ILOMATAILOMATA

Ilomata International Journal of Tax and AccountingIlomata International Journal of Tax and AccountingNon-performing loans have posed a persistent challenge in Ghana, impacting negatively on financial stability and economic growth. Studies have been conducted on NPLs focusing on external factors. However, the real impact of internal determinants has not been explored in the Ghanaian context. This work investigates the effect of macroeconomic and bank-specific variables on NPLs in Ghana, using existing data from published financial reports of nine firms from 2008 to 2021. This study focuses on NPLs as proxies for the dependent variable, while GDP growth rate, banks size, capital adequacy, and unemployment are used as predictor variables. The random effects technique was employed for examination using Ordinary Least Squares. The discoveries prove that GDP has insignificant negative influence on NPLs, whilst bank size and capital adequacy have positive and statistically significant effect on NPLs. Again, unemployment has statistically significant effect on NPLs and bank performance. Banks need to strengthen credit risk management frameworks, particularly for larger institutions, and refine the capital adequacy strategies to align with actual risk exposure. This calls for regulators to adjust capital requirements and explore employment support mechanisms to mitigate the complex relationship between unemployment and NPLs, ensuring that policies are tailored to suit local conditions.

In conclusion, the study reveals complex associations between macroeconomic indicators and bank-specific variables with non-performing loans in Ghana.The insignificant impact of GDP growth on NPLs highlights that economic growth alone isnt a primary driver of loan performance, diverging from existing literature.A significant positive relationship exists between bank size and NPLs, indicating that larger banks can face amplified credit risks.However, a noteworthy point is the positive correlation between capital adequacy ratio and NPLs, showing a complex dynamic within the banking sector.

Future research could investigate the impact of fintech innovations on NPLs in Ghana, examining whether technology-driven credit scoring and risk assessment tools can improve loan performance and reduce defaults; furthermore, studies could delve into the role of financial literacy programs for borrowers in mitigating NPLs, to assess the effectiveness of educational initiatives in improving repayment rates and informed borrowing decisions; finally, its crucial to explore the influence of governmental policies and regulatory frameworks supporting small and medium-sized enterprises (SMEs) regarding credit access and NPLs, as easing financial constraints and nurturing a supportive regulatory environment for SMEs could alleviate credit risks and contribute to the overall stability of the banking system. These areas of investigation should involve both quantitative and qualitative methodologies, incorporating data from banks, borrowers, and policymakers to obtain a nuanced understanding of these complex relationships and facilitate targeted policy interventions.

- Pengaruh Risiko Kredit dan Risiko Likuiditas Terhadap Profitabilitas Bank: Studi Kasus pada Bank BUMN... doi.org/10.37641/jimkes.v6i3.294Pengaruh Risiko Kredit dan Risiko Likuiditas Terhadap Profitabilitas Bank Studi Kasus pada Bank BUMN doi 10 37641 jimkes v6i3 294

- Vol. 7, No. 4; December 2020 (Abstract 7). vol december abstract journal business economic policy issn... doi.org/10.30845/jbep.v7n4p7Vol 7 No 4 December 2020 Abstract 7 vol december abstract journal business economic policy issn doi 10 30845 jbep v7n4p7

| File size | 289.75 KB |

| Pages | 18 |

| DMCA | Report |

Related /

INTEKOMINTEKOM Penelitian berikutnya dapat memperluas cakupan studi dan masa waktu penelitian serta mendalami analisis lebih lanjut untuk mengidentifikasi tren dan perubahanPenelitian berikutnya dapat memperluas cakupan studi dan masa waktu penelitian serta mendalami analisis lebih lanjut untuk mengidentifikasi tren dan perubahan

