LIFESCIFILIFESCIFI

Arthatama: Journal of Business Management and AccountingArthatama: Journal of Business Management and AccountingThis systematic review explores how digital transformation in the Indonesian banking sector contributes to sustainable growth through innovation, strategic adaptation, and policy alignment. Drawing on nine peer-reviewed articles published between 2020 and 2025, the study synthesizes evidence from databases such as Scopus, Web of Science, and Google Scholar, using Publish or Perish to support data collection. The findings reveal that digital tools – including mobile banking, AI, blockchain, and digital infrastructure – improve operational efficiency, financial inclusion, and resilience in banking institutions. The review identifies five thematic research clusters: digital innovation strategies, economic and environmental sustainability, empirical performance evaluation, systemic challenges, and local implementation. These themes collectively demonstrate how digital transformation acts as a strategic enabler for inclusive economic development in Indonesia. The study highlights the importance of policy innovation, SME integration, and digital literacy programs while noting the limited number of Indonesia-specific empirical studies as a major limitation.

In conclusion, this article provides a thorough understanding of the role of digital transformation in Indonesias banking sector and its potential to foster sustainable growth.The research findings will be instrumental in guiding future strategies and initiatives to overcome existing challenges and maximize the benefits of digitalization in the financial services industry.The banking sector in Indonesia is undergoing significant transformation accelerated by the COVID-19 pandemic, which has necessitated a reevaluation of traditional business models as organizations pivot towards digital solutions.Ultimately, digital transformation holds significant promise for advancing sustainable growth in Indonesias banking sector, but also highlights the necessity for ongoing policy support, infrastructural investment, and human capital development.

Berdasarkan temuan penelitian ini, beberapa saran penelitian lanjutan dapat diajukan untuk memperdalam pemahaman tentang transformasi digital di sektor perbankan Indonesia dan dampaknya terhadap pertumbuhan berkelanjutan. Pertama, penelitian longitudinal dengan pendekatan mixed-method sangat diperlukan untuk menangkap tren digital yang terus berkembang di sektor keuangan Asia Tenggara secara lebih akurat. Pendekatan ini memungkinkan peneliti untuk melacak perubahan perilaku konsumen, adopsi teknologi, dan dampak kebijakan dari waktu ke waktu. Kedua, penelitian lebih lanjut dapat difokuskan pada pengembangan model bisnis inovatif yang mengintegrasikan prinsip-prinsip keberlanjutan ke dalam operasi perbankan digital. Hal ini mencakup eksplorasi bagaimana teknologi blockchain dapat digunakan untuk meningkatkan transparansi dan akuntabilitas dalam pembiayaan berkelanjutan, serta bagaimana AI dapat dimanfaatkan untuk mengidentifikasi dan mengurangi risiko lingkungan dalam portofolio investasi. Ketiga, penelitian perlu menyelidiki dampak transformasi digital terhadap inklusi keuangan, khususnya bagi kelompok masyarakat yang kurang terlayani, seperti UMKM dan masyarakat pedesaan. Penelitian ini dapat mengeksplorasi bagaimana desain layanan digital yang inklusif dan program literasi keuangan yang efektif dapat menjangkau kelompok-kelompok ini dan memberdayakan mereka untuk berpartisipasi dalam ekonomi digital.

| File size | 454.93 KB |

| Pages | 20 |

| DMCA | Report |

Related /

MKRIMKRI Paper ini menyimpulkan tiga hal utama mengenai metode omnibus.meskipun tidak menolak keberadaan metode omnibus dalam Undang‑Undang Pembentukan PeraturanPaper ini menyimpulkan tiga hal utama mengenai metode omnibus.meskipun tidak menolak keberadaan metode omnibus dalam Undang‑Undang Pembentukan Peraturan

MKRIMKRI Praktik “memborong dukungan partai oleh kandidat kuat serta dominasi elite partai mempersempit ruang kompetisi. Untuk mencegah hal tersebut, diperlukanPraktik “memborong dukungan partai oleh kandidat kuat serta dominasi elite partai mempersempit ruang kompetisi. Untuk mencegah hal tersebut, diperlukan

MKRIMKRI Ketiga, praktik Mahkamah cenderung menggunakan penyeimbangan yang tidak terstruktur dan belum mengembangkan uji proporsionalitas bertahap yang disiplin.Ketiga, praktik Mahkamah cenderung menggunakan penyeimbangan yang tidak terstruktur dan belum mengembangkan uji proporsionalitas bertahap yang disiplin.

