STIE AASSTIE AAS

International Journal of Economics, Business and Accounting Research (IJEBAR)International Journal of Economics, Business and Accounting Research (IJEBAR)The purpose of this study was to determine the level of contribution of the advertisement tax on revenue, which in the era of regional autonomy, local governments are required to always improve the reception area, such as an increase in local tax revenue through advertising tax receipts. This research applies descriptive analysis method, wherein the method is used to provide a systematic explanation, actual and accurate statement of fact, and just describe situations or events not to seek or explain the relationships and testing hypotheses. From the analysis of the data shows that Sukoharjo advertisement tax revenue from the year 2012-2016 reached an average of 119.02%. Advertisement tax contribution rate to the Local Tax reached an average 3.06%, to the level of the advertisement tax revenue contribution to the local revenue of the year 2012-2016 is still in very less criteria with an average 1.50%.

Based on the results of the research and discussion that has been done on the contribution of advertisement tax to PAD of Sukoharjo, it can be concluded that the advertisement tax revenue contribution to the Local Tax Revenue with an average of 3.While the advertisement tax revenue contribution to PAD Sukoharjo district for 5 years is still included in the criteria is very less with an average of 1.This result meant that the advertisement tax management need to be considered to be optimal.Therefore, it is necessary to enhance data collection of objects, optimize untapped potential, and regularly disseminate information on the importance of advertisement tax to support public welfare.

Berdasarkan latar belakang, metode, hasil, dan keterbatasan penelitian ini, terdapat beberapa saran penelitian lanjutan yang dapat dilakukan. Pertama, penelitian lebih lanjut dapat dilakukan untuk menganalisis efektivitas strategi penegakan hukum terhadap pelanggaran peraturan periklanan, seperti pemasangan billboard ilegal, yang dapat meningkatkan potensi penerimaan pajak. Kedua, perlu dilakukan studi komparatif dengan daerah lain yang memiliki karakteristik serupa untuk mengidentifikasi praktik terbaik dalam pengelolaan pajak iklan dan mengadaptasinya di Kabupaten Sukoharjo. Ketiga, penelitian selanjutnya dapat fokus pada pemanfaatan teknologi informasi, seperti sistem pemetaan digital dan sistem pembayaran online, untuk meningkatkan efisiensi dan transparansi dalam proses pengawasan dan pengumpulan pajak iklan. Implementasi sistem informasi yang terintegrasi juga dapat membantu dalam identifikasi potensi pajak baru dan meminimalkan praktik penghindaran pajak. Penelitian-penelitian ini diharapkan dapat memberikan kontribusi signifikan dalam meningkatkan penerimaan daerah dan mendukung pembangunan ekonomi Kabupaten Sukoharjo secara berkelanjutan.

| File size | 528.3 KB |

| Pages | 11 |

| Short Link | https://juris.id/p-1im |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

