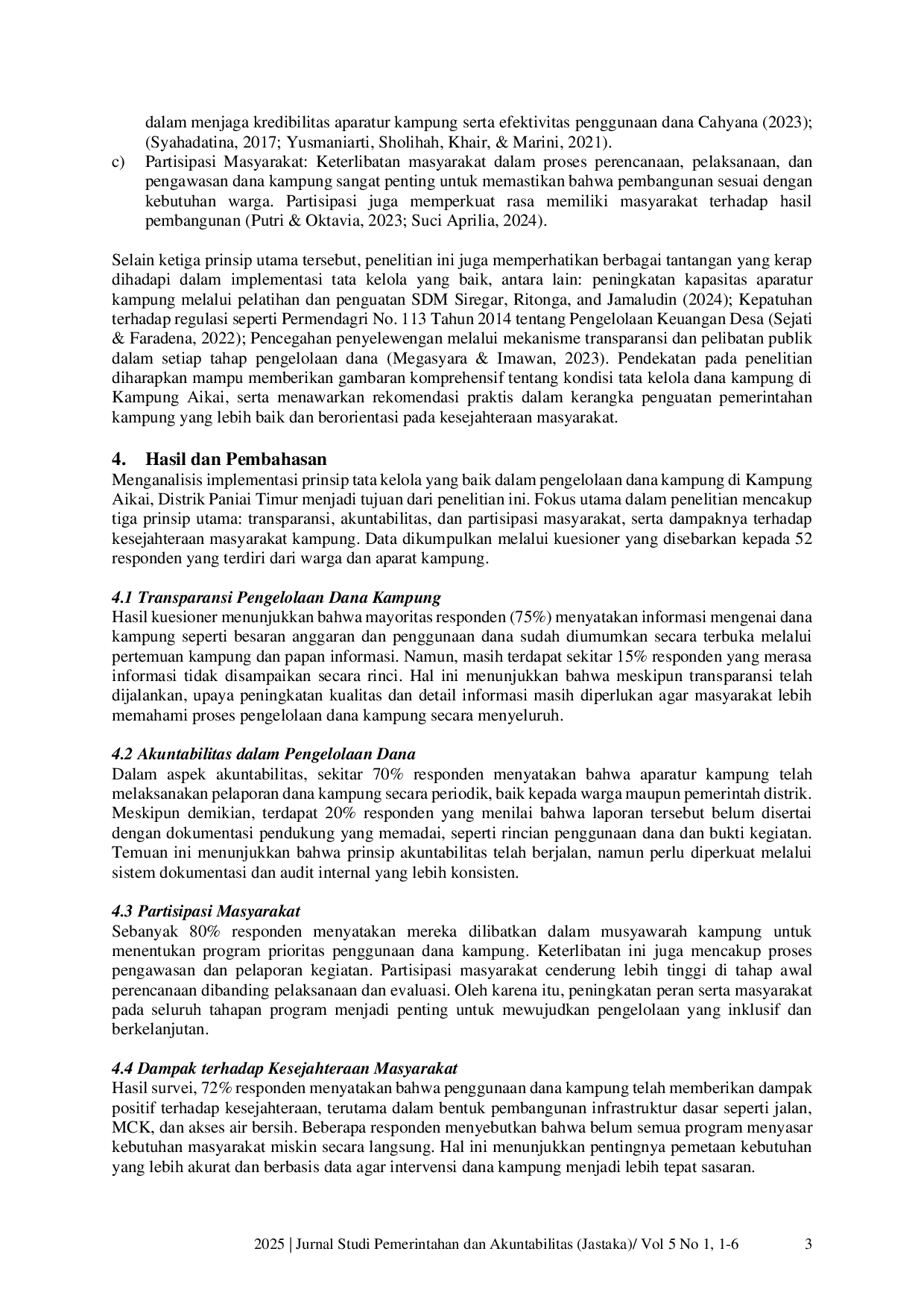

PENERBITGOODWOODPENERBITGOODWOOD Penelitian ini menyimpulkan bahwa pengelolaan dana kampung di Kampung Aikai telah menerapkan prinsip-prinsip tata kelola yang baik, dengan transparansiPenelitian ini menyimpulkan bahwa pengelolaan dana kampung di Kampung Aikai telah menerapkan prinsip-prinsip tata kelola yang baik, dengan transparansi

