ESC IDESC ID

International Journal of Economy, Education and Entrepreneurship (IJE3)International Journal of Economy, Education and Entrepreneurship (IJE3)This study aims to determine the effect of profitability, liquidity, and company size on the timeliness of financial reporting of energy sector companies listed on the Indonesia Stock Exchange (IDX) in 2019-2022. The type of research used in this research is a quantitative approach. This research uses secondary data from the annual financial reports of energy sector companies listed on IDX for 2019-2020. The population in this study included all energy sector companies listed on the IDX in the 2019-2022 period. The sampling technique used in this research was purposive sampling, so the sample used was 18 companies. The data analysis used to test the hypothesis is logistic regression with a significance level of 5% and using SPSS version 29. The results of this study indicate that profitability and company size do not affect the timeliness of corporate financial reporting, as evidenced by the significance value > 0.05 in the hypothesis test results. Liquidity is proven to affect the timeliness of corporate financial reporting, with a significance value in the hypothesis test <0.05.

The study concludes that profitability and company size do not influence the timeliness of financial reporting for energy sector companies listed on the Indonesia Stock Exchange during the 2019-2022 period.Conversely, liquidity significantly affects the timeliness of financial reporting.These findings suggest that companies in the energy sector should prioritize maintaining adequate liquidity to ensure timely financial reporting.The results of this research are expected to be useful for companies and investors in making decisions related to financial reporting.

Future research could explore the influence of corporate governance mechanisms, such as audit committee independence and the presence of institutional investors, on the timeliness of financial reporting in the energy sector. Additionally, investigating the role of regulatory enforcement and the impact of specific accounting standards on reporting delays would provide valuable insights. Expanding the scope of the study to include companies from other sectors and utilizing a longer time frame could enhance the generalizability of the findings. Furthermore, a qualitative approach, such as interviews with financial managers, could provide a deeper understanding of the challenges companies face in meeting reporting deadlines and the factors that contribute to delays, ultimately leading to more effective strategies for improving financial reporting timeliness and transparency within the Indonesian capital market. This could also include examining the impact of external factors like geopolitical events, such as the Russia-Ukraine war, on reporting timeliness.

- Pengaruh Profitabilitas, Ukuran Perusahaan, dan Leverage Terhadap Ketepatan Waktu Pelaporan Keuangan... doi.org/10.33087/eksis.v12i1.240Pengaruh Profitabilitas Ukuran Perusahaan dan Leverage Terhadap Ketepatan Waktu Pelaporan Keuangan doi 10 33087 eksis v12i1 240

- THE ANALYSIS OF THE EFFECT OF PROFITABILITY, LIQUIDITY, AND COMPANY SIZE ON TIMELINESS OF FINANCIAL REPORTING... doi.org/10.53067/ije3.v4i1.237THE ANALYSIS OF THE EFFECT OF PROFITABILITY LIQUIDITY AND COMPANY SIZE ON TIMELINESS OF FINANCIAL REPORTING doi 10 53067 ije3 v4i1 237

| File size | 251.15 KB |

| Pages | 11 |

| Short Link | https://juris.id/p-2TW |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

ARSHMEDIAARSHMEDIA Faktor eksternal melibatkan pengaruh lingkungan keluarga, metode pengajaran, dan kurangnya dukungan keluarga. Kombinasi kedua faktor ini menimbulkan ancamanFaktor eksternal melibatkan pengaruh lingkungan keluarga, metode pengajaran, dan kurangnya dukungan keluarga. Kombinasi kedua faktor ini menimbulkan ancaman

ARSHMEDIAARSHMEDIA Metode penelitian yang digunakan adalah pendekatan kualitatif dengan jenis library research dimana data-data diperoleh dari analisis sumber-sumber informasiMetode penelitian yang digunakan adalah pendekatan kualitatif dengan jenis library research dimana data-data diperoleh dari analisis sumber-sumber informasi

