UNTARUNTAR

International Journal of Application on Economics and BusinessInternational Journal of Application on Economics and BusinessThis research investigates the impact of cognitive aspects and AI attributes on the continued adoption of AI-powered mobile banking applications in Malaysia. It examines the relatively recent incorporation of AI into Malaysian mobile banking and the extent to which age influences user intentions. A total of 398 participants were surveyed, with data analysis conducted using SPSS. The results indicate that factors such as perceived usefulness, ease of use, enjoyment, and intelligence significantly contribute to users continued engagement with AI-enabled banking apps, with age playing a moderating role. However, perceived anthropomorphism did not have a statistically significant effect on user intention, nor did age significantly moderate the connection between perceived intelligence and continuance intention. The studys findings aim to enhance AI-enabled banking applications, fostering a more user-friendly and satisfying experience across different age groups. These insights provide valuable direction for software developers and financial institutions aiming to optimize user satisfaction and engagement with AI-powered mobile banking systems.

This study confirms the significant influence of perceived usefulness, ease of use, enjoyment, and intelligence on the continued use of AI-powered mobile banking apps.Age plays a moderating role in these relationships, highlighting the need for tailored approaches to user experience.Notably, perceived anthropomorphism did not significantly impact user intention, suggesting that focusing on functional aspects is more crucial.These findings provide valuable insights for developers and financial institutions to optimize user satisfaction and engagement with AI-driven mobile banking.

Future research should expand the studys scope beyond Malaysia to assess the generalizability of the findings in diverse cultural and economic contexts. Investigating the moderating effects of income and education levels could provide a more nuanced understanding of user behavior. Furthermore, longitudinal studies are needed to explore the long-term impact of perceived anthropomorphism on users continued use of AI-enhanced mobile banking applications, and to examine how evolving AI capabilities influence user expectations and adoption patterns. Finally, research could explore the integration of emerging technologies, such as biometric authentication and personalized financial advice powered by AI, to further enhance the user experience and foster greater trust in AI-driven mobile banking services. These investigations should aim to provide actionable insights for financial institutions and technology developers to create more effective and user-centric AI-powered banking solutions, ultimately driving wider adoption and maximizing the benefits of this transformative technology.

- Access to TAR UMT Library Online Resources. access tar umt library resources terms conditions of shall... doi-org.tarc.idm.oclc.org/10.1108/02644400810855940Access to TAR UMT Library Online Resources access tar umt library resources terms conditions of shall doi org tarcm oclc 10 1108 02644400810855940

- Investigating Mobile Banking Continuance Intention: A MixedâMethods Approach - Hidayat-ur-Rehman... hindawi.com/journals/misy/2021/9994990Investigating Mobile Banking Continuance Intention A MixedyAAAaMethods Approach Hidayat ur Rehman hindawi journals misy 2021 9994990

