UNNARUNNAR

IJEBD (International Journal of Entrepreneurship and Business Development)IJEBD (International Journal of Entrepreneurship and Business Development)This studys aim is to do an analysis on the effect of current ratio along with debt to equity ratio on return on assets in the property and real estate sub-sector that is on Indonesia Stock Exchanges (IDX) list during 2020-2023, with the moderating variable being company size. Quantitative research methods were implemented for this study, with a causal associative approach. Moderated Regression Analysis (MRA) was applied as the technique for data analysis, with Eviews statistical software utilized. The findings revealed that current ratio as well as debt to equity ratio impact return on assets significantly. This means that an increased liquidity, along with the proportion of debt can reduce the efficiency and profitability of the company. Company size strengthens the effect by functioning as a moderating variable. This research only focuses on the real estate and property sub-sector that is on IDXs list during 2020-2023. Therefore, this studys results may not be generalizable to different sectors or periods.

The study concludes that the Current Ratio (CR) significantly impacts Return on Assets (ROA), with increased liquidity potentially decreasing ROA due to lower asset utilization efficiency.Furthermore, the Debt to Equity Ratio (DER) also significantly affects ROA, as higher debt proportions can reduce company profitability due to increased financial risks.Finally, company size moderates the relationship between liquidity and profitability, as well as leverage and profitability, suggesting larger firms can better manage liquidity and debt to improve financial performance.

Penelitian selanjutnya dapat dilakukan dengan memperluas cakupan sektor industri untuk menguji generalisasi temuan penelitian ini, sehingga dapat memberikan gambaran yang lebih komprehensif mengenai pengaruh rasio keuangan terhadap profitabilitas di berbagai sektor ekonomi. Selain itu, penelitian di masa depan dapat menggabungkan variabel-variabel lain yang berpotensi memengaruhi ROA, seperti faktor makroekonomi (misalnya, suku bunga, inflasi, nilai tukar) atau karakteristik perusahaan (misalnya, struktur kepemilikan, kualitas manajemen) untuk mendapatkan model yang lebih akurat dan komprehensif. Terakhir, penelitian lanjutan dapat mengeksplorasi secara lebih mendalam mekanisme bagaimana ukuran perusahaan memoderasi hubungan antara rasio keuangan dan ROA, misalnya dengan menganalisis peran ukuran perusahaan dalam memengaruhi akses terhadap pendanaan, efisiensi operasional, atau pengambilan keputusan investasi.

- Pengaruh Current Ratio dan Debt to Equity Ratio terhadap Return on Asset Studi pada Perusahaan Pt. Wijaya... openjournal.unpam.ac.id/index.php/JIPER/article/view/39694Pengaruh Current Ratio dan Debt to Equity Ratio terhadap Return on Asset Studi pada Perusahaan Pt Wijaya openjournal unpam ac index php JIPER article view 39694

- Pengaruh Likuiditas Terhadap Profitabilitas Dengan Ukuran Perusahaan Sebagai Variabel Moderasi | Jurnal... doi.org/10.47709/jebma.v3i3.3141Pengaruh Likuiditas Terhadap Profitabilitas Dengan Ukuran Perusahaan Sebagai Variabel Moderasi Jurnal doi 10 47709 jebma v3i3 3141

- Determinan Kinerja Keuangan dengan Size sebagai Pemoderasi pada Perusahaan Food and Beverages yang Terdaftar... journal.ipm2kpe.or.id/index.php/JOMB/article/view/4509Determinan Kinerja Keuangan dengan Size sebagai Pemoderasi pada Perusahaan Food and Beverages yang Terdaftar journal ipm2kpe index php JOMB article view 4509

| File size | 346.58 KB |

| Pages | 9 |

| DMCA | Report |

Related /

ADAIADAI Based on the financial ratio analysis of PT Unilever Indonesia Tbk. for the 2019–2024 period, the company exhibits varied performance across differentBased on the financial ratio analysis of PT Unilever Indonesia Tbk. for the 2019–2024 period, the company exhibits varied performance across different