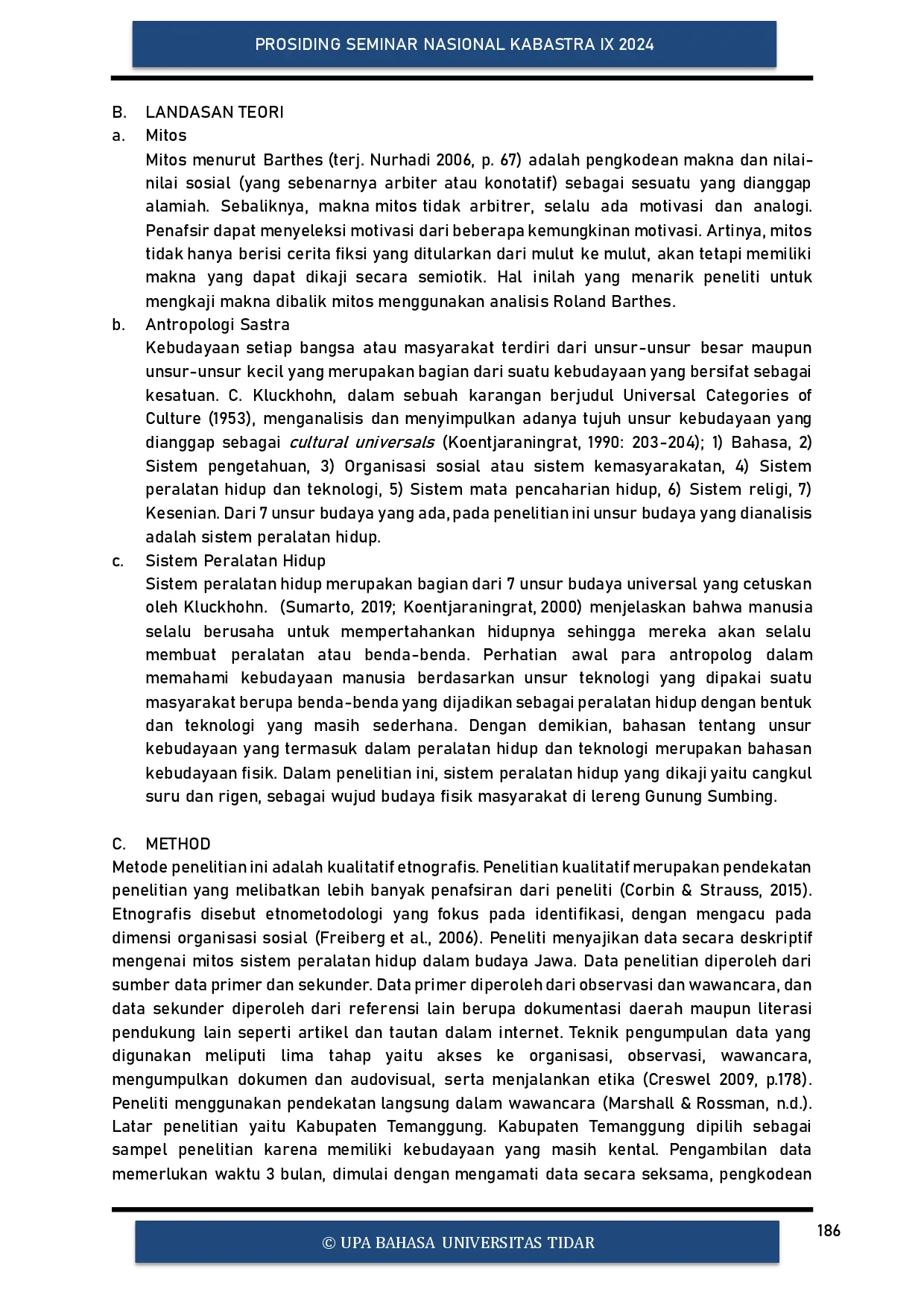

UTMUTM Adapun rigen merupakan alat menjemur tembakau yang dipercaya sebagai kendaraan Ki Ageng Makukuhan. Simbol dalam alat pertanian ini bermakna kesederhanaanAdapun rigen merupakan alat menjemur tembakau yang dipercaya sebagai kendaraan Ki Ageng Makukuhan. Simbol dalam alat pertanian ini bermakna kesederhanaan

