UGMUGM

Gadjah Mada International Journal of BusinessGadjah Mada International Journal of BusinessThe study was organized into two major concerns: first, identifying the gains from international diversification in emerging stock markets from the Philippine and the Indonesian perspectives and determining which perspective yields the greater gains; and second, determining how many securities must be included to obtain an optimal investment portfolio from the Philippine and Indonesia perspectives. The empirical results indicate that there are gains from international diversification, both from the Philippine and Indonesian perspectives, in two to eight emerging stock markets. Generally the gains are greater from the Indonesian perspective than the Philippine perspective in all country combinations. Further, this study found that the number of stocks needed to form an optimum domestic investment portfolio was bigger for the Indonesian investors perspective (at 15 stocks) than for the Filipino investor (14).

The study reveals that there are gains from international diversification from both the Philippine and Indonesian perspectives.Generally, the gains are greater from the Indonesian perspective than the Philippine perspective.The number of stocks needed to form an optimum domestic investment portfolio is 15 for Indonesian investors and 14 for Filipino investors.These findings highlight the benefits of portfolio diversification in emerging stock markets.

Berdasarkan temuan penelitian ini, beberapa saran untuk penelitian lanjutan dapat diajukan. Pertama, penelitian lebih lanjut dapat dilakukan untuk menguji dampak dari strategi lindung nilai (hedging) terhadap keuntungan diversifikasi internasional, dengan mempertimbangkan berbagai instrumen lindung nilai dan biaya yang terkait. Kedua, studi komparatif dapat dilakukan dengan melibatkan lebih banyak negara berkembang lainnya, untuk mengidentifikasi pola dan faktor-faktor yang mempengaruhi keuntungan diversifikasi internasional di berbagai wilayah. Ketiga, penelitian dapat diperluas dengan memasukkan variabel makroekonomi seperti inflasi, suku bunga, dan pertumbuhan ekonomi, untuk menganalisis bagaimana kondisi ekonomi global dan domestik mempengaruhi efektivitas diversifikasi portofolio di pasar saham Indonesia dan Filipina. Penelitian ini akan memberikan wawasan yang lebih mendalam bagi investor dan pengelola portofolio dalam mengambil keputusan investasi yang optimal di pasar saham yang dinamis.