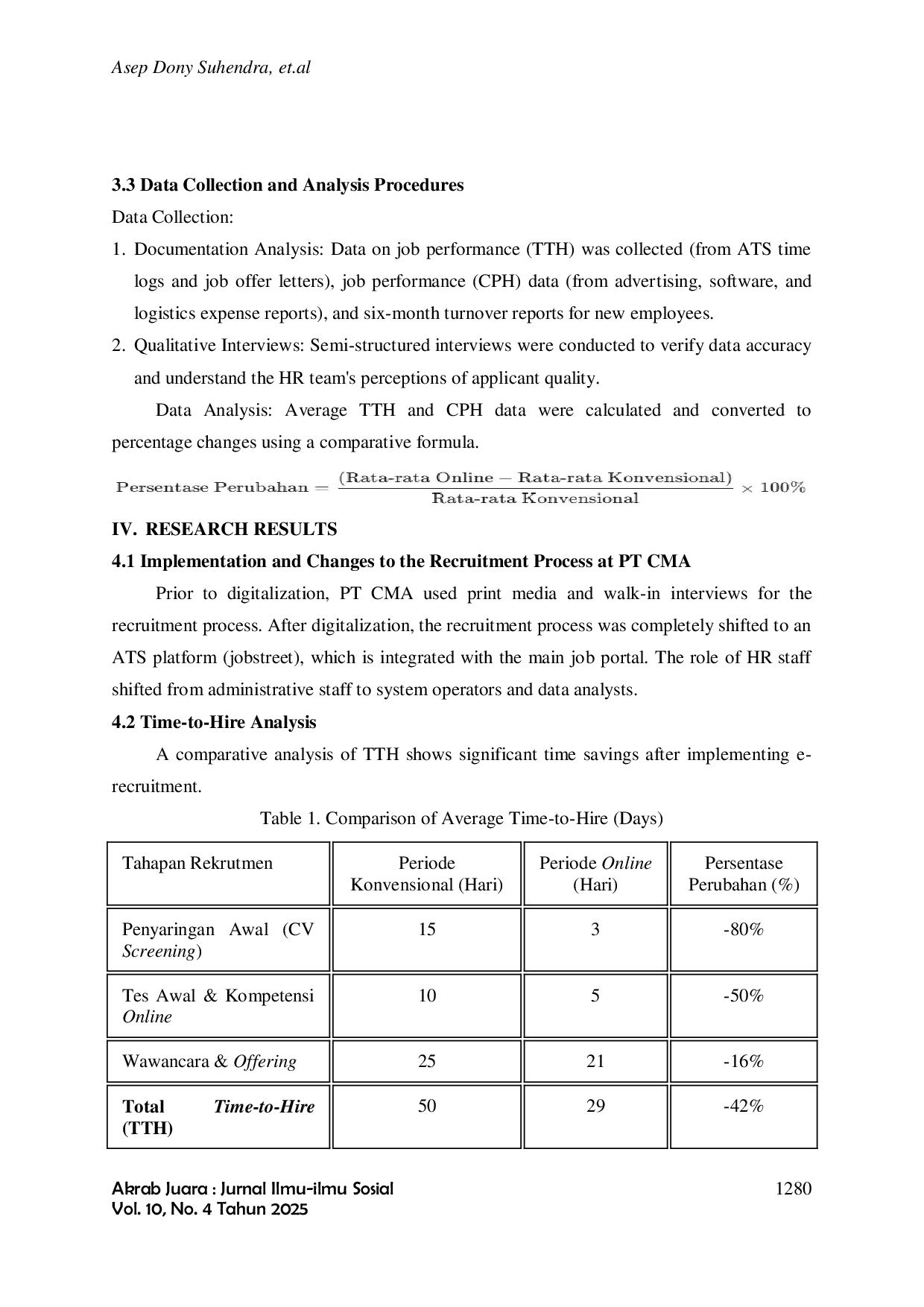

AKRABJUARAAKRABJUARA Tujuan penelitian ini berfokus pada analisis komparatif efektivitas penerapan rekrutmen online (e-rekrutmen) di PT Cipta Mulia Adinugraha (CMA) denganTujuan penelitian ini berfokus pada analisis komparatif efektivitas penerapan rekrutmen online (e-rekrutmen) di PT Cipta Mulia Adinugraha (CMA) dengan

