STIE AMKOPSTIE AMKOP

Bata Ilyas Educational Management ReviewBata Ilyas Educational Management ReviewThis literature review examines key trends and challenges in the banking industrys evolution, focusing on digital transformation, customer-centric strategies, regulatory compliance, fintech disruptions, and sustainable finance practices. The purpose is to analyze how these elements reshape banking operations and strategy. The research design involved a comprehensive synthesis of existing studies and scholarly works to provide a nuanced understanding of the subject. Findings reveal that digital technologies like AI, ML, and big data analytics are streamlining processes, enhancing decision-making, and fostering innovation in financial products and services. Customer-centric approaches, including personalized services and seamless omnichannel interactions, are becoming pivotal for customer satisfaction and loyalty. The review also highlights the importance of agile risk management frameworks, advanced technologies, and ESG integration in navigating regulatory complexities and ensuring compliance. The implications underscore banks need to embrace digitalization, sustainability, and regulatory adaptability to stay competitive and meet evolving customer expectations while fostering long-term relationships and trust.

The gap identified between recent studies and the current empirical and theoretical aspects of this focused study underscores the critical necessity for a holistic comprehension of the intricate interplay and impact of emerging trends and challenges on the strategic trajectory of banks.This entails thoroughly examining how the integration of burgeoning technologies, evolving regulatory frameworks, and shifting customer preferences converge within the dynamic context of banking business models.By bridging this gap, this literature review aspires to enrich the existing scholarly discourse by comprehensively analyzing the present landscape, illuminating potential avenues for future research exploration and advancement.How do emerging trends and challenges in the evolving banking sectors impact strategic decision-making and business outcomes for banks.The objectives are to analyze key trends shaping the banking industry, including digitalization, regulatory compliance, and sustainability.and to evaluate the challenges faced by banks in adapting to these trends and develop strategic recommendations for navigating the evolving landscape effectively.

Berdasarkan tinjauan literatur, beberapa saran penelitian lanjutan yang menarik dapat dikembangkan. Pertama, penelitian dapat mengeksplorasi lebih dalam bagaimana bank dapat mengintegrasikan teknologi blockchain secara lebih efektif untuk meningkatkan keamanan dan transparansi transaksi keuangan, serta mengurangi risiko penipuan. Hal ini melibatkan studi kasus tentang implementasi blockchain di berbagai bank dan analisis dampak terhadap efisiensi operasional dan kepercayaan pelanggan. Kedua, penelitian dapat meneliti lebih lanjut tentang bagaimana bank dapat mengembangkan strategi personalisasi yang lebih canggih berdasarkan analisis data pelanggan, dengan mempertimbangkan aspek etika dan privasi data. Penelitian ini dapat melibatkan eksperimen dengan berbagai algoritma personalisasi dan evaluasi dampaknya terhadap kepuasan dan loyalitas pelanggan. Ketiga, penelitian dapat mengkaji bagaimana bank dapat berkolaborasi dengan fintech untuk menciptakan solusi inovatif yang memenuhi kebutuhan pelanggan yang terus berkembang, sambil tetap mematuhi regulasi yang berlaku. Penelitian ini dapat melibatkan studi komparatif tentang model kolaborasi yang berbeda dan analisis faktor-faktor yang memengaruhi keberhasilan kemitraan tersebut. Dengan menggabungkan ketiga saran ini, diharapkan dapat memberikan kontribusi signifikan terhadap pemahaman tentang bagaimana bank dapat beradaptasi dengan perubahan lanskap keuangan dan memberikan nilai tambah bagi pelanggan.

| File size | 541.95 KB |

| Pages | 14 |

| Short Link | https://juris.id/p-2JO |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

POLSRIPOLSRI Analisis regresi linier berganda kemudian digunakan untuk menganalisis data. Hasil menunjukkan bahwa suasana toko memiliki pengaruh positif dan signifikanAnalisis regresi linier berganda kemudian digunakan untuk menganalisis data. Hasil menunjukkan bahwa suasana toko memiliki pengaruh positif dan signifikan

