INABAINABA

Journal of Business and Management InabaJournal of Business and Management InabaOne measure to assess the level of soundness or performance of a banks profitability is Return On Assets (ROA). The level of Return On Assets (ROA) is used to measure bank profitability and focuses on the companys ability to earn profits in its operations. Bank Indonesia sets a minimum amount of Return On Assets (ROA) of 1.5%. However, the Return on Assets (ROA) at PT Bank Negara Indonesia Persero, Tbk for the 2011-2021 period fluctuated with a downward trend. Many factors can affect the rise and fall of Return On Assets (ROA). This study aims to explain the effect of Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), and Loan to Deposits Ratio (LDR) on Return On Assets (ROA). This research uses quantitative methods with descriptive and verification approaches. The type of data is secondary data sourced from www.idx.co.id and the annual report of PT Bank Negara Indonesia, Tbk. The data analysis method used is descriptive analysis and verification analysis (classical assumption test, multiple regression analysis, correlation coefficient analysis, coefficient of determination analysis, and hypothesis testing). The results showed that: 1) Return on Assets (ROA) fluctuated with a downward trend with an average of 2.53% and a standard deviation of 0.87. 2) Capital Adequacy Ratio (CAR) fluctuates with a downward trend with an average of 17.97% and a standard deviation of 1.59. 3) Net Interest Margin (NIM) fluctuated with a downward trend with an average of 5.63% and a standard deviation of 0.68. 4) Loan to Deposits Ratio (LDR) fluctuates with an increasing trend with an average of 84.79% and a standard deviation of 6.36. 5) Capital Adequacy Ratio (CAR) has no significant effect on Return On Assets (ROA). 6) Net Interest Margin (NIM) has a significant effect on Return On Assets (ROA). 7) Loan to Deposits Ratio (LDR) has no significant effect on Return On Assets (ROA). 8) Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), and Loan to Deposits Ratio (LDR) simultaneously (together) have a significant effect on Return On Assets (ROA). With the influence contribution of 67.50%, while the remaining 32.50% is influenced by other factors that are not included in the study.

Based on the results of the study and discussion, it can be concluded that the Return on Assets (ROA) at PT Bank Negara Indonesia Persero, Tbk for the period 2011-2021 fluctuated with a downward trend.Capital Adequacy Ratio (CAR) did not have a significant effect on Return On Assets (ROA), while Net Interest Margin (NIM) had a significant effect.Furthermore, Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), and Loan to Deposits Ratio (LDR) simultaneously had a significant effect on Return On Assets (ROA) at PT Bank Negara Indonesia Persero, Tbk during the 2011-2021 period.

Penelitian lebih lanjut dapat dilakukan dengan memperluas cakupan variabel independen yang mempengaruhi ROA, seperti dengan menambahkan variabel biaya operasional (BOPO), atau variabel makroekonomi seperti tingkat inflasi dan suku bunga. Hal ini bertujuan untuk mendapatkan pemahaman yang lebih komprehensif mengenai faktor-faktor yang secara signifikan berkontribusi terhadap profitabilitas bank. Selain itu, penelitian mendatang dapat fokus pada analisis moderasi atau mediasi dari variabel lain, misalnya peran tata kelola perusahaan atau kualitas aset, dalam hubungan antara CAR, NIM, LDR, dan ROA. Pendekatan ini dapat mengungkap mekanisme kompleks yang mempengaruhi kinerja keuangan bank. Terakhir, studi komparatif antara bank-bank dengan profil risiko dan strategi bisnis yang berbeda dapat memberikan wawasan berharga mengenai efektivitas berbagai pendekatan manajemen dalam meningkatkan ROA, serta mengidentifikasi praktik terbaik yang dapat diadopsi oleh industri perbankan secara keseluruhan. Penelitian ini diharapkan dapat memberikan rekomendasi yang lebih spesifik dan relevan bagi para pembuat kebijakan dan praktisi di sektor perbankan.