AKRABJUARAAKRABJUARA This is proven by T count0,05). Knowledge sharing influences teacher performance at SMA Negeri 2 Sungai Penuh City.organizational culture influences teacherThis is proven by T count0,05). Knowledge sharing influences teacher performance at SMA Negeri 2 Sungai Penuh City.organizational culture influences teacher

IUQIBOGORIUQIBOGOR Penelitian ini menganalisis potensi pengembangan pariwisata berkelanjutan dan moderasi beragama sebagai strategi untuk menciptakan pariwisata halal. DalamPenelitian ini menganalisis potensi pengembangan pariwisata berkelanjutan dan moderasi beragama sebagai strategi untuk menciptakan pariwisata halal. Dalam

UNNARUNNAR Temuan: Dari hasil studi yang telah dilakukan, menunjukkan bahwa Srikandi Tempe Chips berhasil mengimplementasikan strategi pemasaran menggunakan analisisTemuan: Dari hasil studi yang telah dilakukan, menunjukkan bahwa Srikandi Tempe Chips berhasil mengimplementasikan strategi pemasaran menggunakan analisis

STIEMAHARDHIKASTIEMAHARDHIKA Hasil penelitian menunjukkan bahwa ROA berpengaruh negatif signifikan terhadap FD. CR, KI, dan UP tidak berpengaruh negatif signifikan terhadap FD. DERHasil penelitian menunjukkan bahwa ROA berpengaruh negatif signifikan terhadap FD. CR, KI, dan UP tidak berpengaruh negatif signifikan terhadap FD. DER

PELITA BANGSAPELITA BANGSA Data diperoleh dari kuesiober yang diberikan kepada responden dan dianalisis menggunakan model struktural (SmartPLS 4). Penelitian menghasilkan temuanData diperoleh dari kuesiober yang diberikan kepada responden dan dianalisis menggunakan model struktural (SmartPLS 4). Penelitian menghasilkan temuan

RCF INDONESIARCF INDONESIA And Job Satisfaction has a positive and significant effect on Employee Performance, as evidenced by employees who already feel safe and comfortable atAnd Job Satisfaction has a positive and significant effect on Employee Performance, as evidenced by employees who already feel safe and comfortable at

Useful /

GREENPUBGREENPUB Hasil kegiatan menunjukkan peningkatan pemahaman peserta mengenai pentingnya menjaga kesehatan psikologis serta kemampuan memanfaatkan teknologi digitalHasil kegiatan menunjukkan peningkatan pemahaman peserta mengenai pentingnya menjaga kesehatan psikologis serta kemampuan memanfaatkan teknologi digital

STIEMAHARDHIKASTIEMAHARDHIKA Fintech syariah adalah halal jika diterapkan sesuai prinsip fiqh muamalah dengan menghindari riba, maysir, dan gharar. 117/DSN-MUI/II/2018, fintech syariahFintech syariah adalah halal jika diterapkan sesuai prinsip fiqh muamalah dengan menghindari riba, maysir, dan gharar. 117/DSN-MUI/II/2018, fintech syariah