JURNALUNIV45SBYJURNALUNIV45SBY Hasil yang diperoleh dari penelitian ini ialah dengan mengetahui hasil perumusan alternatif strategi pengembangan pemasaran UMKM Sweety Bakery yaitu (1)Hasil yang diperoleh dari penelitian ini ialah dengan mengetahui hasil perumusan alternatif strategi pengembangan pemasaran UMKM Sweety Bakery yaitu (1)

STIE AASSTIE AAS Penelitian selanjutnya disarankan memperluas wilayah studi, meningkatkan ukuran sampel, serta menambahkan variabel seperti kepercayaan merek dan keterlibatanPenelitian selanjutnya disarankan memperluas wilayah studi, meningkatkan ukuran sampel, serta menambahkan variabel seperti kepercayaan merek dan keterlibatan

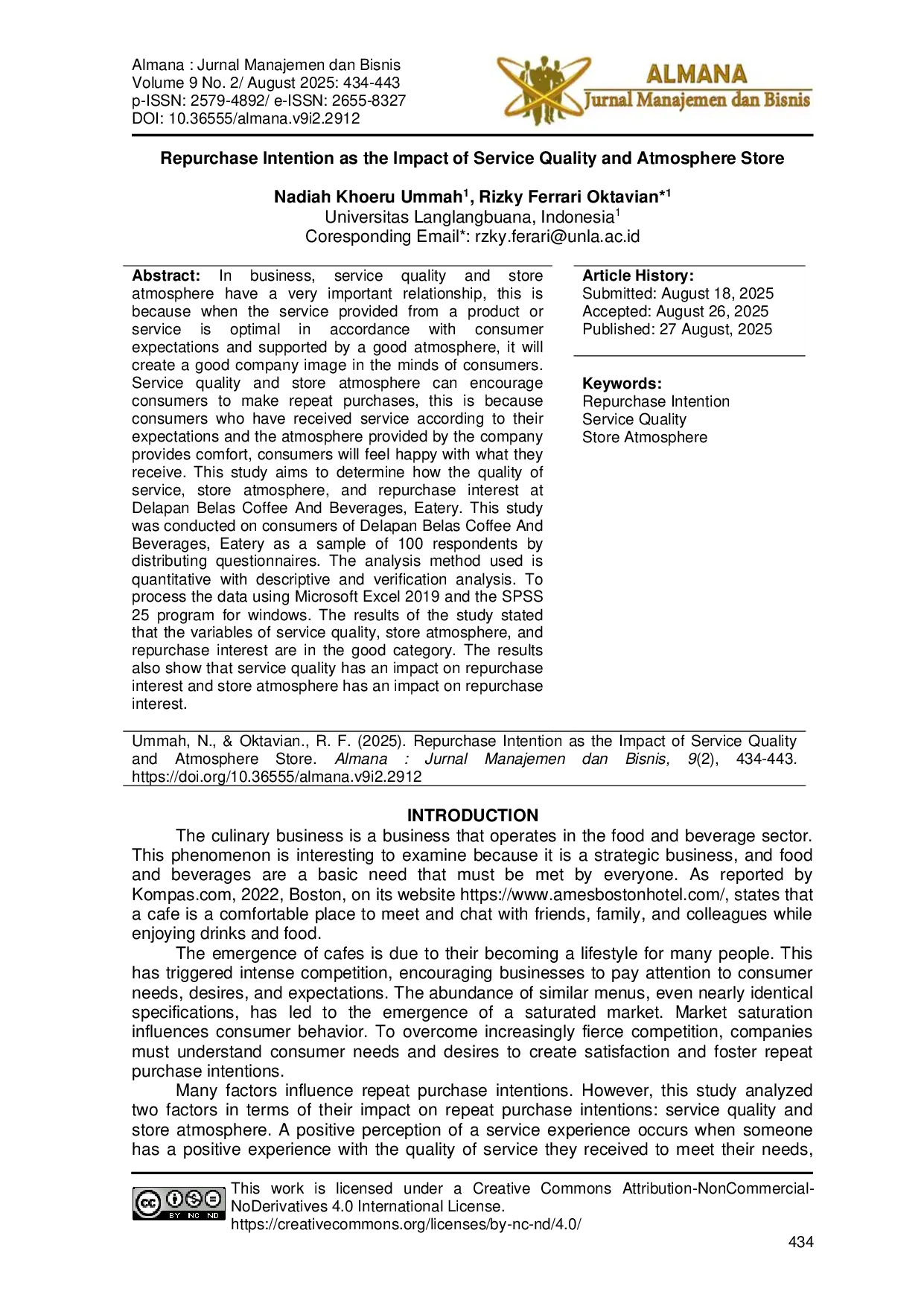

UnlaUnla Suasana toko berdampak secara parsial terhadap minat pembelian kembali di Delapan Belas Coffee and Beverages, Eatery. Kualitas layanan dan suasana tokoSuasana toko berdampak secara parsial terhadap minat pembelian kembali di Delapan Belas Coffee and Beverages, Eatery. Kualitas layanan dan suasana toko