- Vol. 4 No. 6 (2024): Journal of Accounting and Finance Management (January - February 2024) | Journal... dinastires.org/JAFM/issue/view/38Vol 4 No 6 2024 Journal of Accounting and Finance Management January February 2024 Journal dinastires JAFM issue view 38

- The Effect of Net Interest Margin (NIM), Operating Expenses, Operating Income (BOPO), Loan to Deposit... jurnal.syntax-idea.co.id/index.php/syntax-idea/article/view/4227The Effect of Net Interest Margin NIM Operating Expenses Operating Income BOPO Loan to Deposit jurnal syntax idea index php syntax idea article view 4227

- The Effect Of Net Interest Margin, Operating Cost of Operating Income, And Loan To Deposit Ratio On Return... doi.org/10.38035/jafm.v4i6.283The Effect Of Net Interest Margin Operating Cost of Operating Income And Loan To Deposit Ratio On Return doi 10 38035 jafm v4i6 283

- Pengaruh ROA, ROE, LDR, CAR, Dan NPL Terhadap Harga Saham Perbankan Yang Terdaftar di BEI | ARBITRASE:... doi.org/10.47065/arbitrase.v3i1.479Pengaruh ROA ROE LDR CAR Dan NPL Terhadap Harga Saham Perbankan Yang Terdaftar di BEI ARBITRASE doi 10 47065 arbitrase v3i1 479

| File size | 382.5 KB |

| Pages | 19 |

| DMCA | Report |

Related /

UMNUMN Hasil penelitian menunjukkan bahwa tidak terdapat perbedaan signifikan pada rasio likuiditas (Current Ratio), rasio profitabilitas (Return on Asset Ratio,Hasil penelitian menunjukkan bahwa tidak terdapat perbedaan signifikan pada rasio likuiditas (Current Ratio), rasio profitabilitas (Return on Asset Ratio,