| File size | 120.43 KB |

| Pages | 23 |

| DMCA | ReportReport |

Related /

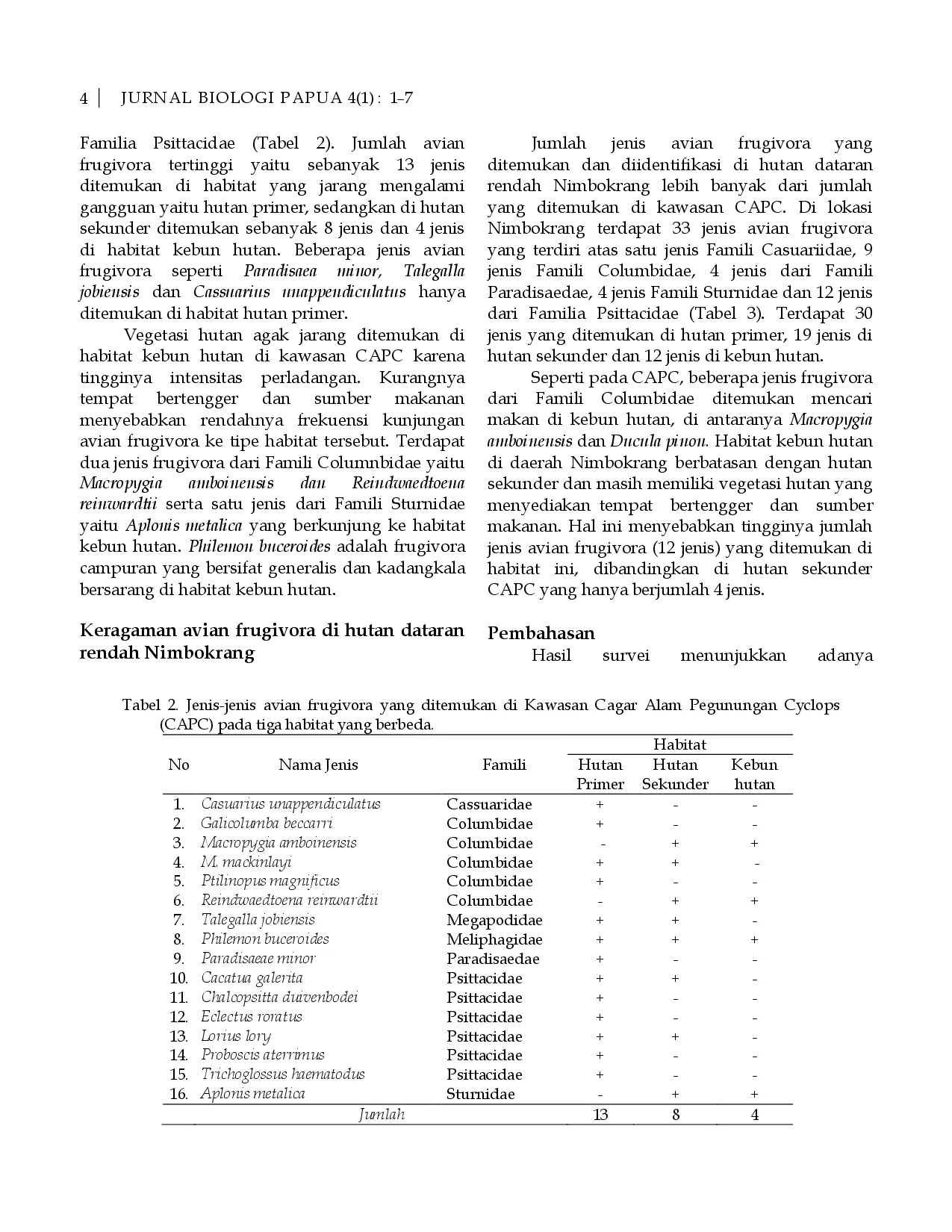

UncenUncen Temuan ini memiliki implikasi bagi pengelolaan hutan dan program reboisasi hutan dataran rendah Papua. Keragaman avian frugivora di hutan dataran rendahTemuan ini memiliki implikasi bagi pengelolaan hutan dan program reboisasi hutan dataran rendah Papua. Keragaman avian frugivora di hutan dataran rendah

UGMUGM Sebagian besar literatur tentang budaya terkait dengan penyusunan budaya organisasi strategis, yang dipandang sebagai cara untuk mencapai keunggulan kompetitifSebagian besar literatur tentang budaya terkait dengan penyusunan budaya organisasi strategis, yang dipandang sebagai cara untuk mencapai keunggulan kompetitif

UGMUGM Namun, model dapat berguna dalam menemukan variabel dan menentukan bobot yang menentukan PER pada suatu titik waktu. Model PER cross-sectional tidak konsistenNamun, model dapat berguna dalam menemukan variabel dan menentukan bobot yang menentukan PER pada suatu titik waktu. Model PER cross-sectional tidak konsisten

UNUDUNUD Pariwisata bukan proses satu arah, melainkan proses dialektika antara masyarakat lokal dan pengunjung, yang terus berubah. Saat ini, proses tersebut memasukiPariwisata bukan proses satu arah, melainkan proses dialektika antara masyarakat lokal dan pengunjung, yang terus berubah. Saat ini, proses tersebut memasuki

Useful /

STIE AASSTIE AAS Populasi terdiri dari 120 karyawan yang dipilih sebagai sampel menggunakan teknik pengambilan sampel jenuh yang digabungkan dengan purposive sampling.Populasi terdiri dari 120 karyawan yang dipilih sebagai sampel menggunakan teknik pengambilan sampel jenuh yang digabungkan dengan purposive sampling.

STIE AASSTIE AAS Data dikumpulkan melalui kuesioner dengan menggunakan skala Likert 1-5 dan dianalisis menggunakan metode Partial Least Square-Structural Equation ModelingData dikumpulkan melalui kuesioner dengan menggunakan skala Likert 1-5 dan dianalisis menggunakan metode Partial Least Square-Structural Equation Modeling

STIE AASSTIE AAS Bank mampu mencapai status Very Sound, namun berakhir dengan penurunan signifikan menjadi Fairly Sound pada tahun 2024. Hal ini terutama disebabkan olehBank mampu mencapai status Very Sound, namun berakhir dengan penurunan signifikan menjadi Fairly Sound pada tahun 2024. Hal ini terutama disebabkan oleh

UNESAUNESA Namun, terdapat beberapa masalah teknis terkait kinerja aplikasi yang perlu diperbaiki. Penelitian ini memberikan kontribusi bagi pengembangan media pembelajaranNamun, terdapat beberapa masalah teknis terkait kinerja aplikasi yang perlu diperbaiki. Penelitian ini memberikan kontribusi bagi pengembangan media pembelajaran