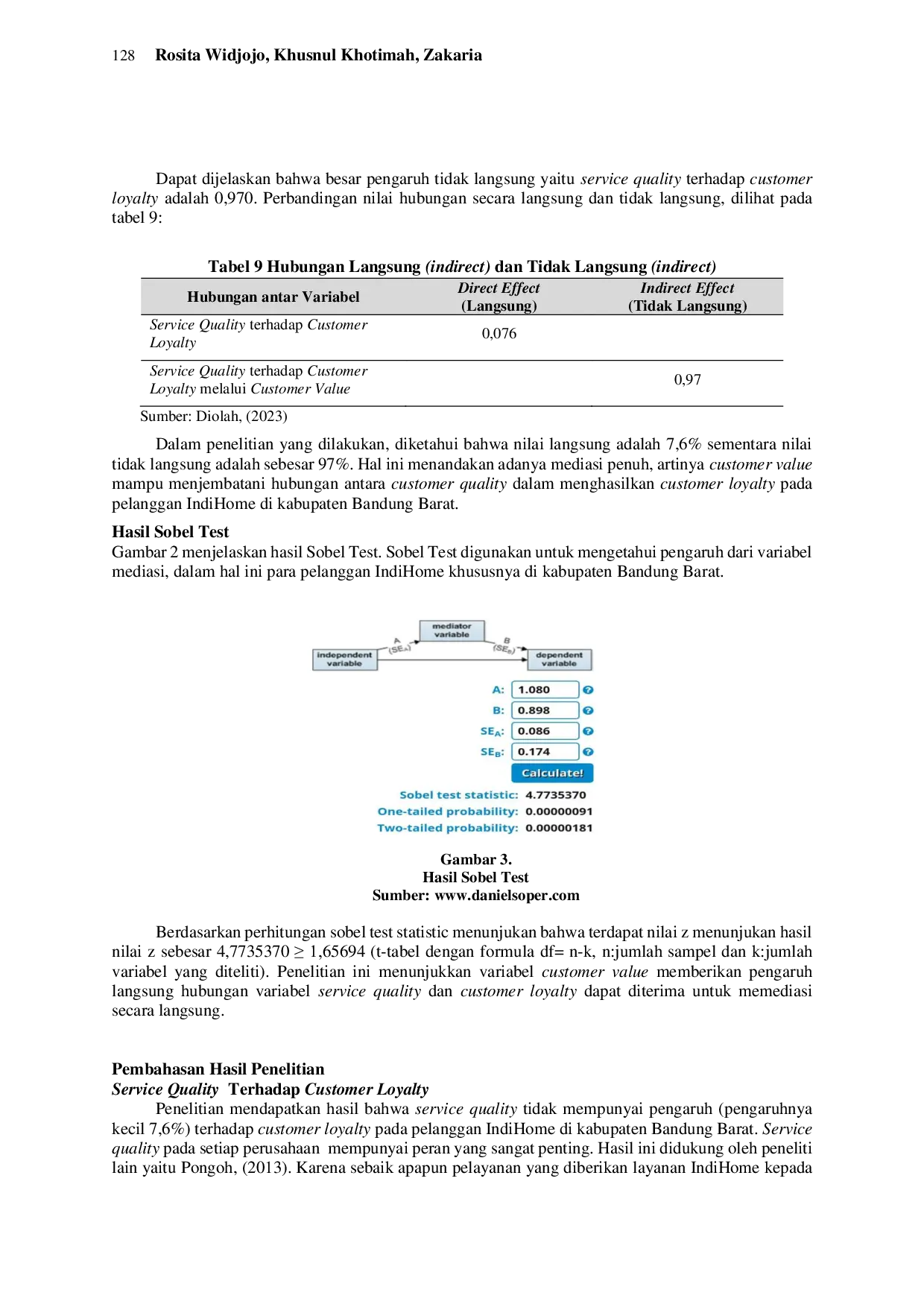

PPSUNIYAPPPSUNIYAP Uji Sobel memperkuat temuan mediasi penuh ini. Kualitas layanan IndiHome berdampak terbatas langsung pada loyalitas pelanggan (7,6%), namun berpengaruhUji Sobel memperkuat temuan mediasi penuh ini. Kualitas layanan IndiHome berdampak terbatas langsung pada loyalitas pelanggan (7,6%), namun berpengaruh

STIEGICISTIEGICI Data-data yang telah memenuhi uji validitas, uji reabilitas, dan uji asumsi klasik diolah sehingga menghasilkan persamaan regresi sebagai berikut: Y= 24.699Data-data yang telah memenuhi uji validitas, uji reabilitas, dan uji asumsi klasik diolah sehingga menghasilkan persamaan regresi sebagai berikut: Y= 24.699