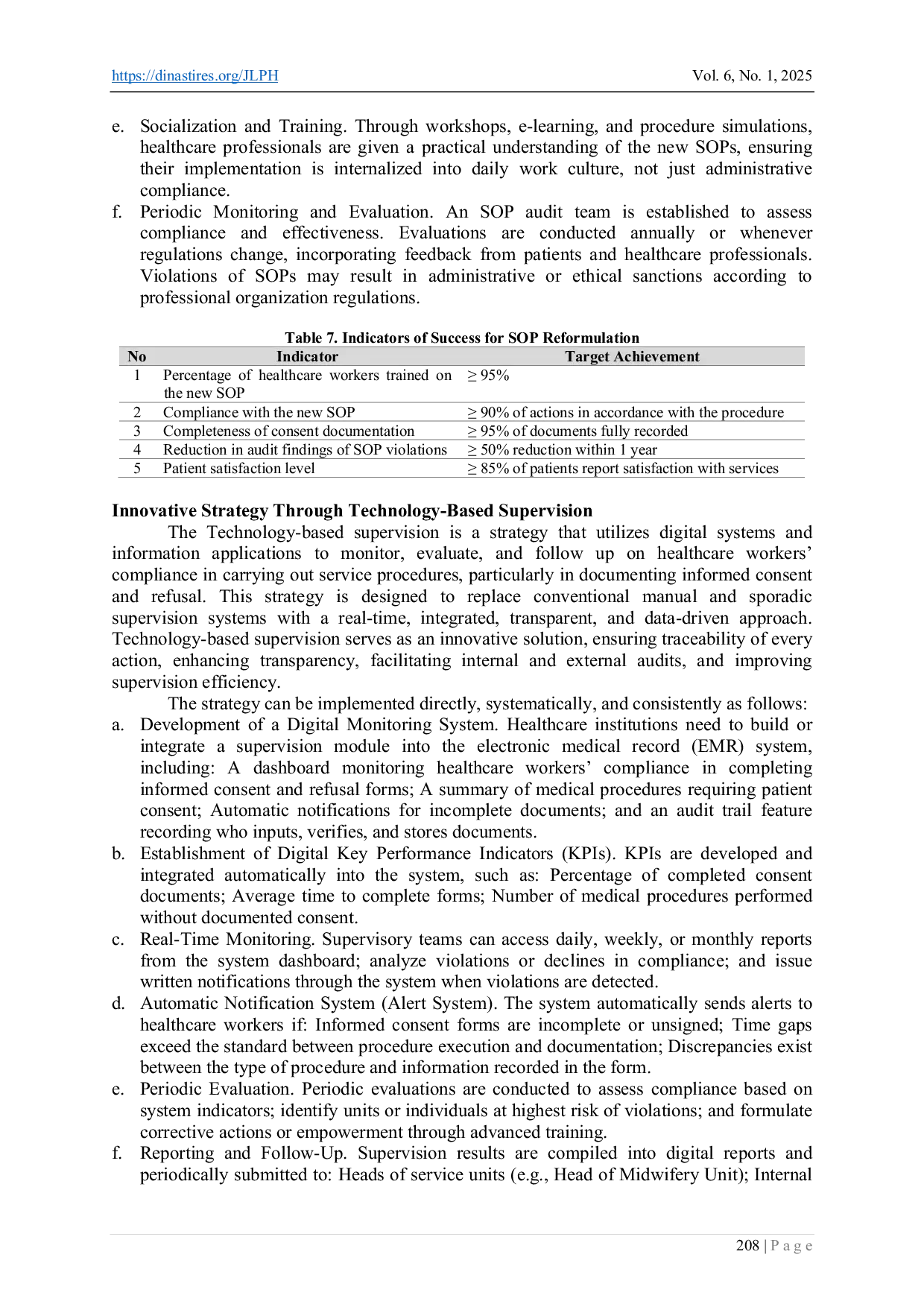

DINASTIRESDINASTIRES Temuan ini menekankan pentingnya memperkuat kapasitas hukum melalui penyebaran dan peningkatan literasi hukum kesehatan. Selain itu, standarisasi penerapanTemuan ini menekankan pentingnya memperkuat kapasitas hukum melalui penyebaran dan peningkatan literasi hukum kesehatan. Selain itu, standarisasi penerapan

