JIMF BIJIMF BI

Journal of Islamic Monetary Economics and FinanceJournal of Islamic Monetary Economics and FinanceThis study identifies elements of Islamic Corporate Governance (ICG) that contribute to the performance of shariah-compliant firms. A systematic literature review is carried out on 173 relevant articles from the Scopus database, spanning from 2004 to 2024. It identifies five key elements of ICG: (1) Shariah board governance, (2) management and board governance, (3) audit and risk governance, (4) sustainable governance, and (5) Muslim management and board governance. These key elements encompass various sub-elements that have diverse impacts on firm performance across financial, social, and environmental dimensions. The findings offer specific implications for Indonesia, emphasizing the integration of sustainability practices into corporate governance mechanisms and considering distinct approaches to ICG mechanisms for dual-sector performance between Islamic Financial Institutions (IFIs) and non-IFIs.

This study validates that ICG mechanisms are strongly aligned with the goals of Shariah (Maqashid Shariah), which include preserving wealth, safeguarding the community (ummah), and protecting the environment.These principles of Maqashid Shariah resonate with the framework of the triple bottom line, encapsulated by the tagline “people, planet, and profit, which emphasizes that businesses should not only pursue economic gains but also contribute positively to society and the environment.This study also clarifies that some identified elements of ICG may not differ significantly from those used in conventional corporate governance.However, the key distinction lies in the integration of Islamic values within each element of the ICG structure.The alternative ICG Mechanism recommends that policymakers, such as the Bank of Indonesia, the Financial Services Authority, and the National Sharia Council, implement regulations with specific requirements for companies seeking inclusion in the Shariah stock index.

Based on the findings, several research avenues emerge. Firstly, future research could investigate the interplay between religiosity and ICG practices, moving beyond simple religious affiliation to explore the depth of faith-based motivations influencing corporate decisions. Secondly, longitudinal studies are needed to track the evolving impact of sustainability committees and other governance elements over time, assessing their effectiveness in driving both financial and non-financial performance. Thirdly, cross-cultural comparative analyses could examine how ICG principles are adapted and implemented across different Muslim-majority countries, identifying best practices and potential challenges for Indonesia. Finally, research could explore the development and implementation of tailored Islamic ethical business indices and Sharia operational training programs to support and improve the integration of Islamic values within Indonesian companies.

| File size | 442.71 KB |

| Pages | 28 |

| DMCA | Report |

Related /

JIMF BIJIMF BI Hasil ini menekankan kebutuhan bank Islam di Indonesia untuk bertransisi menuju SICG dan menyarankan agar pembuat kebijakan memfasilitasi transformasiHasil ini menekankan kebutuhan bank Islam di Indonesia untuk bertransisi menuju SICG dan menyarankan agar pembuat kebijakan memfasilitasi transformasi