PENERBITGOODWOODPENERBITGOODWOOD Kontribusi penulis menyampaikan terima kasih kepada dosen pembimbing Ibu Yunita Fitria, informan dan aparat desa di Teluk Bayur, serta keluarga dan temanKontribusi penulis menyampaikan terima kasih kepada dosen pembimbing Ibu Yunita Fitria, informan dan aparat desa di Teluk Bayur, serta keluarga dan teman

IFRELIFREL The curriculum and learning of Islamic Religious Education (PAI) at the Senior High School (SMA) level face significant challenges in line with the dynamicsThe curriculum and learning of Islamic Religious Education (PAI) at the Senior High School (SMA) level face significant challenges in line with the dynamics

UNISLAUNISLA Tujuan penelitian ini adalah untuk mengetahui permasalahan psikologis siswa, serta upaya yang dilakukan siswa dalam mengatasi permasalahan psikologis tersebut.Tujuan penelitian ini adalah untuk mengetahui permasalahan psikologis siswa, serta upaya yang dilakukan siswa dalam mengatasi permasalahan psikologis tersebut.

UNISLAUNISLA Dari kajian literatur diidentifikasi sembilan jenis aktivitas yang dapat diterapkan, antara lain bernyanyi, menonton video, bermain permainan, mendengarkanDari kajian literatur diidentifikasi sembilan jenis aktivitas yang dapat diterapkan, antara lain bernyanyi, menonton video, bermain permainan, mendengarkan

PUSDIKRA PUBLISHINGPUSDIKRA PUBLISHING The research method is qualitative description through case studies. The participants were teachers of grades 1 to 6 and teachers of sports subjects. TheThe research method is qualitative description through case studies. The participants were teachers of grades 1 to 6 and teachers of sports subjects. The

UACUAC Penelitian kualitatif ini bertujuan untuk meninjau kegunaan Kerangka Pengembangan Keterampilan Penelitian (RSD) di kalangan mahasiswa perguruan tinggiPenelitian kualitatif ini bertujuan untuk meninjau kegunaan Kerangka Pengembangan Keterampilan Penelitian (RSD) di kalangan mahasiswa perguruan tinggi

Useful /

JURNALGRAHAKIRANAJURNALGRAHAKIRANA Hasil penelitian menunjukkan bahwa tingkat pendidikan memiliki pengaruh positif dan signifikan terhadap daya beli, sedangkan variabel usia tidak memilikiHasil penelitian menunjukkan bahwa tingkat pendidikan memiliki pengaruh positif dan signifikan terhadap daya beli, sedangkan variabel usia tidak memiliki

JURNALGRAHAKIRANAJURNALGRAHAKIRANA Terdapat pengaruh positif dan signifikan antara kualitas pelayanan pegawai terhadap kepuasan jamaah haji pada layanan keberangkatan tahun 2024 di UPT AsramaTerdapat pengaruh positif dan signifikan antara kualitas pelayanan pegawai terhadap kepuasan jamaah haji pada layanan keberangkatan tahun 2024 di UPT Asrama

JURNALGRAHAKIRANAJURNALGRAHAKIRANA Kebijakan yang komprehensif, peningkatan kapasitas sumber daya manusia, serta integrasi antar instansi menjadi kunci untuk mewujudkan sistem pemerintahanKebijakan yang komprehensif, peningkatan kapasitas sumber daya manusia, serta integrasi antar instansi menjadi kunci untuk mewujudkan sistem pemerintahan

DINUSDINUS Promosi dirancang dalam bentuk digital sebagai media utama yang diantaranya terdiri dari Instagram terdiri dari feed dan story dan Twitter. Selain mediaPromosi dirancang dalam bentuk digital sebagai media utama yang diantaranya terdiri dari Instagram terdiri dari feed dan story dan Twitter. Selain media