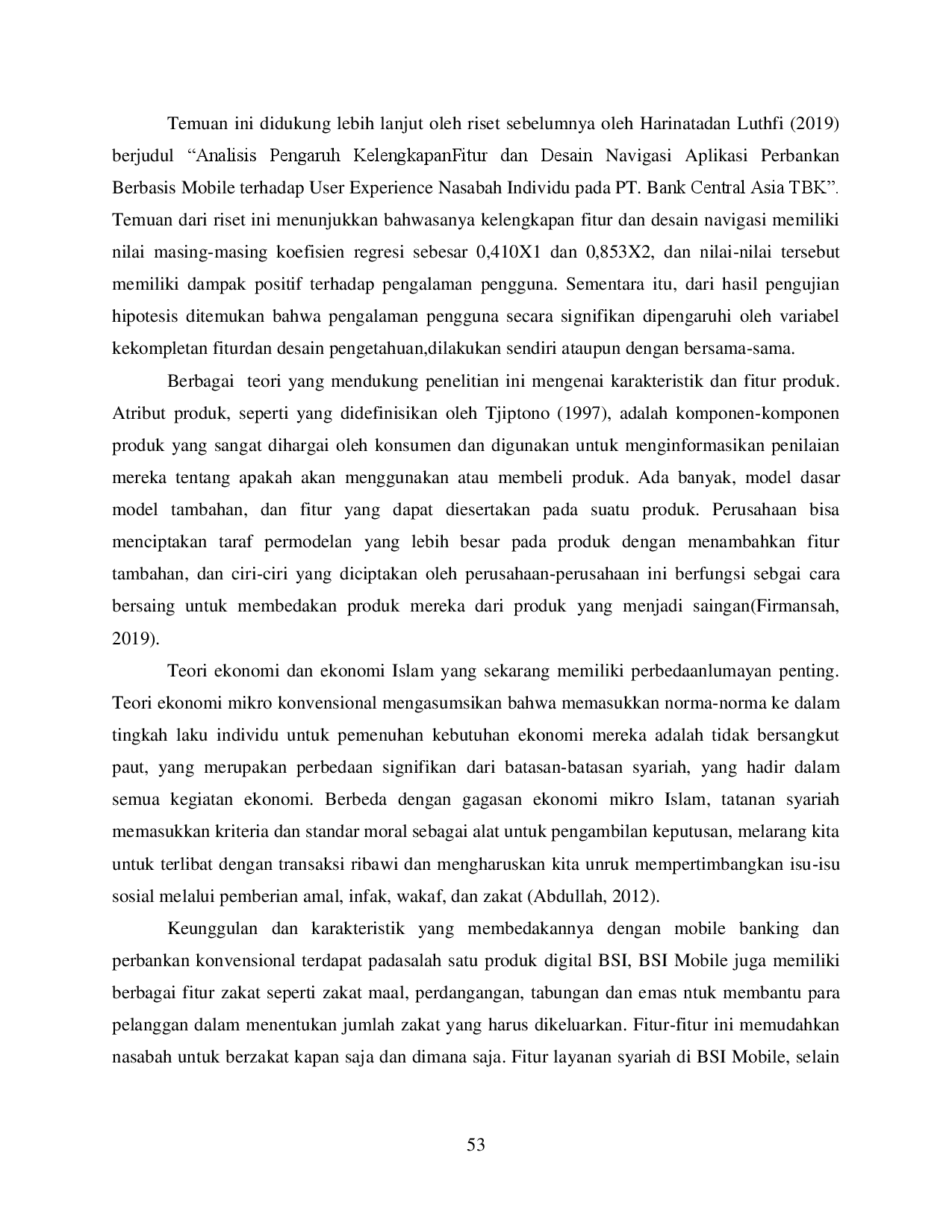

IAIN BONEIAIN BONE Secara simultan, kualitas layanan dan fitur produk BSI Mobile berpengaruh signifikan terhadap kepuasan nasabah. Bank Syariah Indonesia Tbk terus meningkatkanSecara simultan, kualitas layanan dan fitur produk BSI Mobile berpengaruh signifikan terhadap kepuasan nasabah. Bank Syariah Indonesia Tbk terus meningkatkan

IBI DarmajayaIBI Darmajaya Analisis berdasarkan usia mengungkapkan bahwa karyawan usia 18‑21 tahun memiliki persepsi tertinggi pada dimensi pengaruh ideal dan terendah pada kepercayaanAnalisis berdasarkan usia mengungkapkan bahwa karyawan usia 18‑21 tahun memiliki persepsi tertinggi pada dimensi pengaruh ideal dan terendah pada kepercayaan