MKRIMKRI 60/PUU-XXII/2024 merupakan langkah signifikan dalam memperkuat demokrasi lokal di Indonesia, dengan menyamakan syarat pencalonan antara partai politik60/PUU-XXII/2024 merupakan langkah signifikan dalam memperkuat demokrasi lokal di Indonesia, dengan menyamakan syarat pencalonan antara partai politik

MKRIMKRI Hal tersebut sejalan dengan Putusan MK Nomor 114/PUU-XX/2022 yang, dalam pertimbangan hukumnya, menghendaki penyempurnaan sistem proporsional sekalipunHal tersebut sejalan dengan Putusan MK Nomor 114/PUU-XX/2022 yang, dalam pertimbangan hukumnya, menghendaki penyempurnaan sistem proporsional sekalipun

MKRIMKRI Permasalahan hukum yang timbul setelah diucapkannya Putusan Mahkamah Konstitusi Nomor 59/PUU-XXI/2023 adalah bahwa putusan tersebut tidak turut mengujiPermasalahan hukum yang timbul setelah diucapkannya Putusan Mahkamah Konstitusi Nomor 59/PUU-XXI/2023 adalah bahwa putusan tersebut tidak turut menguji

MKRIMKRI Hasil penelitian menunjukkan bahwa ketidaknetralan presiden dalam proses Pilpres 2024 bertentangan dengan konstitusi dan nilai etik, sehingga presidenHasil penelitian menunjukkan bahwa ketidaknetralan presiden dalam proses Pilpres 2024 bertentangan dengan konstitusi dan nilai etik, sehingga presiden

UMMUMM Penelitian ini membandingkan regulasi AI di sektor perbankan dan fintech Indonesia dan Singapura, fokus pada kesenjangan antara regulasi dan kondisi nyata.Penelitian ini membandingkan regulasi AI di sektor perbankan dan fintech Indonesia dan Singapura, fokus pada kesenjangan antara regulasi dan kondisi nyata.

Useful /

KPUKPU Pemilu hijau di Indonesia menghadapi tantangan signifikan akibat belum adanya regulasi yang secara eksplisit mengatur standar lingkungan dalam penyelenggaraanPemilu hijau di Indonesia menghadapi tantangan signifikan akibat belum adanya regulasi yang secara eksplisit mengatur standar lingkungan dalam penyelenggaraan

IBSIBS Tujuan penelitian ini adalah untuk mengetahui bagaimana pengaruh job resources terhadap employee engagement dan dampaknya pada turnover intention baikTujuan penelitian ini adalah untuk mengetahui bagaimana pengaruh job resources terhadap employee engagement dan dampaknya pada turnover intention baik

E GREENATIONE GREENATION Ini termasuk penerapan sistem penghematan energi, strategi pengurangan polusi, dan penggunaan sumber daya terbarukan. Secara konsisten, penelitian menunjukkanIni termasuk penerapan sistem penghematan energi, strategi pengurangan polusi, dan penggunaan sumber daya terbarukan. Secara konsisten, penelitian menunjukkan