| File size | 518.95 KB |

| Pages | 15 |

| DMCA | Report |

Related /

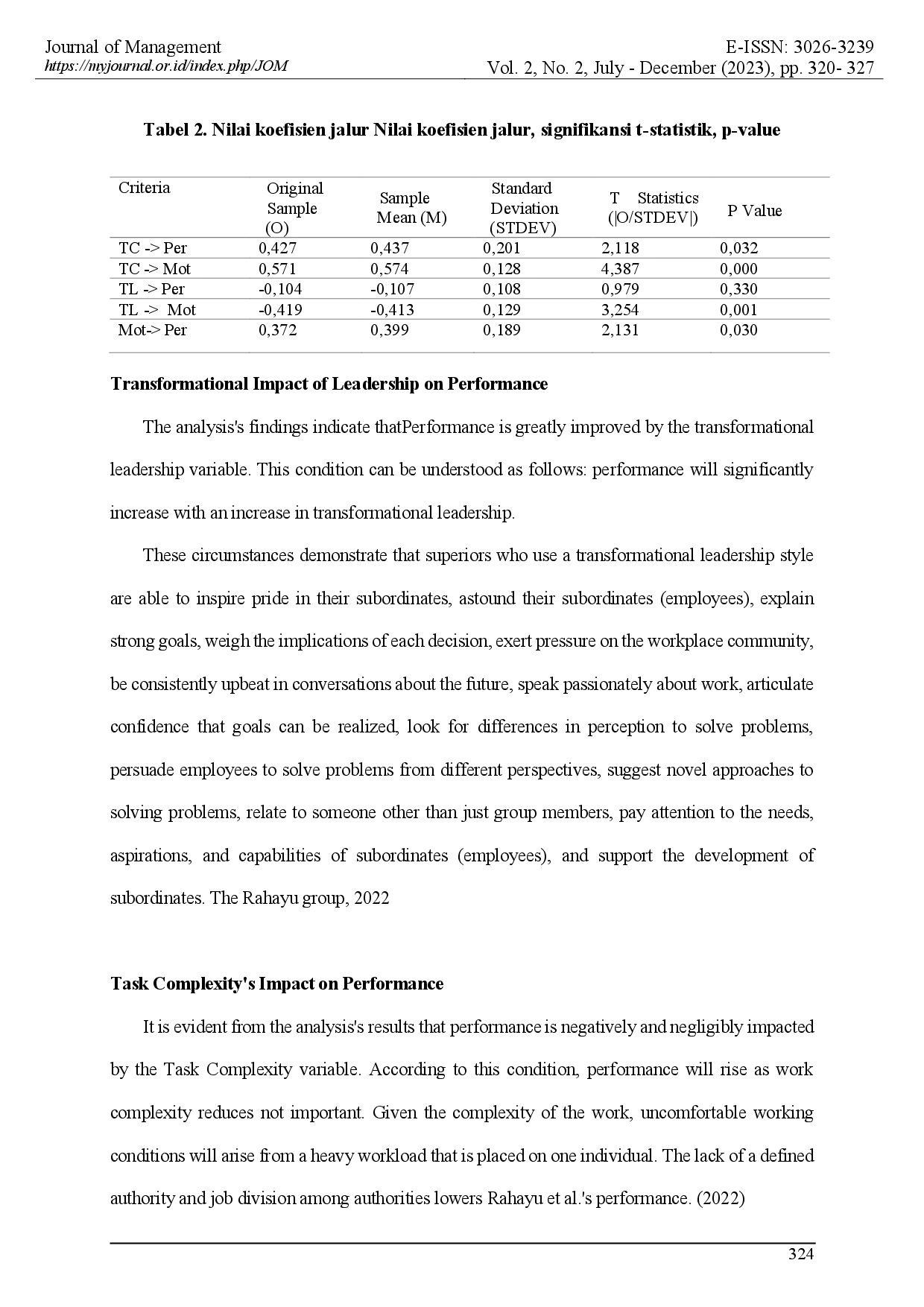

MYJOURNALMYJOURNAL Motivasi tidak memediasi dampak kompleksitas tugas terhadap kinerja, dan dampak kepemimpinan transformasional terhadap kinerja juga tidak signifikan secaraMotivasi tidak memediasi dampak kompleksitas tugas terhadap kinerja, dan dampak kepemimpinan transformasional terhadap kinerja juga tidak signifikan secara

UNTARUNTAR Selain itu, niat dan motivasi daur ulang e-waste mobile berkaitan erat dengan mindset lingkungan individu, strategi insentif, pendidikan lingkungan, kenyamanan,Selain itu, niat dan motivasi daur ulang e-waste mobile berkaitan erat dengan mindset lingkungan individu, strategi insentif, pendidikan lingkungan, kenyamanan,

UNTARUNTAR Penelitian ini bertujuan untuk mengeksplorasi pengaruh kepercayaan, neofobia makanan, manfaat yang dirasakan, risiko yang dirasakan, dan kealamian yangPenelitian ini bertujuan untuk mengeksplorasi pengaruh kepercayaan, neofobia makanan, manfaat yang dirasakan, risiko yang dirasakan, dan kealamian yang