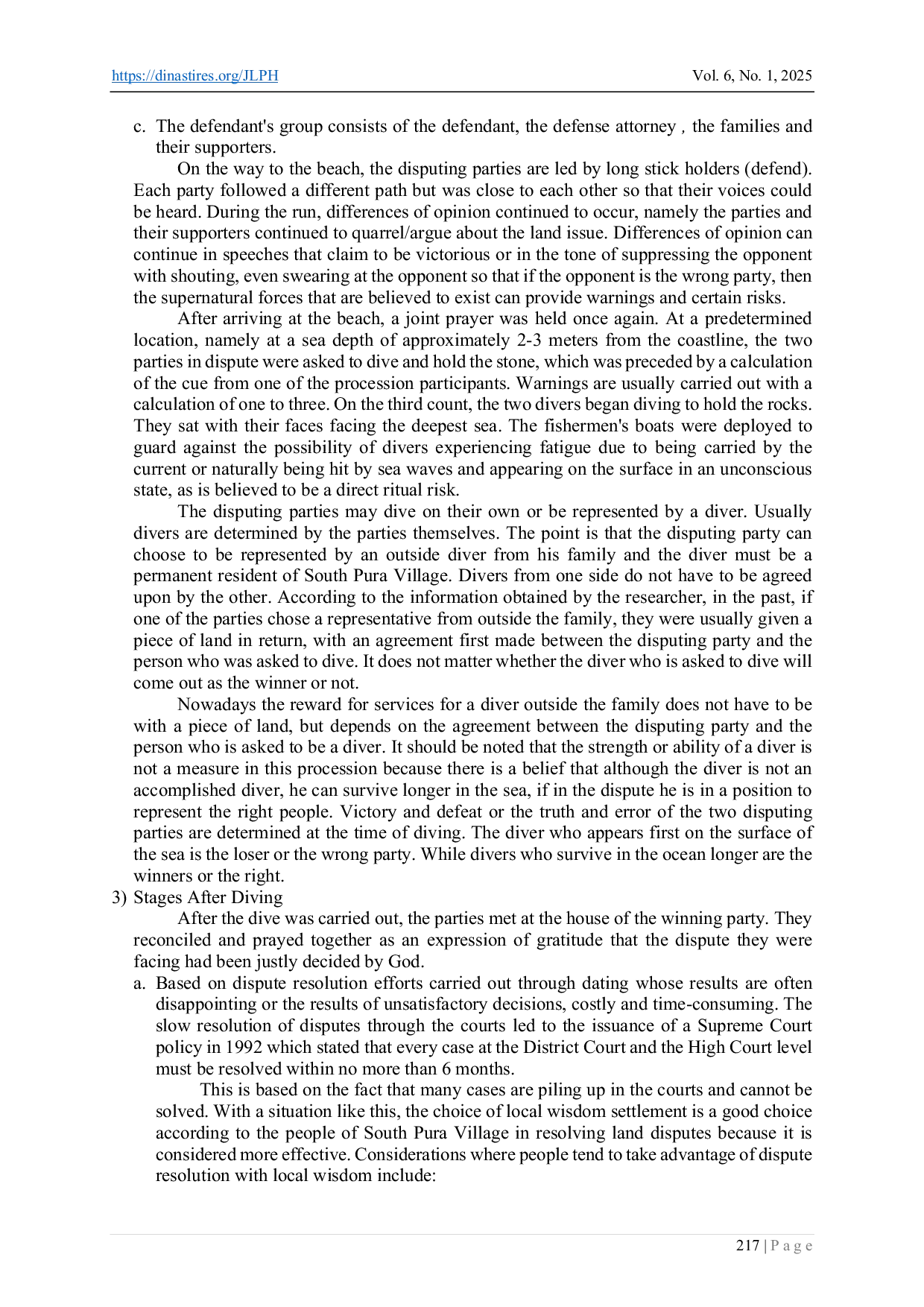

DINASTIRESDINASTIRES Land disputes are a common problem in rural areas that still rely on customary land inheritance without formal ownership documents. This study examinesLand disputes are a common problem in rural areas that still rely on customary land inheritance without formal ownership documents. This study examines

