YPIDATHUYPIDATHU

Sharia Oikonomia Law JournalSharia Oikonomia Law JournalThe rise of startups in Indonesia has created a growing demand for innovative financing models that align with Shariah principles. Shariah-compliant venture capital (SCVC) offers a unique opportunity to support startups while adhering to Islamic ethical standards, such as the prohibition of riba (interest) and gharar (uncertainty). This study explores the potential of SCVC as a financing model for startups in Indonesia, focusing on its alignment with Shariah principles, its impact on startup growth, and the challenges faced by stakeholders. The research aims to identify effective strategies for implementing SCVC and propose recommendations for enhancing its role in fostering ethical and sustainable entrepreneurship. Using a mixed-methods approach, this study combines quantitative analysis of startup financing data with qualitative interviews with venture capitalists, Shariah scholars, and startup founders. Data were analyzed to assess the compatibility of SCVC with Shariah principles, its financial performance, and its contribution to startup success. The findings reveal that SCVC can effectively support startups while adhering to Islamic ethics, but challenges such as limited awareness, regulatory gaps, and risk-sharing complexities hinder its widespread adoption. The study concludes that promoting SCVC in Indonesia requires targeted strategies, including education, reforms, and capacity-building for stakeholders. This research contributes to the discourse on Islamic finance and entrepreneurship by providing practical recommendations for policymakers and practitioners to foster ethical and sustainable startup ecosystems through SCVC.

This research highlights the potential of Shariah-compliant venture capital (SCVC) as a viable financing model for Indonesian startups, particularly those in sectors aligned with Shariah principles.SCVC-funded startups demonstrate higher revenue growth rates, indicating the effectiveness of Shariah-compliant financing in supporting early-stage ventures.However, challenges such as limited scalability, regulatory constraints, and access to follow-on funding hinder its full potential, necessitating targeted strategies to enhance the SCVC ecosystem and promote ethical and sustainable entrepreneurship.

Further research should investigate the development of standardized Shariah compliance frameworks specifically tailored for venture capital investments in Indonesia, addressing the complexities of risk-sharing and contract structures. Additionally, studies could explore the potential of integrating digital technologies, such as blockchain, to enhance transparency and efficiency in SCVC transactions, fostering greater trust and participation from investors and entrepreneurs. Finally, a comparative analysis of SCVC models across different Muslim-majority countries could identify best practices and inform policy recommendations for strengthening the Indonesian SCVC ecosystem, ultimately promoting a more inclusive and sustainable startup landscape by examining the impact of government incentives and regulatory reforms on SCVC adoption and performance.

| File size | 177.94 KB |

| Pages | 13 |

| DMCA | Report |

Related /

AFEBIAFEBI Customer Journey Mapping dan Empathy Map digunakan untuk mengidentifikasi tantangan utama, seperti ketiadaan aplikasi mobile yang membatasi kenyamananCustomer Journey Mapping dan Empathy Map digunakan untuk mengidentifikasi tantangan utama, seperti ketiadaan aplikasi mobile yang membatasi kenyamanan