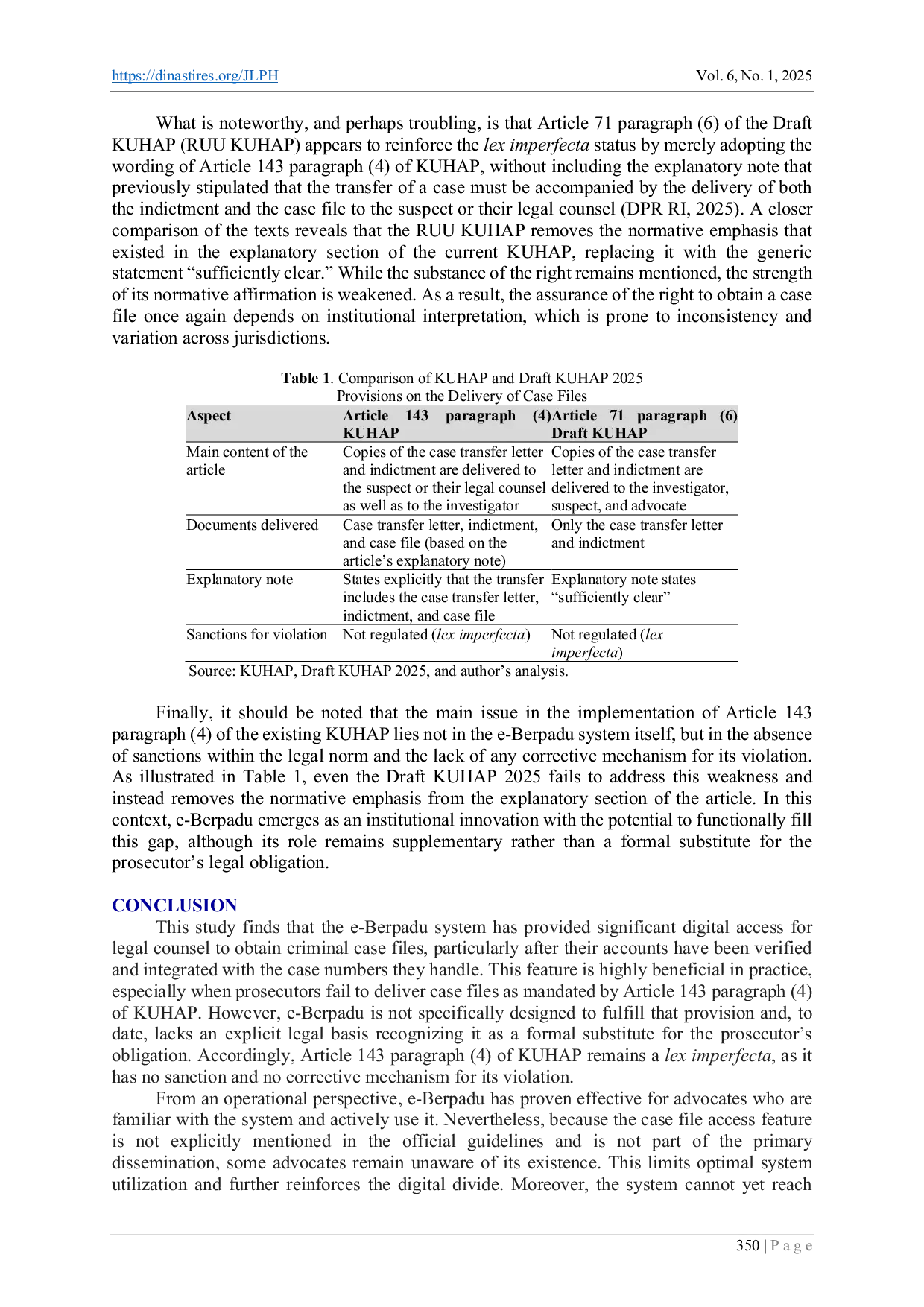

DINASTIRESDINASTIRES This study examines the role of the e-Berpadu system in addressing the lex imperfecta nature of Article 143 paragraph (4) of the Indonesian Criminal ProcedureThis study examines the role of the e-Berpadu system in addressing the lex imperfecta nature of Article 143 paragraph (4) of the Indonesian Criminal Procedure

DINASTIRESDINASTIRES Namun, terdapat kebutuhan untuk meningkatkan kejelasan ketentuan dan efisiensi mekanisme penyelesaian sengketa. Perlindungan konsumen merupakan aspek krusialNamun, terdapat kebutuhan untuk meningkatkan kejelasan ketentuan dan efisiensi mekanisme penyelesaian sengketa. Perlindungan konsumen merupakan aspek krusial

STTABSTTAB Dalam masyarakat Kristen Saluan, praktik ini menimbulkan ketegangan antara tradisi leluhur dan ajaran teologi Kristen mengenai keadaan jiwa setelah kematian.Dalam masyarakat Kristen Saluan, praktik ini menimbulkan ketegangan antara tradisi leluhur dan ajaran teologi Kristen mengenai keadaan jiwa setelah kematian.

STTABSTTAB Spiritualitas Kristen tidak boleh kehilangan akar inkarnasionalnya, sebab iman Kristen berakar pada kehadiran Allah yang nyata dalam tubuh dan komunitas.Spiritualitas Kristen tidak boleh kehilangan akar inkarnasionalnya, sebab iman Kristen berakar pada kehadiran Allah yang nyata dalam tubuh dan komunitas.

STTABSTTAB Doktrin dyothelitisme menegaskan bahwa Yesus Kristus memiliki dua kehendak, yaitu kehendak ilahi dan kehendak manusiawi, yang selaras tanpa pertentangan.Doktrin dyothelitisme menegaskan bahwa Yesus Kristus memiliki dua kehendak, yaitu kehendak ilahi dan kehendak manusiawi, yang selaras tanpa pertentangan.