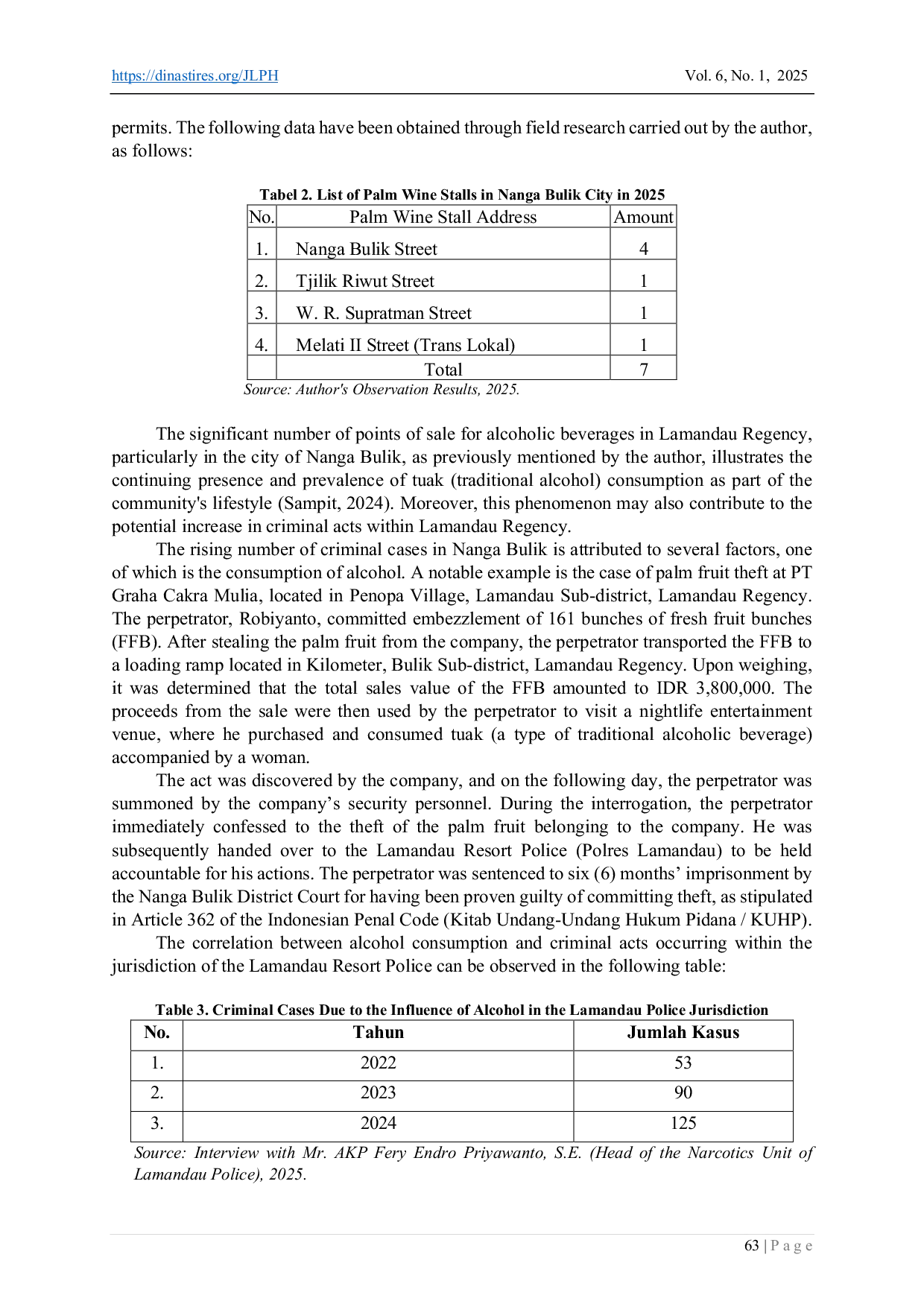

DINASTIRESDINASTIRES The illegal trade of tuak within the jurisdiction of the Lamandau Police Resort is a multifaceted issue encompassing legal, social, economic, and culturalThe illegal trade of tuak within the jurisdiction of the Lamandau Police Resort is a multifaceted issue encompassing legal, social, economic, and cultural

ULUMUNAULUMUNA Integrasi nilai-nilai Islam dan kearifan lokal dalam pembelajaran sains memiliki dampak signifikan terhadap pembentukan karakter. Model struktural menunjukkanIntegrasi nilai-nilai Islam dan kearifan lokal dalam pembelajaran sains memiliki dampak signifikan terhadap pembentukan karakter. Model struktural menunjukkan

STIEMAHARDHIKASTIEMAHARDHIKA Penelitian ini bertujuan untuk menganalisis pengaruh Current Ratio (CR), Debt to Equity Ratio (DER), Return on Assets (ROA), Kepemilikan InstitusionalPenelitian ini bertujuan untuk menganalisis pengaruh Current Ratio (CR), Debt to Equity Ratio (DER), Return on Assets (ROA), Kepemilikan Institusional

UMPOUMPO Hasil studi menjelaskan bahwa UMKM industri makanan dan minuman dikategorikan ke dalam kerentanan sedang terhadap ancaman COVID-19, di mana sensitivitasHasil studi menjelaskan bahwa UMKM industri makanan dan minuman dikategorikan ke dalam kerentanan sedang terhadap ancaman COVID-19, di mana sensitivitas