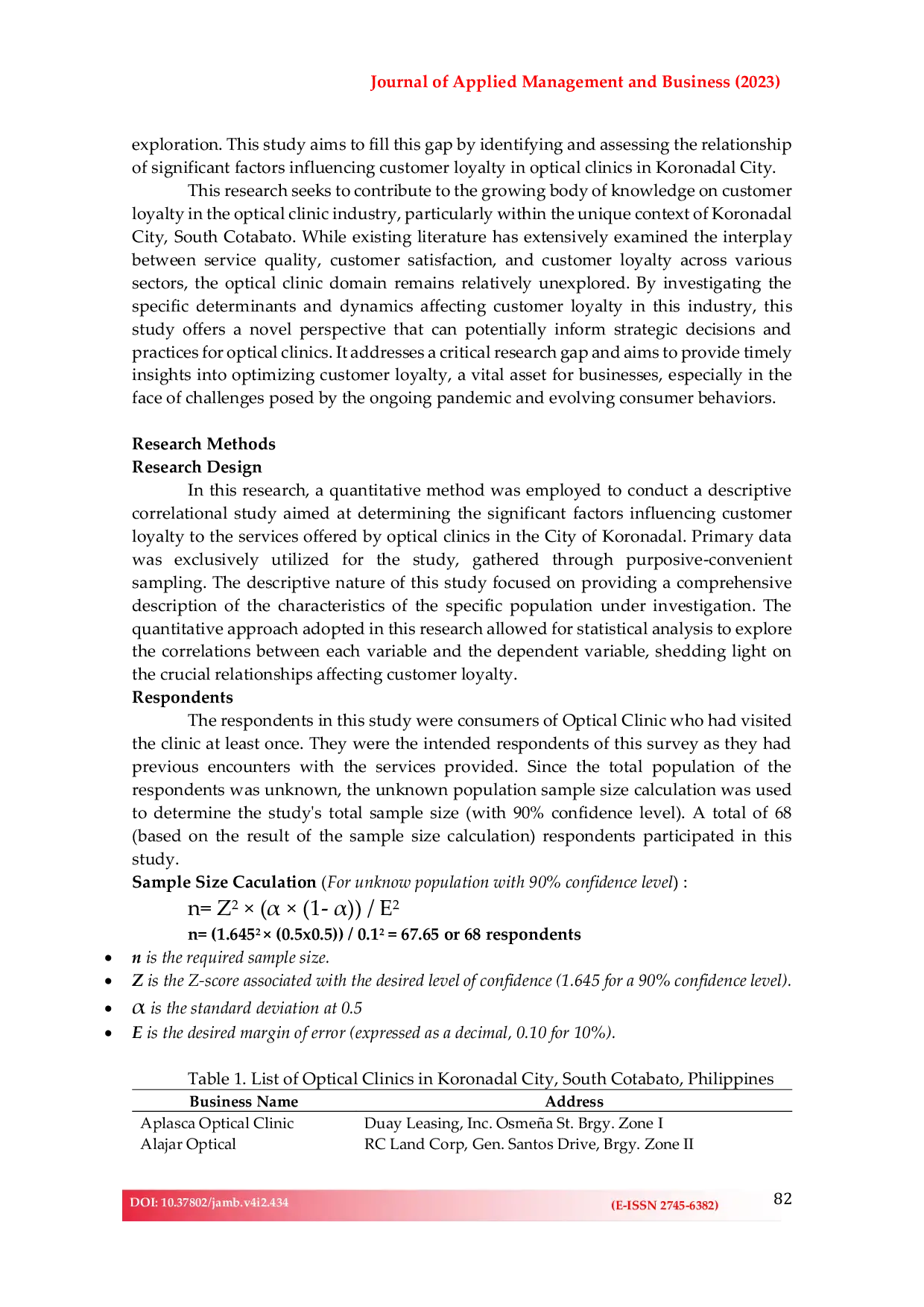

DINAMIKADINAMIKA Studi ini menginvestigasi faktor-faktor yang mempengaruhi loyalitas pelanggan di industri klinik optik Koronadal. Penelitian ini bertujuan untuk memberikanStudi ini menginvestigasi faktor-faktor yang mempengaruhi loyalitas pelanggan di industri klinik optik Koronadal. Penelitian ini bertujuan untuk memberikan

STIAMISTIAMI Penelitian ini menggunakan metode deskriptif dengan data kuantitatif, karena data dikumpulkan dalam bentuk angka atau kalimat dan kemudian dianalisis untukPenelitian ini menggunakan metode deskriptif dengan data kuantitatif, karena data dikumpulkan dalam bentuk angka atau kalimat dan kemudian dianalisis untuk

Useful /

LARISMALARISMA Kajian ini menegaskan bahwa pemahaman derivasi dan infleksi secara terpadu merupakan kunci untuk memahami sistem pembentukan kata dalam bahasa Arab secaraKajian ini menegaskan bahwa pemahaman derivasi dan infleksi secara terpadu merupakan kunci untuk memahami sistem pembentukan kata dalam bahasa Arab secara

JOURNALKEBERLANJUTANJOURNALKEBERLANJUTAN The results of the survey indicate that motivation has no significant effect on employee performance, motivation has a positive and significant effectThe results of the survey indicate that motivation has no significant effect on employee performance, motivation has a positive and significant effect

CASCAS Ulama Nusantara memainkan peran sentral dalam proses ini dengan mengintegrasikan ajaran Islam universal dengan nilai-nilai budaya lokal, mengembangkanUlama Nusantara memainkan peran sentral dalam proses ini dengan mengintegrasikan ajaran Islam universal dengan nilai-nilai budaya lokal, mengembangkan

POLITEKNIKACEHPOLITEKNIKACEH Penelitian ini bertujuan untuk menganalisis perlakuan akuntansi penerimaan dan pengeluaran kas pada CV. Al Fzail Jaya di Banda Aceh. Penelitian ini menyorotiPenelitian ini bertujuan untuk menganalisis perlakuan akuntansi penerimaan dan pengeluaran kas pada CV. Al Fzail Jaya di Banda Aceh. Penelitian ini menyoroti