E JOURNALLPPMUNSAE JOURNALLPPMUNSA Responden dalam penelitian ini adalah petani jagung lahan kering di Desa Pelat, Kecamatan Unter Iwes, yang dipilih melalui teknik accidental sampling danResponden dalam penelitian ini adalah petani jagung lahan kering di Desa Pelat, Kecamatan Unter Iwes, yang dipilih melalui teknik accidental sampling dan

IPTSIPTS Namun, berdasarkan pengakuan mahasiswa, keterlibatan mereka dalam kegiatan sosial masih minim karena kesibukan akademik dan perbedaan gaya hidup. MeskiNamun, berdasarkan pengakuan mahasiswa, keterlibatan mereka dalam kegiatan sosial masih minim karena kesibukan akademik dan perbedaan gaya hidup. Meski

UIN MATARAMUIN MATARAM Tradisi keagamaan, pengajian bersama, dan kegiatan adat yang dipadukan dengan nilai Islam menjadi media penting dalam proses rekonstruksi sosial, termasukTradisi keagamaan, pengajian bersama, dan kegiatan adat yang dipadukan dengan nilai Islam menjadi media penting dalam proses rekonstruksi sosial, termasuk

POLIMEDIAPOLIMEDIA Mitranya yaitu kelompok masyarakat di satu kelurahan yang diwakili oleh 35 orang kepala keluarga sebagai anggota dari rukun sosial kemasyarakatan dimaksud.Mitranya yaitu kelompok masyarakat di satu kelurahan yang diwakili oleh 35 orang kepala keluarga sebagai anggota dari rukun sosial kemasyarakatan dimaksud.