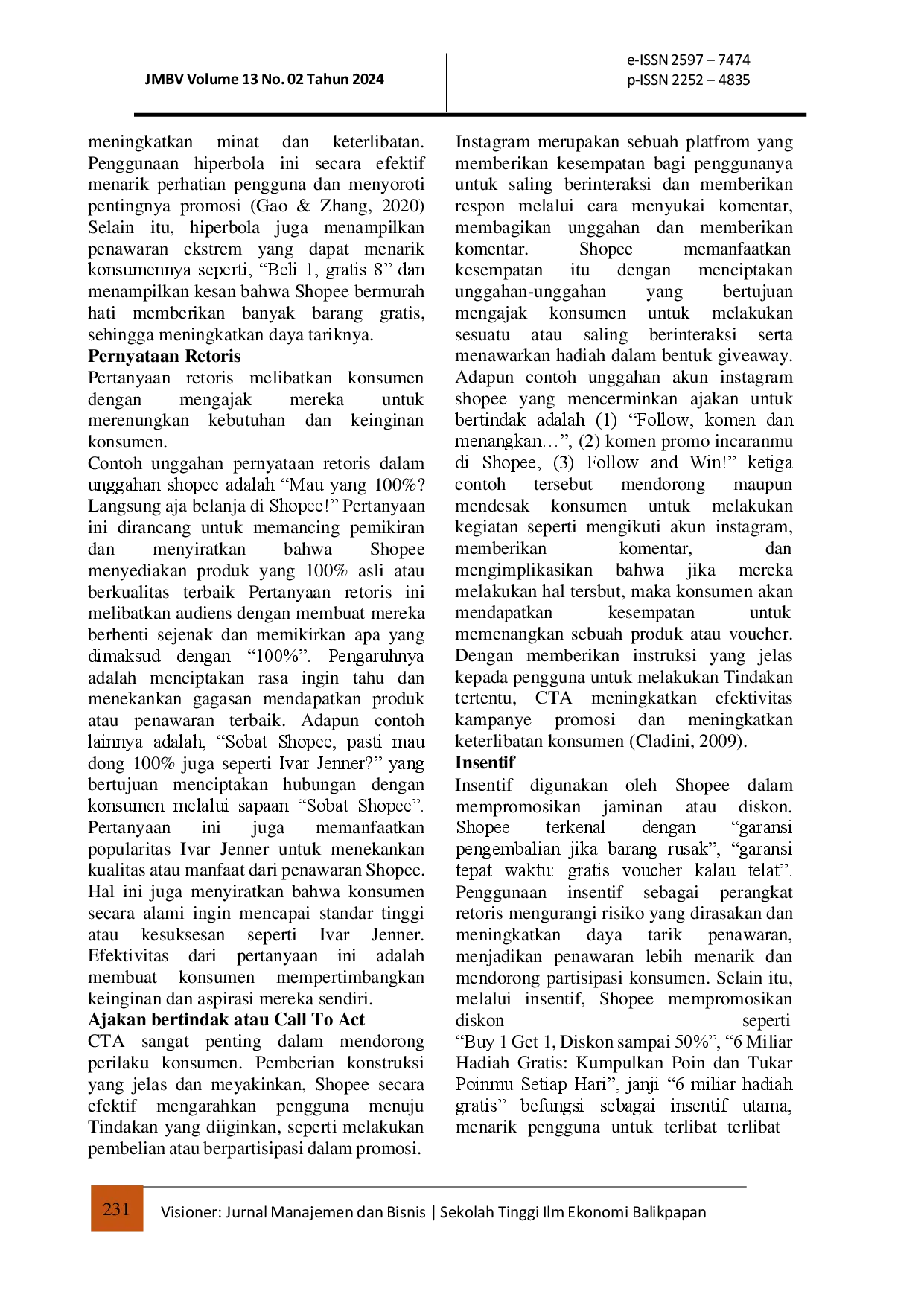

STIEBALIKPAPANSTIEBALIKPAPAN Hasil studi ini menunjukkan bahwa metafora menciptakan citra yang hidup, hiperbola menarik perhatian, pertanyaan retoris mendorong interaksi, CTA mendorongHasil studi ini menunjukkan bahwa metafora menciptakan citra yang hidup, hiperbola menarik perhatian, pertanyaan retoris mendorong interaksi, CTA mendorong