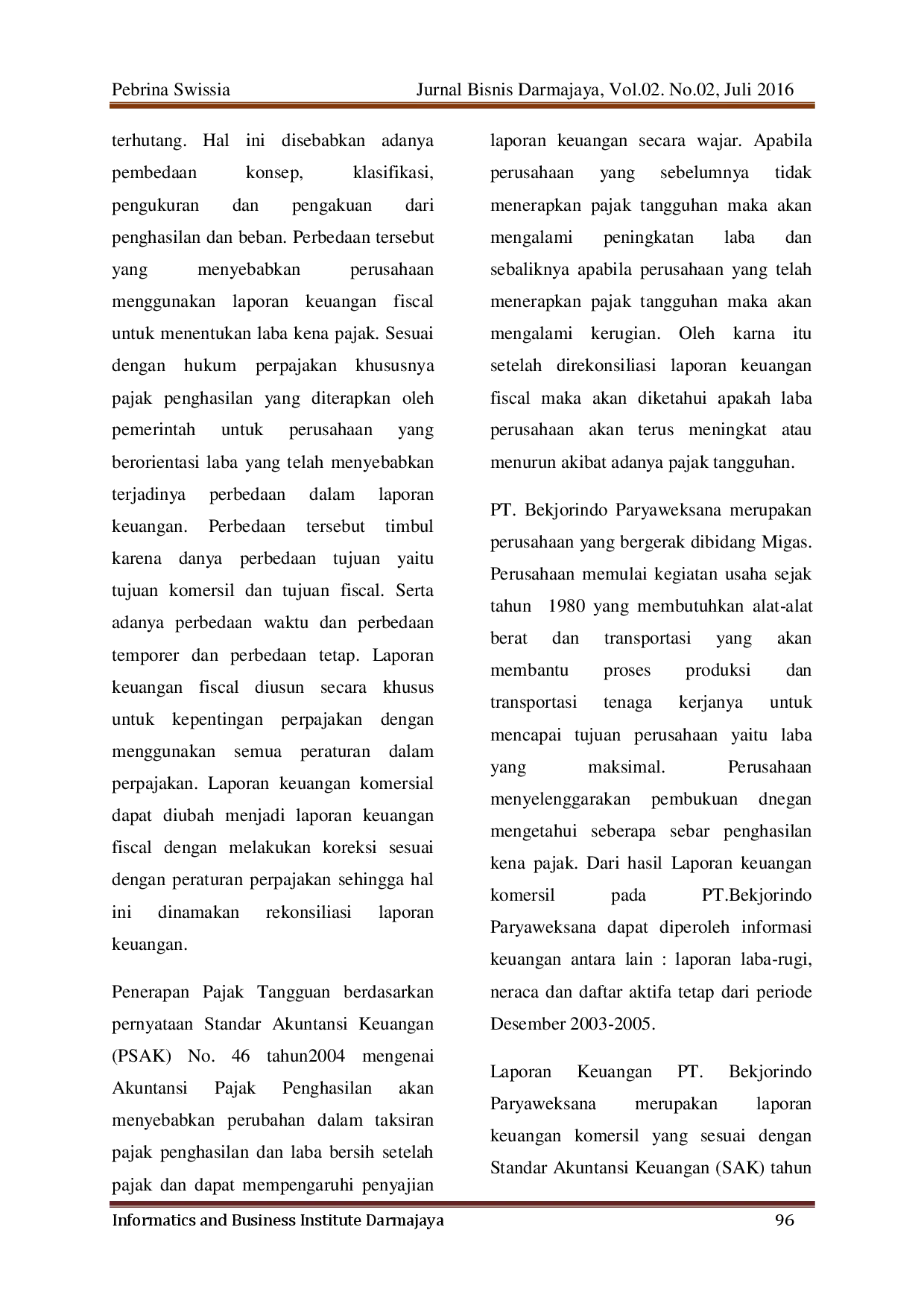

IBI DarmajayaIBI Darmajaya Laporan keuangan PT Bekjorindo Paryaweksana merupakan laporan keuangan komersial yang sesuai dengan Standar Akuntansi Keuangan (SAK) tahun 2004 sedangkanLaporan keuangan PT Bekjorindo Paryaweksana merupakan laporan keuangan komersial yang sesuai dengan Standar Akuntansi Keuangan (SAK) tahun 2004 sedangkan