SINTHOPSINTHOP Namun, adopsi dan efektivitas inovasi ini masih belum merata, dimana beberapa pendidik telah merangkul alat digital dengan kreativitas dan sensitivitasNamun, adopsi dan efektivitas inovasi ini masih belum merata, dimana beberapa pendidik telah merangkul alat digital dengan kreativitas dan sensitivitas

STKYAKOBUSSTKYAKOBUS Demikian halnya dengan guru-guru pendidikan agama katolik (PAK). Jika prosedur rekrutmen dan seleksi guru PAK diikuti dengan baik, maka kebutuhan akanDemikian halnya dengan guru-guru pendidikan agama katolik (PAK). Jika prosedur rekrutmen dan seleksi guru PAK diikuti dengan baik, maka kebutuhan akan

STIEPARISTIEPARI Media pembelajaran berbasis permainan roda putar pada materi rukun sholat kelas 3 di SDIT Baiturrahim telah berhasil dikembangkan sebagai suatu produkMedia pembelajaran berbasis permainan roda putar pada materi rukun sholat kelas 3 di SDIT Baiturrahim telah berhasil dikembangkan sebagai suatu produk

STIEPARISTIEPARI Analisis data dilakukan dengan menelaah data dari berbagai sumber dan membuat abstraksi. Hasil wawancara dan observasi menunjukkan bahwa komunikasi verbalAnalisis data dilakukan dengan menelaah data dari berbagai sumber dan membuat abstraksi. Hasil wawancara dan observasi menunjukkan bahwa komunikasi verbal

STAIN MADINASTAIN MADINA Salah satu solusinya ditawarkan oleh Amitra Syariah Financing dalam bentuk pembiayaan keuangan bagi calon jemaah yang akan menunaikan umrah melalui PT.Salah satu solusinya ditawarkan oleh Amitra Syariah Financing dalam bentuk pembiayaan keuangan bagi calon jemaah yang akan menunaikan umrah melalui PT.

STAIN MADINASTAIN MADINA Dalam pelaksanaan suatu perjanjian terdapat syarat yang harus dipenuhi, dan itu diatur didalam KUHPerdata yang mengatur untuk sahnya suatu perjanjian.Dalam pelaksanaan suatu perjanjian terdapat syarat yang harus dipenuhi, dan itu diatur didalam KUHPerdata yang mengatur untuk sahnya suatu perjanjian.