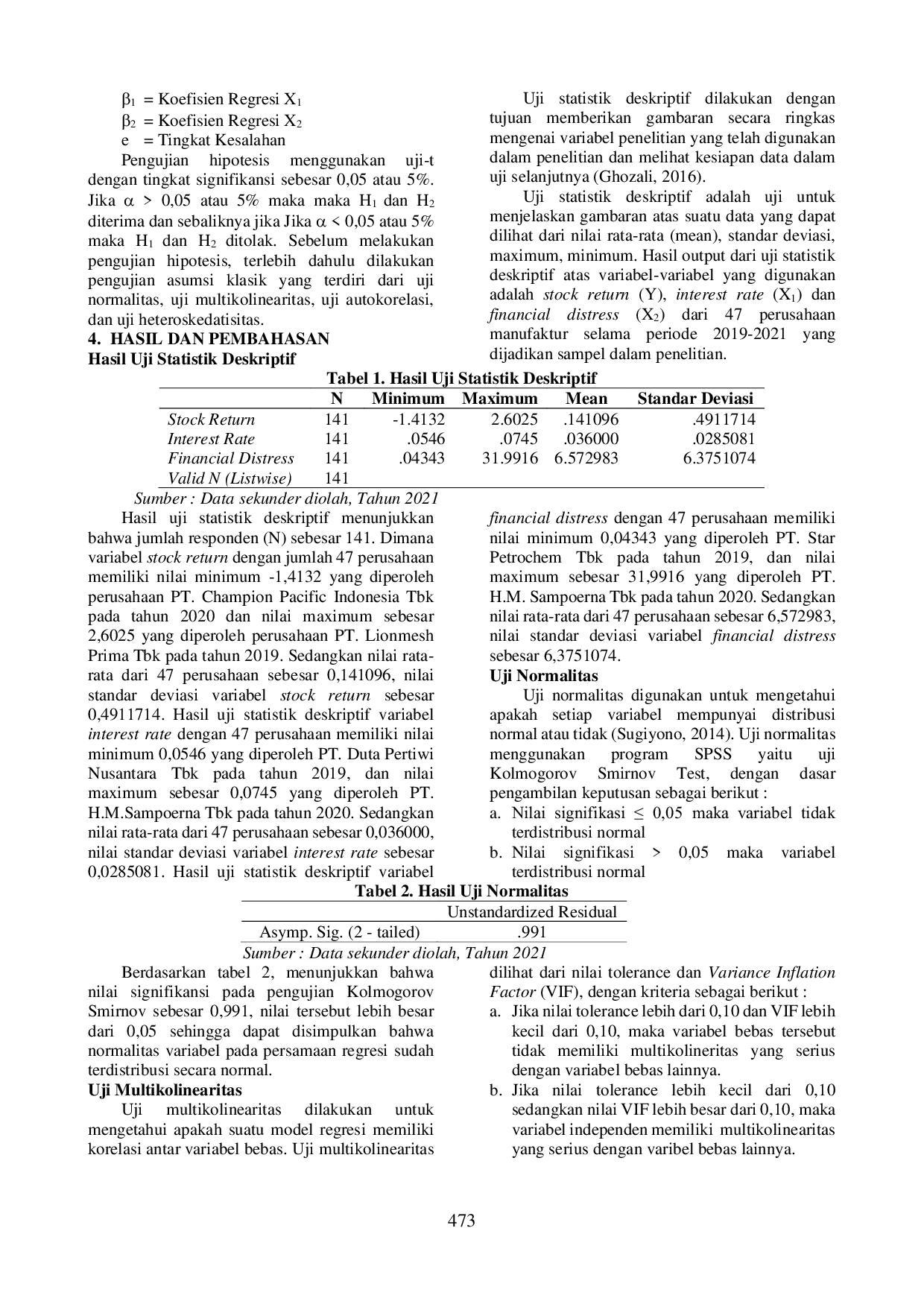

STIE MUTTAQIENSTIE MUTTAQIEN Metode pengambilan sampel menggunakan purposive sampling dengan 47 perusahaan manufaktur. Data penelitian diperoleh dari laporan keuangan perusahaan selamaMetode pengambilan sampel menggunakan purposive sampling dengan 47 perusahaan manufaktur. Data penelitian diperoleh dari laporan keuangan perusahaan selama

Useful /

JIMF BIJIMF BI Dalam analisis ini, kami mempertimbangkan peran religiusitas dalam hubungan antara keduanya. Data dikumpulkan melalui kuesioner yang diisi sendiri dariDalam analisis ini, kami mempertimbangkan peran religiusitas dalam hubungan antara keduanya. Data dikumpulkan melalui kuesioner yang diisi sendiri dari