IBI DarmajayaIBI Darmajaya Bank Danamon Unit Metro dan dapat digunakan sebagai bahan pertimbangan untuk mengatasi masalah yang dihadapi oleh PT. Bank Danamon Unit Metro. Pada penelitianBank Danamon Unit Metro dan dapat digunakan sebagai bahan pertimbangan untuk mengatasi masalah yang dihadapi oleh PT. Bank Danamon Unit Metro. Pada penelitian

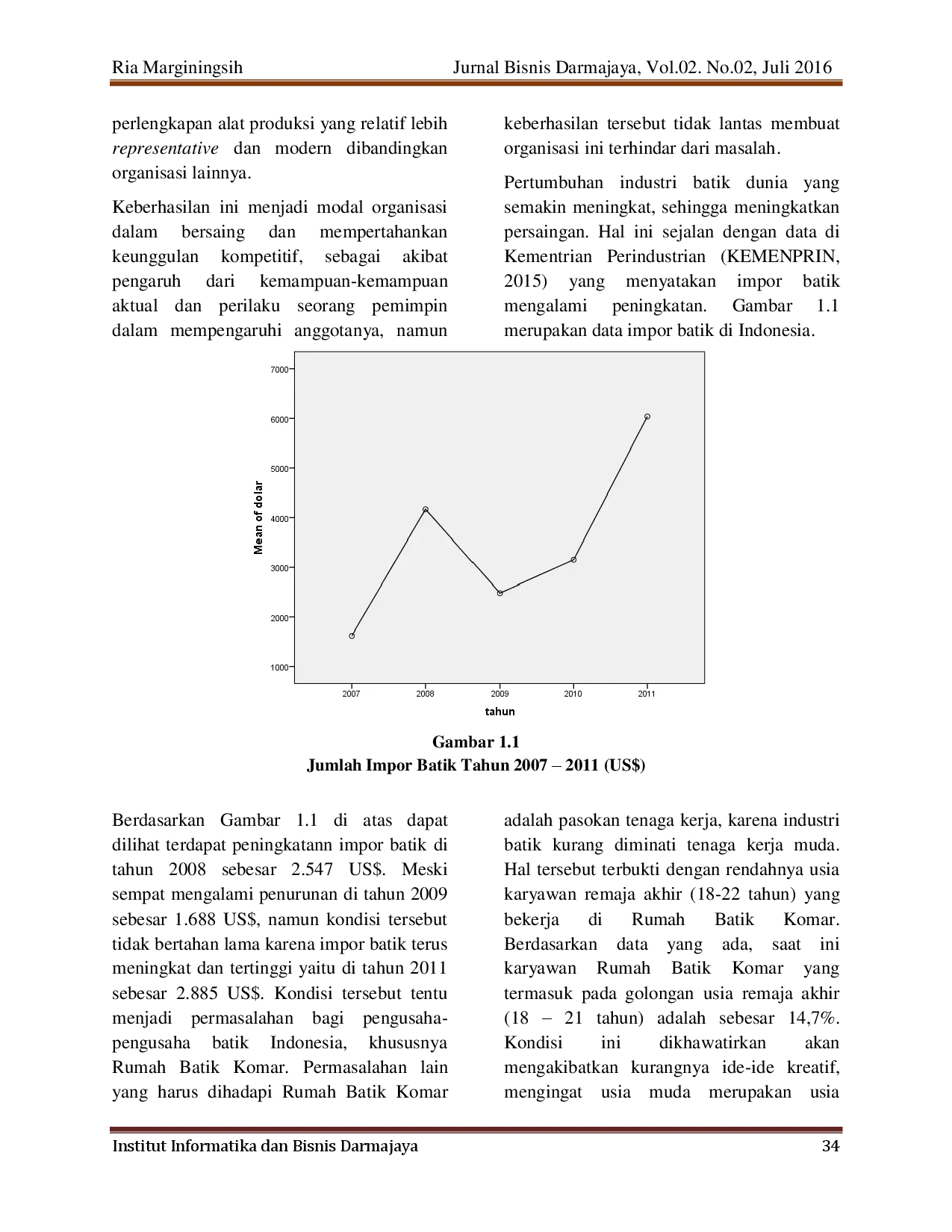

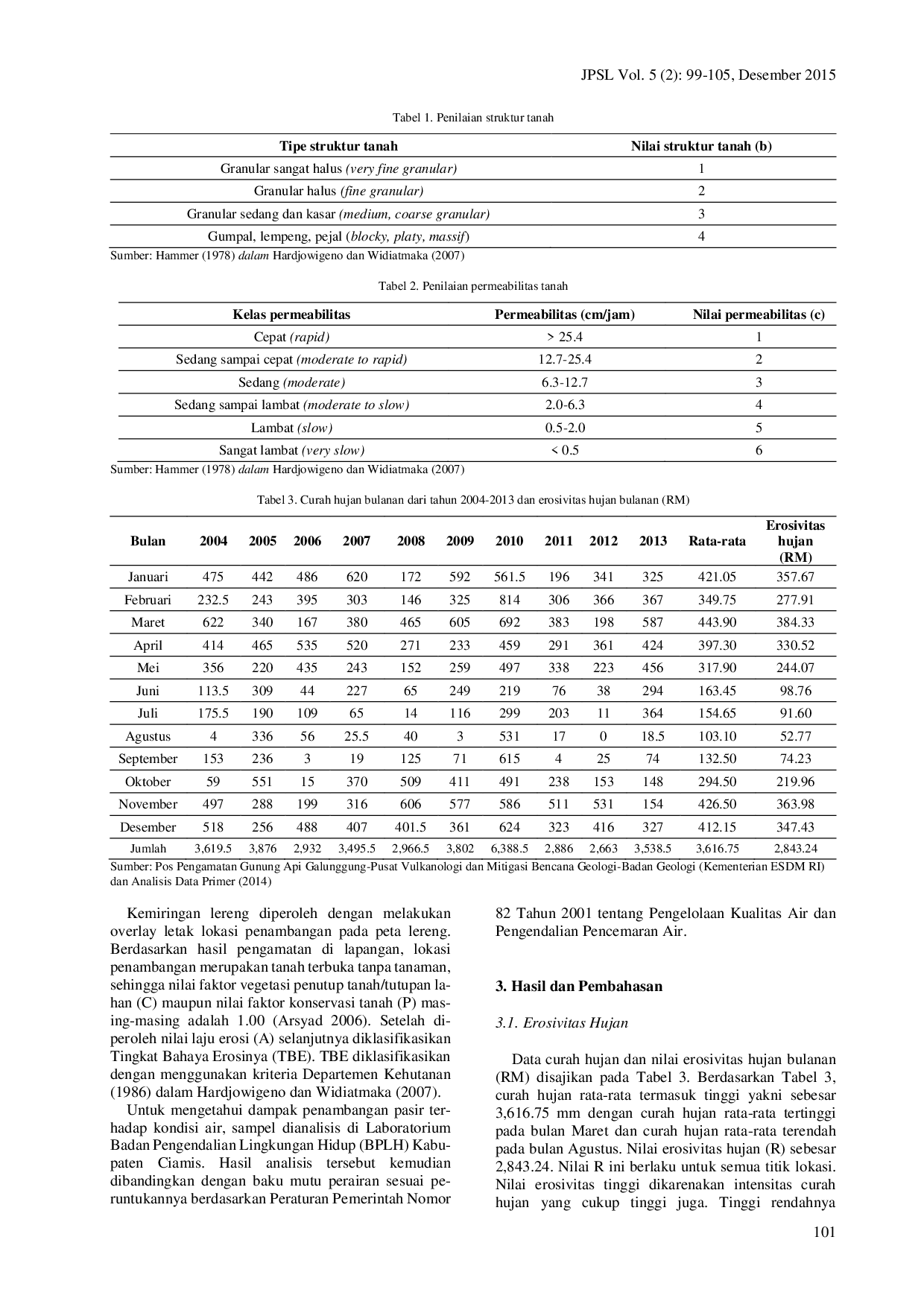

IPBIPB Pasir merupakan komoditas penting untuk konstruksi. Penambangan pasir terbesar di Kabupaten Tasikmalaya terletak di Kecamatan Sukaratu. Kegiatan penambanganPasir merupakan komoditas penting untuk konstruksi. Penambangan pasir terbesar di Kabupaten Tasikmalaya terletak di Kecamatan Sukaratu. Kegiatan penambangan