Useful /

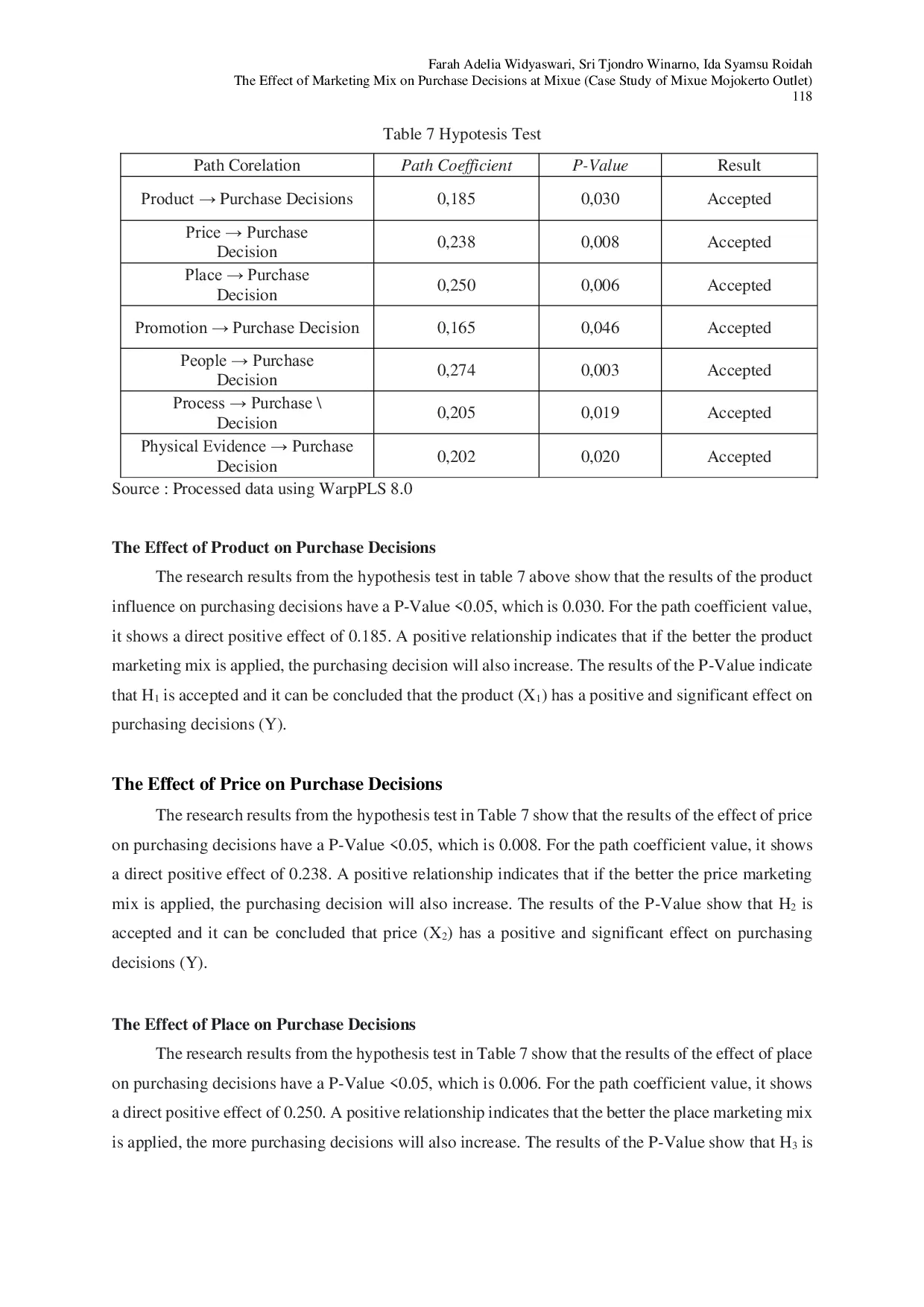

ESC IDESC ID Penggunaan metode PLS sebagai teknik analisis memiliki keunggulan bahwa sampel yang digunakan tidak harus besar dan dapat digunakan dalam mengembangkanPenggunaan metode PLS sebagai teknik analisis memiliki keunggulan bahwa sampel yang digunakan tidak harus besar dan dapat digunakan dalam mengembangkan

STAIN MADINASTAIN MADINA Pengelolaan wakaf produktif memiliki peran penting dalam meningkatkan kesejahteraan umat dan memerlukan pengelolaan yang efektif. Kinerja nazhir menjadiPengelolaan wakaf produktif memiliki peran penting dalam meningkatkan kesejahteraan umat dan memerlukan pengelolaan yang efektif. Kinerja nazhir menjadi

STAIN MADINASTAIN MADINA Di dalam kehidupan sehari-hari ada beberapa bentuk gadai tanah/sawah yang sering dilakukan oleh masyarakat, seperti yang dilakukan oleh masyarakat DesaDi dalam kehidupan sehari-hari ada beberapa bentuk gadai tanah/sawah yang sering dilakukan oleh masyarakat, seperti yang dilakukan oleh masyarakat Desa

STAIN MADINASTAIN MADINA Harta syubhat adalah harta dengan status hukum samar-samar karena percampuran halal dan haram. Ulama mayoritas berpandangan bahwa harta haram tetap tidakHarta syubhat adalah harta dengan status hukum samar-samar karena percampuran halal dan haram. Ulama mayoritas berpandangan bahwa harta haram tetap tidak