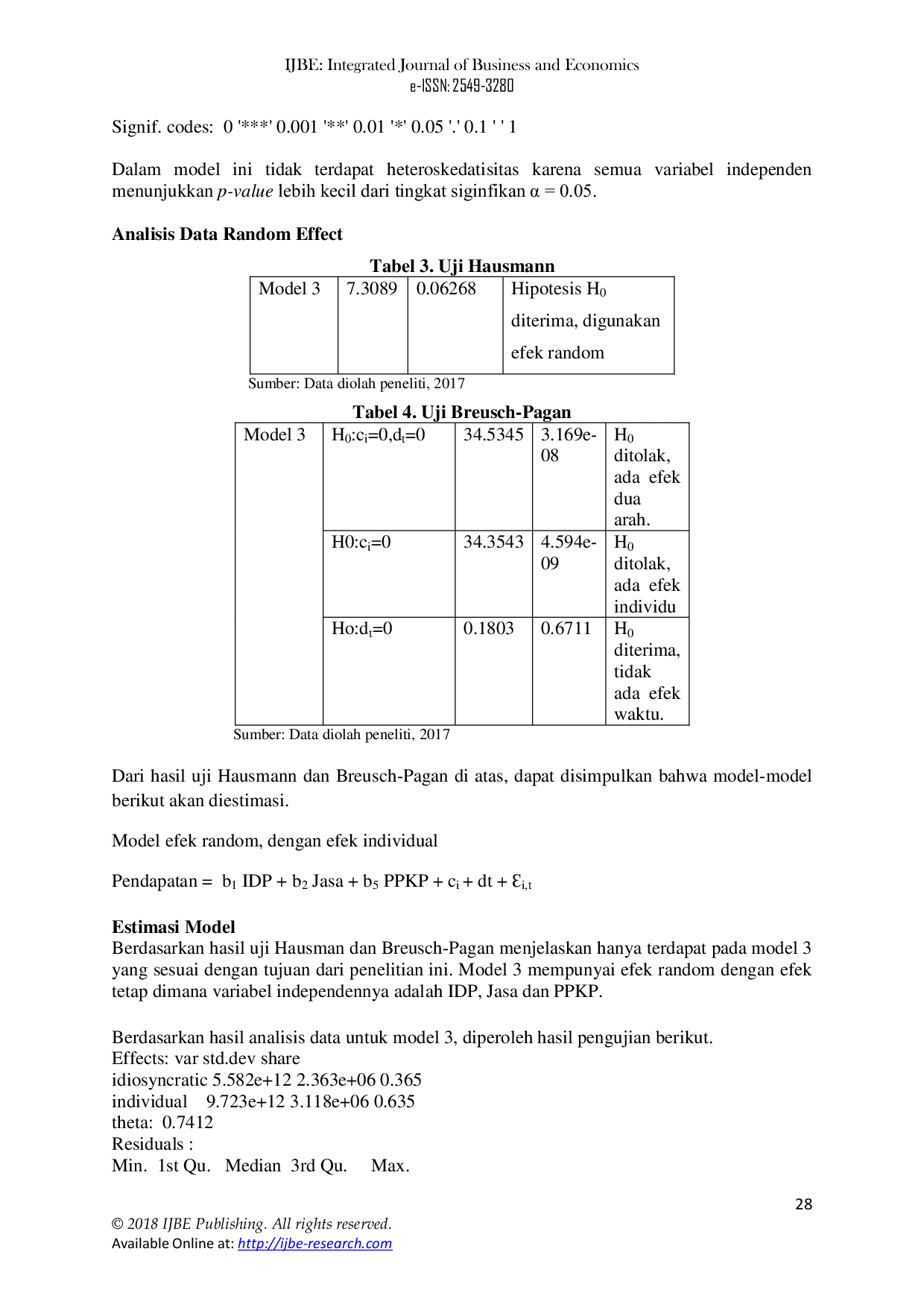

IJBE RESEARCHIJBE RESEARCH And for NIM (Net Interest Margin) ratio required total net profit after tax and income, while BOPO (Operational Cost) required operational and operationalAnd for NIM (Net Interest Margin) ratio required total net profit after tax and income, while BOPO (Operational Cost) required operational and operational

Useful /

STTABSTTAB Importantly, the phenomenon of violence perpetrated in the name of religion does not indicate that religion itself is inherently violent; rather, it underscoresImportantly, the phenomenon of violence perpetrated in the name of religion does not indicate that religion itself is inherently violent; rather, it underscores

STTABSTTAB Fenomena ini menjadi indikator kuat dari dekadensi kepemimpinan yang tidak lagi berpijak pada nilai-nilai alkitabiah dan prinsip teologi etis yang seharusnyaFenomena ini menjadi indikator kuat dari dekadensi kepemimpinan yang tidak lagi berpijak pada nilai-nilai alkitabiah dan prinsip teologi etis yang seharusnya

INABAINABA Upaya branding biasanya memerlukan dukungan finansial yang luas untuk membuat kemajuan dalam meningkatkan kesadaran merek, dan setelahnya meningkatkanUpaya branding biasanya memerlukan dukungan finansial yang luas untuk membuat kemajuan dalam meningkatkan kesadaran merek, dan setelahnya meningkatkan

IJBE RESEARCHIJBE RESEARCH Hal ini seharusnya menjadi acuan pemerintah daerah untuk lebih meningkatkan kualitas atau produksi di bidang pertanian dan jasa-jasa karena potensi iniHal ini seharusnya menjadi acuan pemerintah daerah untuk lebih meningkatkan kualitas atau produksi di bidang pertanian dan jasa-jasa karena potensi ini