STIES PURWAKARTASTIES PURWAKARTA Dokumen seperti Proforma Invoice, Purchase Order, Surat Perjanjian, dan Invoice digunakan secara baik dalam mendukung kelancaran transaksi. Dengan sistemDokumen seperti Proforma Invoice, Purchase Order, Surat Perjanjian, dan Invoice digunakan secara baik dalam mendukung kelancaran transaksi. Dengan sistem

STIES PURWAKARTASTIES PURWAKARTA Mekanisme pembiayaan pemilikan kendaraan bermotor di Bank BJB Syariah sesuai dengan prinsip syariah, termasuk akad Murabahah. Nasabah wajib melengkapiMekanisme pembiayaan pemilikan kendaraan bermotor di Bank BJB Syariah sesuai dengan prinsip syariah, termasuk akad Murabahah. Nasabah wajib melengkapi

STIE AASSTIE AAS Tujuan penelitian ini adalah untuk mengetahui pengaruh inflasi, Tingkat BI, dan Pinjaman Bermasalah (NPL) terhadap profitabilitas bank BUMN yang dipelajariTujuan penelitian ini adalah untuk mengetahui pengaruh inflasi, Tingkat BI, dan Pinjaman Bermasalah (NPL) terhadap profitabilitas bank BUMN yang dipelajari

Useful /

UM-SORONGUM-SORONG Output penelitian ini diharapkan dapat memberikan efek ilmiah dan bermanfaat bagi masyarakat, serta menjadi bahan evaluasi bagi partai politik dalam memberikanOutput penelitian ini diharapkan dapat memberikan efek ilmiah dan bermanfaat bagi masyarakat, serta menjadi bahan evaluasi bagi partai politik dalam memberikan

IPBIPB Pengomposan dapat digunakan sebagai salah satu alternatif solusi dalam mengelola limbah padat. Tujuan penelitian ini adalah (1) mengetahui gambaran awalPengomposan dapat digunakan sebagai salah satu alternatif solusi dalam mengelola limbah padat. Tujuan penelitian ini adalah (1) mengetahui gambaran awal