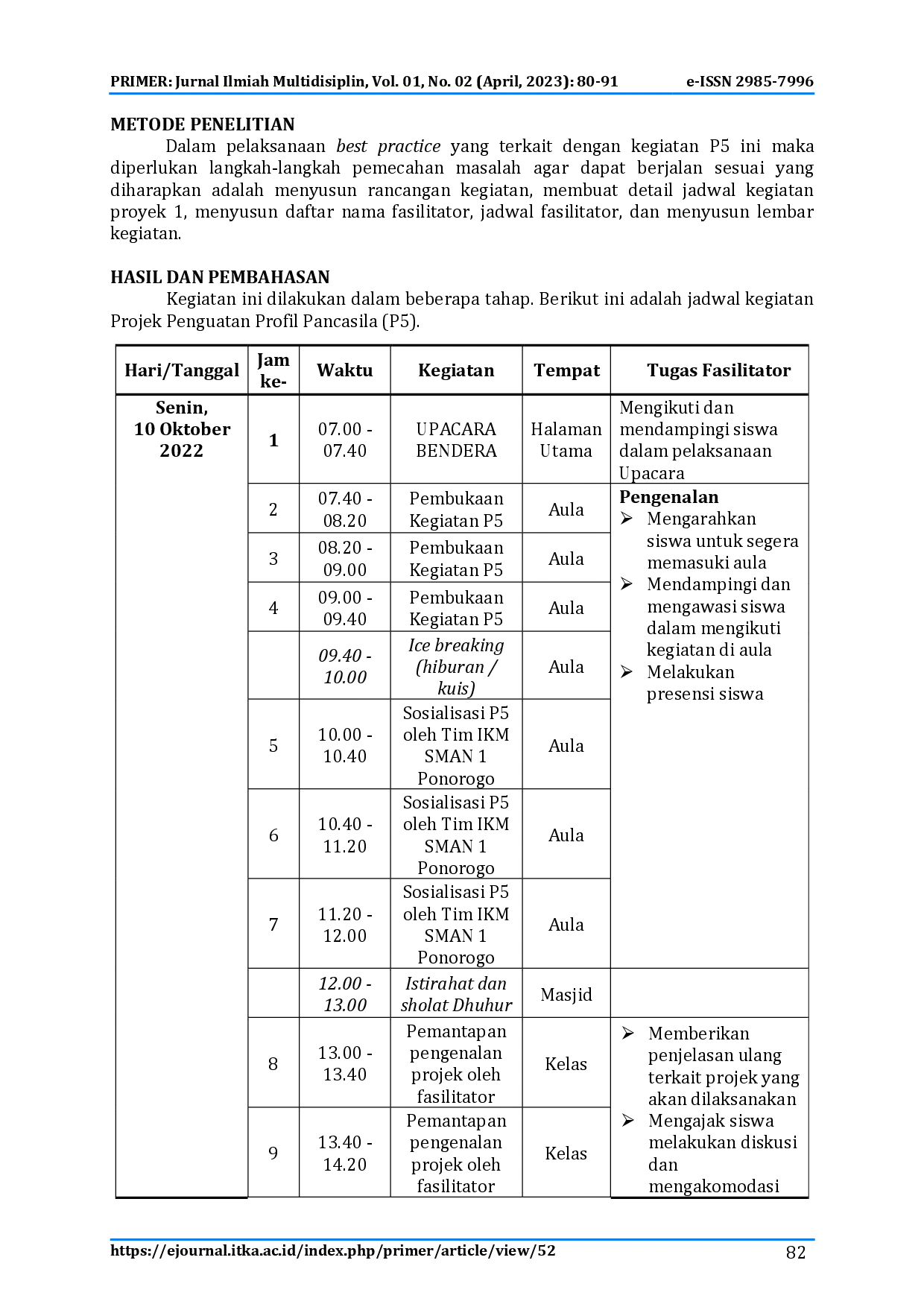

ITKAITKA Projek penguatan profil pelajar Pancasila merupakan kegiatan kokurikuler berbasis projek yang dirancang untuk menguatkan upaya pencapaian kompetensi danProjek penguatan profil pelajar Pancasila merupakan kegiatan kokurikuler berbasis projek yang dirancang untuk menguatkan upaya pencapaian kompetensi dan

STAIMTASTAIMTA Degradasi budaya ini disebabkan oleh industrialisasi, globalisasi, dan keteladanan yang pudar. penggalian nilai-nilai keagamaan dan Pancasila, penyusunanDegradasi budaya ini disebabkan oleh industrialisasi, globalisasi, dan keteladanan yang pudar. penggalian nilai-nilai keagamaan dan Pancasila, penyusunan