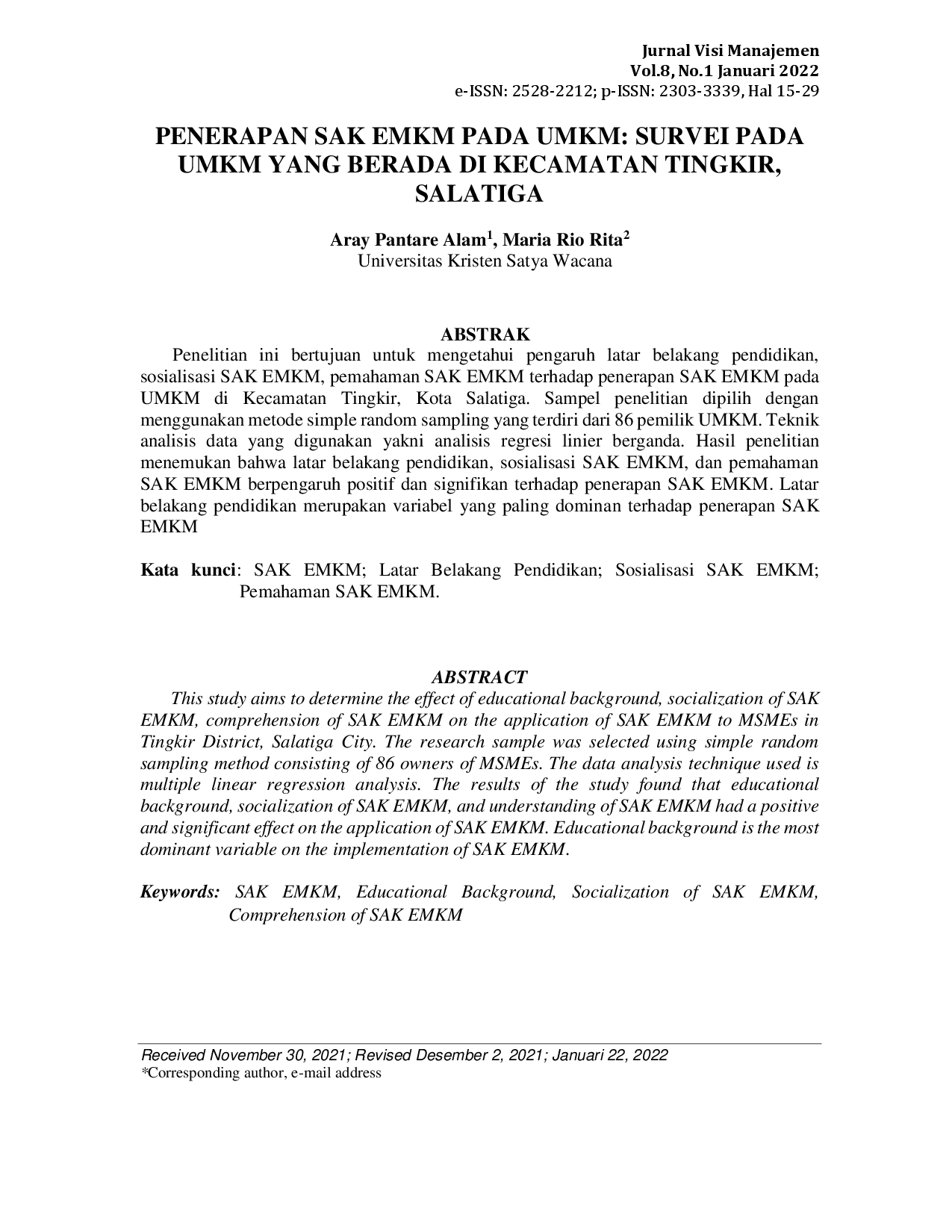

STIEPARISTIEPARI Latar belakang pendidikan merupakan variabel yang paling dominan terhadap penerapan SAK EMKM. Latar belakang pendidikan berpengaruh terhadap penerapanLatar belakang pendidikan merupakan variabel yang paling dominan terhadap penerapan SAK EMKM. Latar belakang pendidikan berpengaruh terhadap penerapan

JIMF BIJIMF BI Indeks yang diusulkan didasarkan pada seperangkat indikator Maqasid yang komprehensif dan pembobotan yang tepat dari setiap indikator Maqasid untuk mencapaiIndeks yang diusulkan didasarkan pada seperangkat indikator Maqasid yang komprehensif dan pembobotan yang tepat dari setiap indikator Maqasid untuk mencapai

ISI YogyakartaISI Yogyakarta Dalam konteks kehidupan, repetisi adalah hal yang selalu ada dalam keseharian seperti kegiatan peribadatan maupun pola hidup, sedangkan dalam konteks pendidikanDalam konteks kehidupan, repetisi adalah hal yang selalu ada dalam keseharian seperti kegiatan peribadatan maupun pola hidup, sedangkan dalam konteks pendidikan