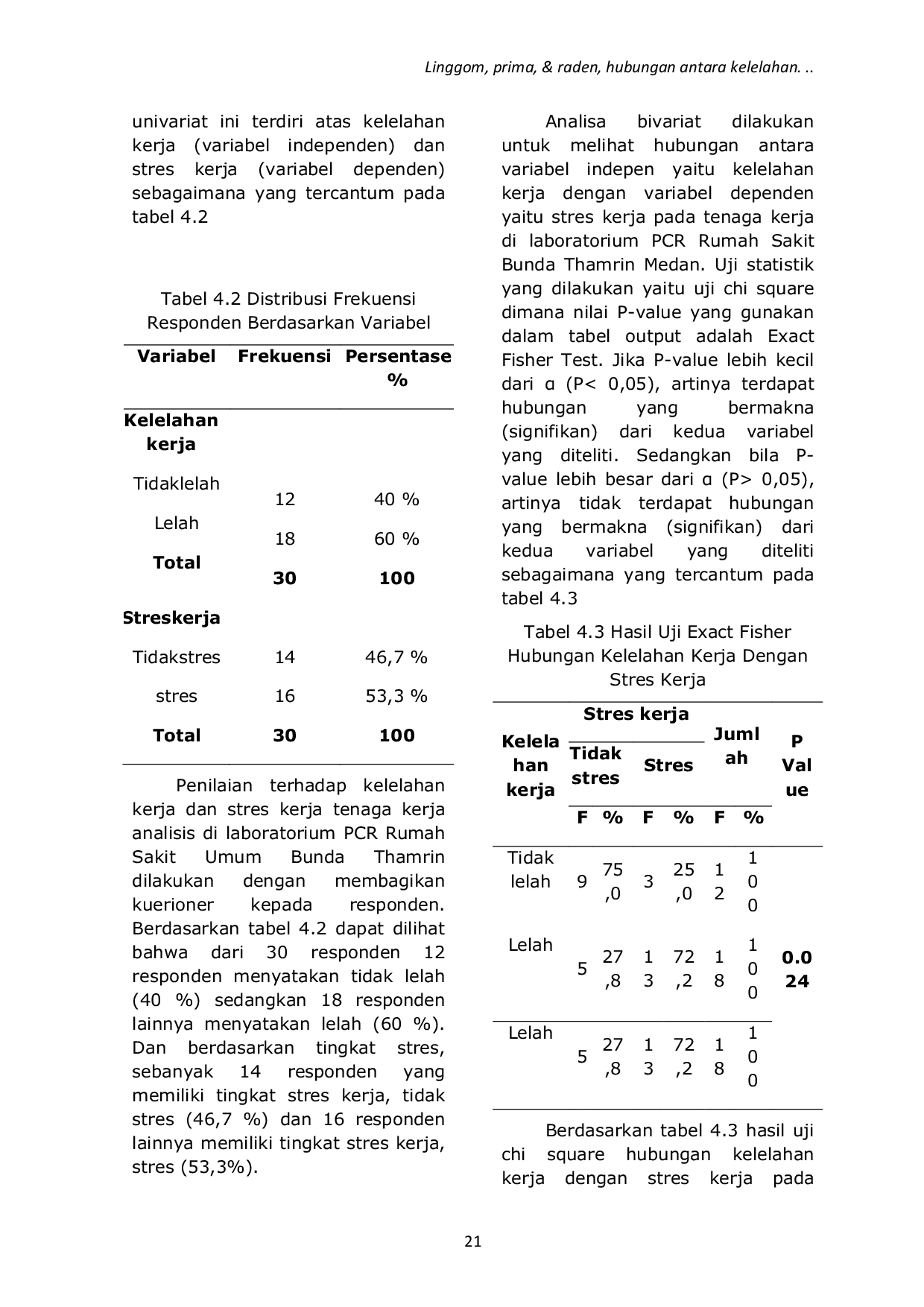

DELIHUSADADELIHUSADA Penelitian ini dilakukan pada tenaga kerja Laboratorium PCR RSU Bunda Thamrin selama tahun 2020‑2021 dengan tujuan mengkaji hubungan antara kelelahanPenelitian ini dilakukan pada tenaga kerja Laboratorium PCR RSU Bunda Thamrin selama tahun 2020‑2021 dengan tujuan mengkaji hubungan antara kelelahan