Useful /

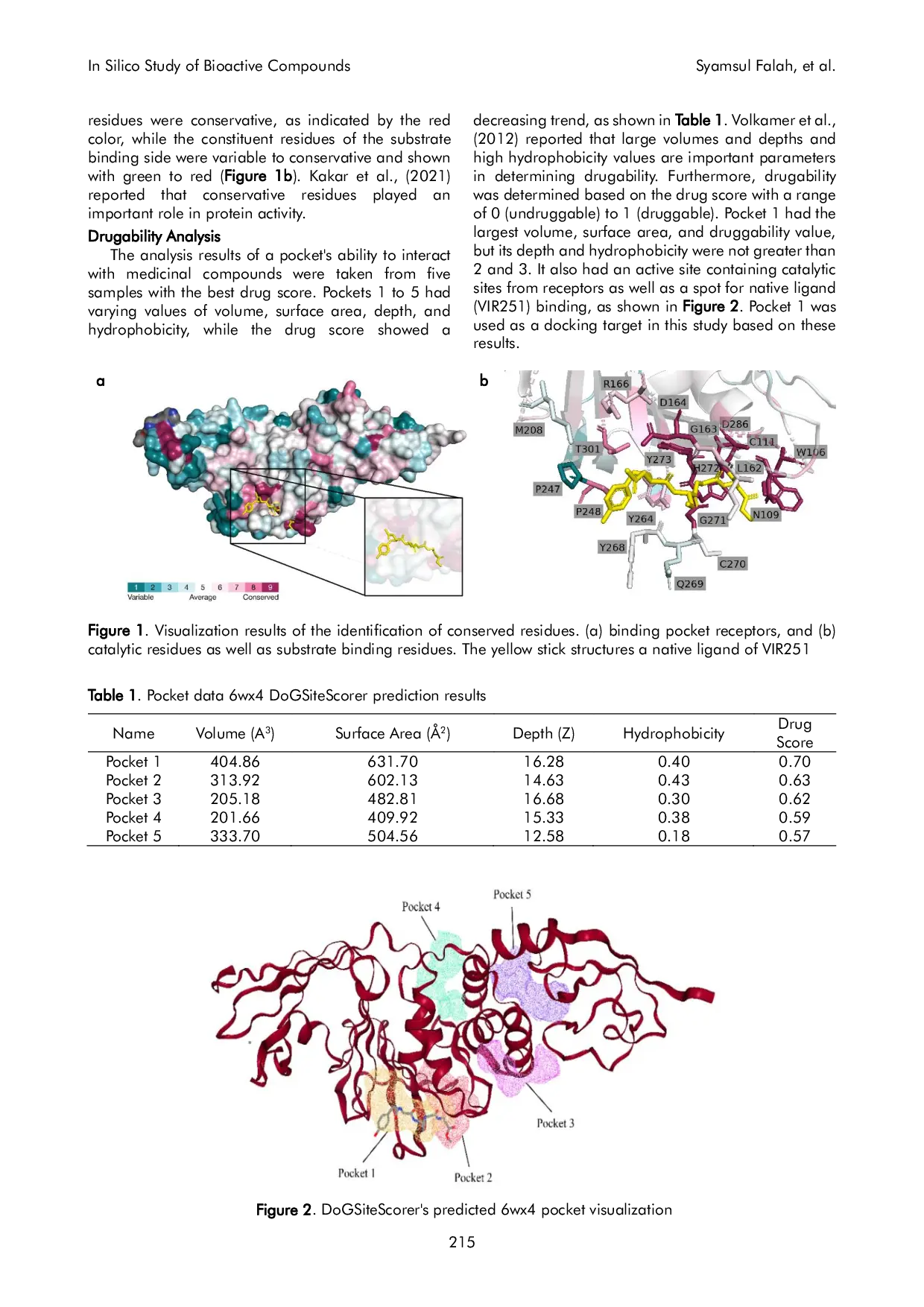

UNSOEDUNSOED Empat ligan uji, yaitu epigallocatechin‑3‑gallate (−98,93 kcal/mol) dari daun S. polyanthum, katekin (−80,10 kcal/mol) dan epikatekin (−80,12 kcal/mol)Empat ligan uji, yaitu epigallocatechin‑3‑gallate (−98,93 kcal/mol) dari daun S. polyanthum, katekin (−80,10 kcal/mol) dan epikatekin (−80,12 kcal/mol)

FAPETUNIPAFAPETUNIPA Hasil menunjukkan bahwa P3, yaitu campuran substrat (50:40:10), memiliki nilai rata-rata kandungan nitrogen, karbon, rasio C/N, dan nilai pH yang tinggiHasil menunjukkan bahwa P3, yaitu campuran substrat (50:40:10), memiliki nilai rata-rata kandungan nitrogen, karbon, rasio C/N, dan nilai pH yang tinggi

FAPETUNIPAFAPETUNIPA Hasil penelitian menunjukkan bahwa tipe kelahiran tunggal memiliki berat lahir dan berat badan umur 90 hari yang lebih tinggi dibandingkan tipe kelahiranHasil penelitian menunjukkan bahwa tipe kelahiran tunggal memiliki berat lahir dan berat badan umur 90 hari yang lebih tinggi dibandingkan tipe kelahiran

FAPETUNIPAFAPETUNIPA Sikap konsumen terhadap karkas ayam pedaging secara keseluruhan dinyatakan positif. Sikap konsumen terhadap karkas ayam pedaging di pasar tradisional SamarindaSikap konsumen terhadap karkas ayam pedaging secara keseluruhan dinyatakan positif. Sikap konsumen terhadap karkas ayam pedaging di pasar tradisional Samarinda