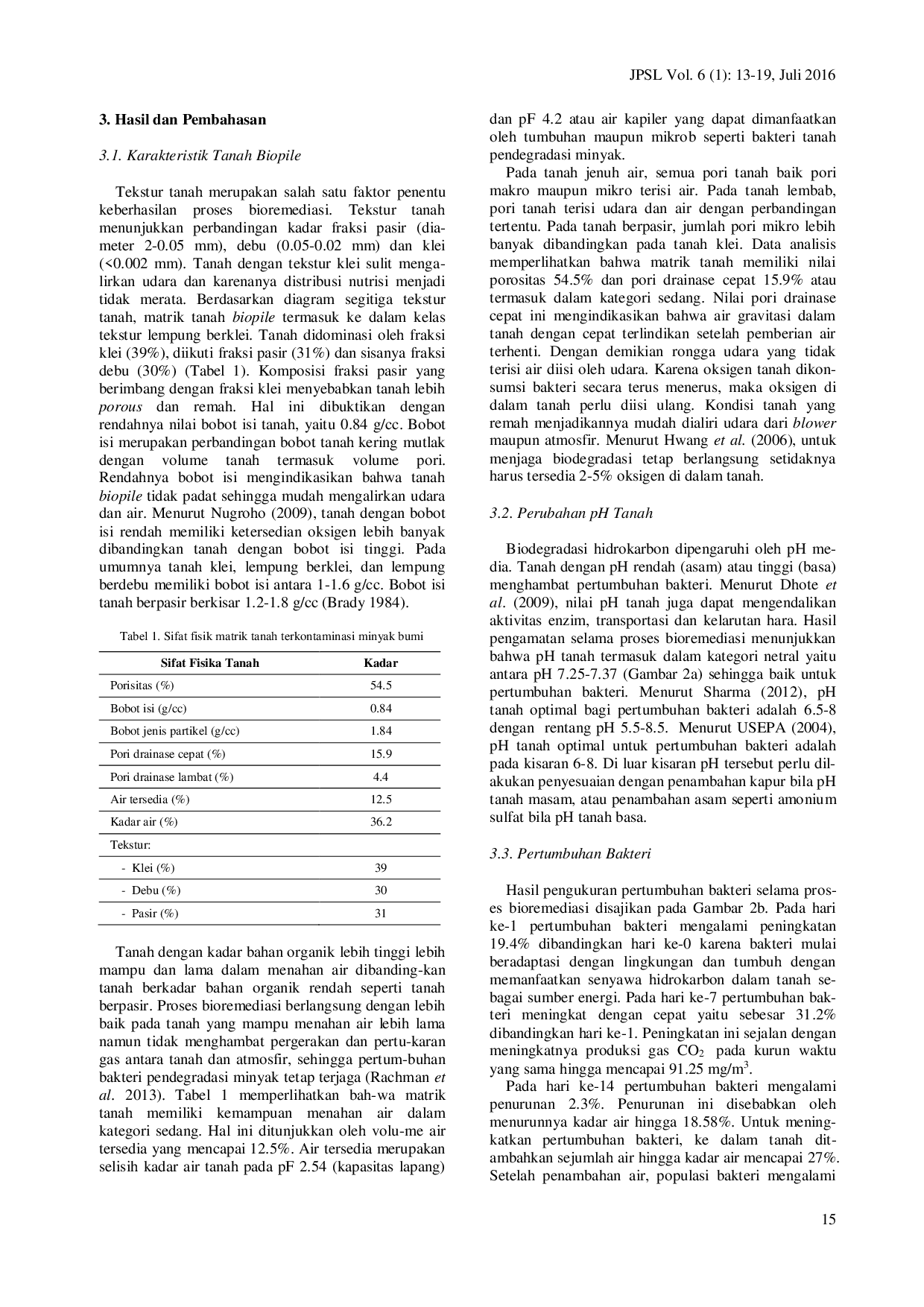

IPBIPB Hasil penelitian menunjukkan penurunan konsentrasi TPH tanah sebesar 76%, dari 4,22% menjadi 1,00%, dalam waktu 63 hari. Total populasi bakteri selamaHasil penelitian menunjukkan penurunan konsentrasi TPH tanah sebesar 76%, dari 4,22% menjadi 1,00%, dalam waktu 63 hari. Total populasi bakteri selama

UM-SORONGUM-SORONG Sistem penataan arsip di Dinas Tenaga Kerja dan Transmigrasi Kabupaten Raja Ampat masih belum baik dan bersifat desentralisasi. Peralatan penyimpanan arsipSistem penataan arsip di Dinas Tenaga Kerja dan Transmigrasi Kabupaten Raja Ampat masih belum baik dan bersifat desentralisasi. Peralatan penyimpanan arsip