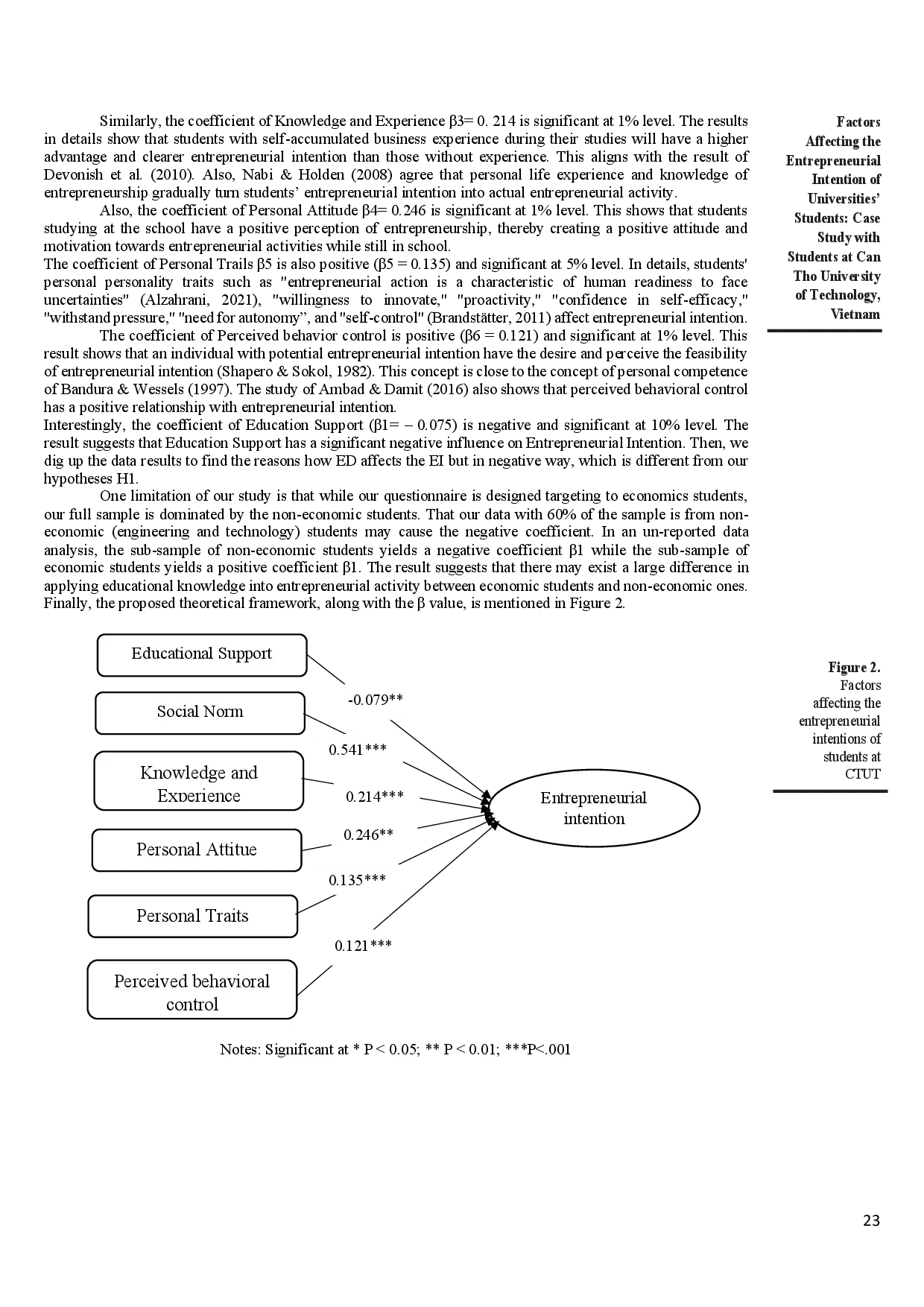

AFEBIAFEBI Survei dilakukan terhadap 925 mahasiswa di CTUT dan data dianalisis dengan SPSS versi 27. Metode SEM digunakan untuk menguji model struktural linier. HasilSurvei dilakukan terhadap 925 mahasiswa di CTUT dan data dianalisis dengan SPSS versi 27. Metode SEM digunakan untuk menguji model struktural linier. Hasil

UNUKALTIMUNUKALTIM Strategi kepemimpinan perubahan menjadi semakin penting dalam era globalisasi dan dinamika dalam dunia pendidikan yang cepat. Penelitian ini membahas strategiStrategi kepemimpinan perubahan menjadi semakin penting dalam era globalisasi dan dinamika dalam dunia pendidikan yang cepat. Penelitian ini membahas strategi

YPIDATHUYPIDATHU The data collection method used is the literature method, which is used to trace historical and theoretical data related to planning in management. StrategicThe data collection method used is the literature method, which is used to trace historical and theoretical data related to planning in management. Strategic

UNCMUNCM Berdasarkan analisis data dan pembahasan yang dilakukan maka dapat disimpulkan bahwa dari penelitian ini menunjukkan kemampuan bertanya siswa kelas VIIIBerdasarkan analisis data dan pembahasan yang dilakukan maka dapat disimpulkan bahwa dari penelitian ini menunjukkan kemampuan bertanya siswa kelas VIII

UNCMUNCM Secara keseluruhan, penelitian ini mengamati hasil UAS pada materi pecahan siswa SD N Sinomwidodo 01. Hasil analisis menunjukkan bahwa banyak siswa belumSecara keseluruhan, penelitian ini mengamati hasil UAS pada materi pecahan siswa SD N Sinomwidodo 01. Hasil analisis menunjukkan bahwa banyak siswa belum

UNCMUNCM Dengan mengadopsi nilai-nilai tersebut, pemimpin masa kini dapat memimpin dengan inspirasi, transformasi, dan tujuan yang lebih besar untuk kemajuan danDengan mengadopsi nilai-nilai tersebut, pemimpin masa kini dapat memimpin dengan inspirasi, transformasi, dan tujuan yang lebih besar untuk kemajuan dan

UNCMUNCM Pembelajaran afektif yang tidak optimal mengakibatkan siswa tidak dapat membiasakan diri untuk berperilaku baik. Penelitian ini menganalisis proses pembelajaranPembelajaran afektif yang tidak optimal mengakibatkan siswa tidak dapat membiasakan diri untuk berperilaku baik. Penelitian ini menganalisis proses pembelajaran

Useful /

YPIDATHUYPIDATHU Upaya pemberantasan terorisme oleh pemerintah dan sektor swasta diharapkan untuk fokus pada peningkatan kerjasama terpadu di semua tingkat masyarakat danUpaya pemberantasan terorisme oleh pemerintah dan sektor swasta diharapkan untuk fokus pada peningkatan kerjasama terpadu di semua tingkat masyarakat dan

YPIDATHUYPIDATHU Jumlah penumpang maksimal bus adalah 15 orang dengan tarif dari Padang ke Solok sebesar Rp.Sistem pembayaran upah berdasarkan gratifikasi yang diterapkanJumlah penumpang maksimal bus adalah 15 orang dengan tarif dari Padang ke Solok sebesar Rp.Sistem pembayaran upah berdasarkan gratifikasi yang diterapkan

YPIDATHUYPIDATHU The aim of the research is the implementation of Sharia-based BUMDes in Kalatiri Village, Burau District, East Luwu Regency. The research seeks to reviewThe aim of the research is the implementation of Sharia-based BUMDes in Kalatiri Village, Burau District, East Luwu Regency. The research seeks to review

UGMUGM Pertanyaan penelitian utama adalah mengapa dan bagaimana keputusan manajemen untuk mengadopsi dan menggunakan TI dipengaruhi (jika ada) oleh interaksiPertanyaan penelitian utama adalah mengapa dan bagaimana keputusan manajemen untuk mengadopsi dan menggunakan TI dipengaruhi (jika ada) oleh interaksi