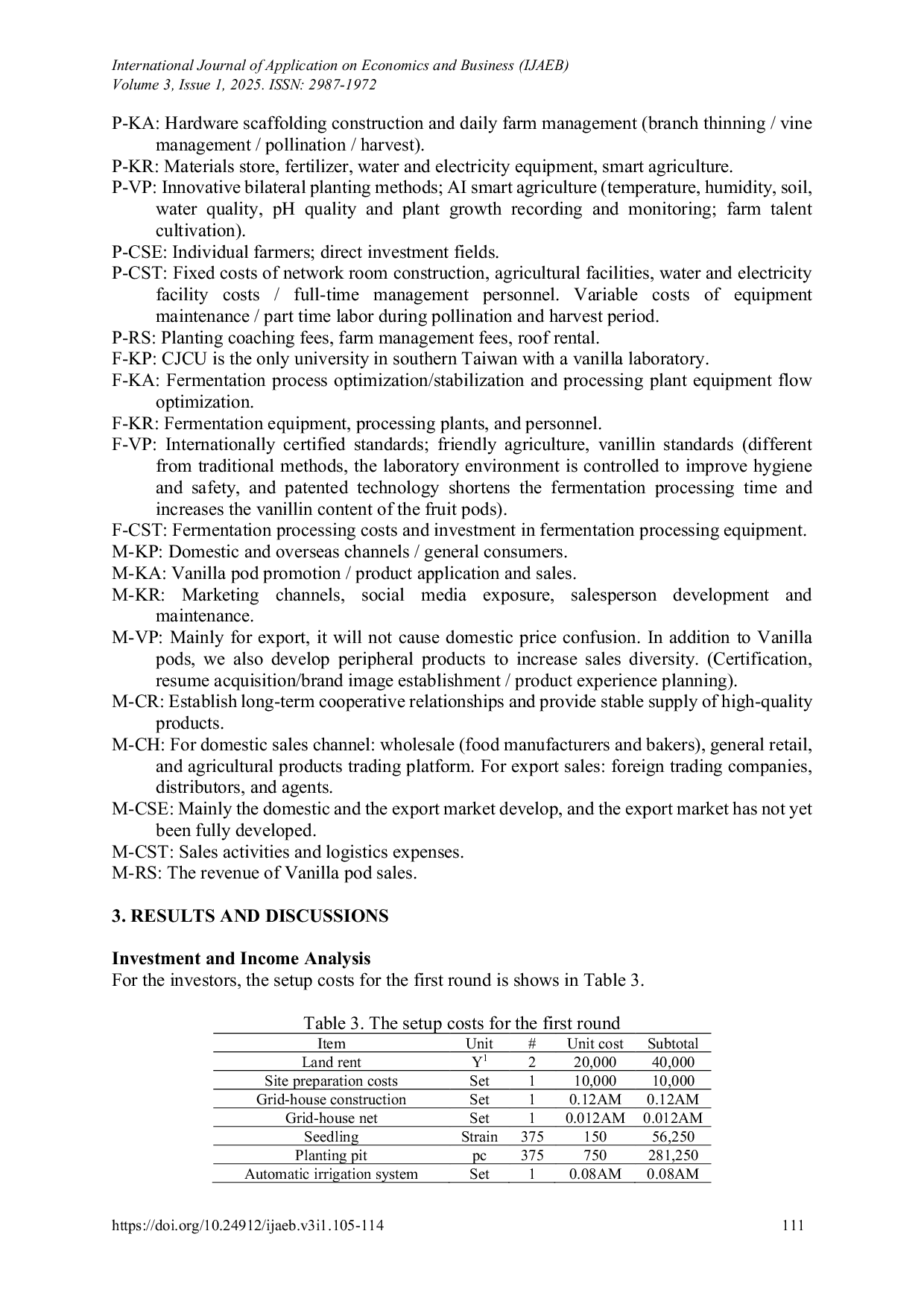

UNTARUNTAR Bagi investor, tingkat pengembalian investasi pada putaran pertama sekitar 13%, dan pada putaran kedua sekitar 25%. Bagi tenaga kerja, mereka dapat memperolehBagi investor, tingkat pengembalian investasi pada putaran pertama sekitar 13%, dan pada putaran kedua sekitar 25%. Bagi tenaga kerja, mereka dapat memperoleh

UNTARUNTAR For enterprises, the net zero emissions issues need to consider the relationship between environmental sustainability, social responsibility, and the enterprisesFor enterprises, the net zero emissions issues need to consider the relationship between environmental sustainability, social responsibility, and the enterprises

UNTARUNTAR Selain itu, mengorganisasi kelompok kerja juga dapat membantu memperluas jaringan. Karyawan dapat memberikan bantuan kepada kolega di tempat kerja danSelain itu, mengorganisasi kelompok kerja juga dapat membantu memperluas jaringan. Karyawan dapat memberikan bantuan kepada kolega di tempat kerja dan

UNTARUNTAR Sebagai contoh, tisu makeup remover yang dikembangkan sendiri pada tahun 2022 menggunakan teknologi biodegradable spinning liquid yang dapat mengangkatSebagai contoh, tisu makeup remover yang dikembangkan sendiri pada tahun 2022 menggunakan teknologi biodegradable spinning liquid yang dapat mengangkat

UNTARUNTAR Pengujian hipotesis dilakukan menggunakan perangkat lunak SPSS Statistics 25 dengan uji beda Paired Sample t-Test. Hasil penelitian menyatakan bahwa terdapatPengujian hipotesis dilakukan menggunakan perangkat lunak SPSS Statistics 25 dengan uji beda Paired Sample t-Test. Hasil penelitian menyatakan bahwa terdapat

Useful /

MYJOURNALMYJOURNAL Sistem keuangan desa di Kecamatan Beloro, Kabupaten Kutai Kartanegara, mengutamakan tanggung jawab dana daerah setelah diuji dan dibahas. Sistem keuanganSistem keuangan desa di Kecamatan Beloro, Kabupaten Kutai Kartanegara, mengutamakan tanggung jawab dana daerah setelah diuji dan dibahas. Sistem keuangan

MYJOURNALMYJOURNAL Penelitian ini bersifat kuantitatif dengan sampel sebanyak delapan puluh empat karyawan PT Ciptaniaga Roda Berdikari. Analisis data dilakukan menggunakanPenelitian ini bersifat kuantitatif dengan sampel sebanyak delapan puluh empat karyawan PT Ciptaniaga Roda Berdikari. Analisis data dilakukan menggunakan

UNTARUNTAR Apakah perubahan sikap akibat perubahan sifat kepribadian dan pengalaman manajerial dalam pengembangan organisasi memengaruhi kinerja. Penelitian ini menitikberatkanApakah perubahan sikap akibat perubahan sifat kepribadian dan pengalaman manajerial dalam pengembangan organisasi memengaruhi kinerja. Penelitian ini menitikberatkan

USUUSU Data tersebut dibandingkan dengan struktur invitasi dalam bahasa Inggris yang dilaporkan oleh Isaacs dan Clark (1990). Disimpulkan bahwa faktor sosio-linguistikData tersebut dibandingkan dengan struktur invitasi dalam bahasa Inggris yang dilaporkan oleh Isaacs dan Clark (1990). Disimpulkan bahwa faktor sosio-linguistik