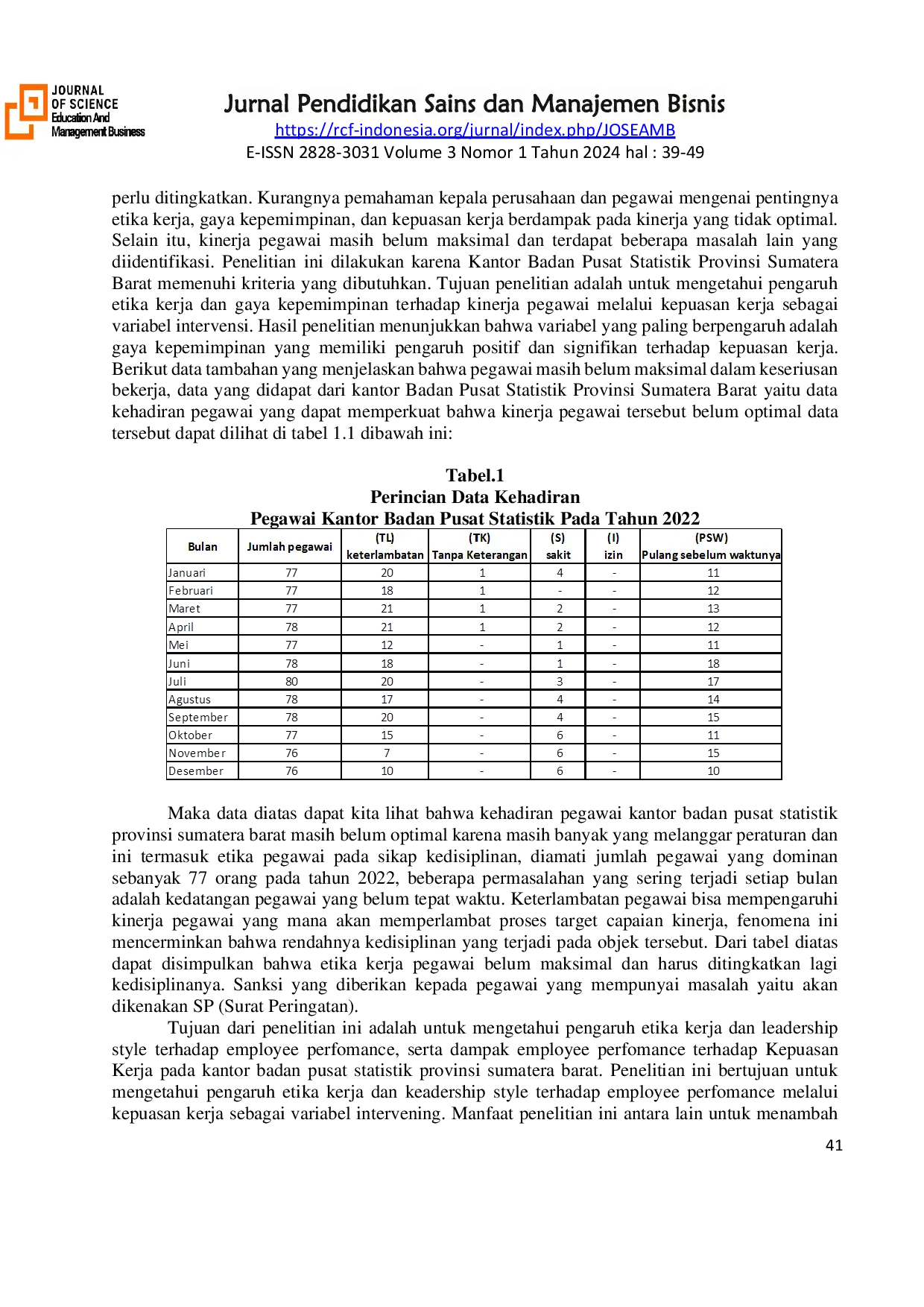

RCF INDONESIARCF INDONESIA Dalam penelitian ini data diperoleh dengan menyebarkan kuesioner dengan menggunakan skala likert. Hasil penelitian ini menunjukkan bahwa variabel yangDalam penelitian ini data diperoleh dengan menyebarkan kuesioner dengan menggunakan skala likert. Hasil penelitian ini menunjukkan bahwa variabel yang

RCF INDONESIARCF INDONESIA The results showed that directly the most dominant variable, namely Career Development, had a positive and significant effect on Work Motivation. Therefore,The results showed that directly the most dominant variable, namely Career Development, had a positive and significant effect on Work Motivation. Therefore,