STIE YAISTIE YAI

Jurnal Riset Akuntansi dan AuditingJurnal Riset Akuntansi dan AuditingThis study examines the effect of perceived fairness of the motor vehicle opsen tax on taxpayer compliance in Bekasi, while also considering the roles of fear of sanctions, tax burden, and transparency. The opsen tax is a newly implemented additional levy aimed at strengthening regional fiscal capacity. Using a quantitative approach, data were collected through a survey of 100 registered vehicle taxpayers in Bekasi and analyzed using multiple linear regression with SPSS. The novelty of this study lies in its empirical focus on the motor vehicle opsen tax, a policy implemented in Indonesia starting in 2025, which has received limited scholarly attention. The findings reveal that perceived tax fairness has a positive but statistically insignificant effect on compliance. In contrast, fear of sanctions, perceived tax burden, and transparency significantly influence taxpayer compliance. Simultaneously, all independent variables contribute significantly to compliance behavior. These results suggest that taxpayer compliance in the early implementation stage of the opsen tax is driven more by enforcement mechanisms and transparency than by perceived fairness alone. The study provides practical implications for local governments to enhance transparency, strengthen tax communication, and balance enforcement with trust-building strategies to improve regional tax compliance.

The study concludes that perceived fairness of the opsen tax does not significantly influence taxpayer compliance in Bekasi, while factors like sanctions, tax burden, and transparency do.The findings highlight the importance of enforcement and transparency in driving compliance during the initial implementation of the opsen tax.Therefore, local governments should prioritize enhancing transparency, strengthening tax communication, and balancing enforcement with trust-building strategies to improve regional tax compliance.

Further research should investigate the long-term effects of the opsen tax on taxpayer behavior as perceptions of fairness evolve and the novelty of the tax diminishes. Additionally, a qualitative study exploring the specific reasons behind taxpayers perceptions of fairness and transparency could provide richer insights into the nuances of compliance in Bekasi. Finally, research could examine the impact of different communication strategies employed by the local government on shaping public perceptions of the opsen tax and fostering a greater sense of trust and willingness to comply, potentially including experiments to test the effectiveness of various messaging approaches. These studies should consider the socio-economic characteristics of Bekasi residents and the unique challenges of regional fiscal management in Indonesia to provide actionable recommendations for policymakers.

- Analisis Kepatuhan Pajak pada Pelaku UMKM Ditinjau dari Sistem dan Pelayanan Pajak | Nur Hanafi | Jurnal... doi.org/10.35836/jakis.v10i2.356Analisis Kepatuhan Pajak pada Pelaku UMKM Ditinjau dari Sistem dan Pelayanan Pajak Nur Hanafi Jurnal doi 10 35836 jakis v10i2 356

- Konsep Penelitian Kuantitatif: Populasi, Sampel, dan Analisis Data (Sebuah Tinjauan Pustaka) | Jurnal... doi.org/10.38035/jim.v3i1.504Konsep Penelitian Kuantitatif Populasi Sampel dan Analisis Data Sebuah Tinjauan Pustaka Jurnal doi 10 38035 jim v3i1 504

- PENGARUH SISTEM PERPAJAKAN, KEADILAN PERPAJAKAN, RELIGIUSITAS PAJAK DAN SANSKI PAJAK TERHADAP PERSEPSI... ojspustek.org/index.php/SJR/article/view/905PENGARUH SISTEM PERPAJAKAN KEADILAN PERPAJAKAN RELIGIUSITAS PAJAK DAN SANSKI PAJAK TERHADAP PERSEPSI ojspustek index php SJR article view 905

| File size | 176.96 KB |

| Pages | 10 |

| DMCA | Report |

Related /

JURNALUNIV45SBYJURNALUNIV45SBY Untuk meningkatkan keterampilan penggunaan media sosial yang tepat dan bermanfaat,maka perlu ada pelatihan dna pendampingan secara berkala bagi UMKM Ensikei.Untuk meningkatkan keterampilan penggunaan media sosial yang tepat dan bermanfaat,maka perlu ada pelatihan dna pendampingan secara berkala bagi UMKM Ensikei.

JURNALUNIV45SBYJURNALUNIV45SBY Hasil yang diperoleh dari penelitian ini ialah dengan mengetahui hasil perumusan alternatif strategi pengembangan pemasaran UMKM Sweety Bakery yaitu (1)Hasil yang diperoleh dari penelitian ini ialah dengan mengetahui hasil perumusan alternatif strategi pengembangan pemasaran UMKM Sweety Bakery yaitu (1)

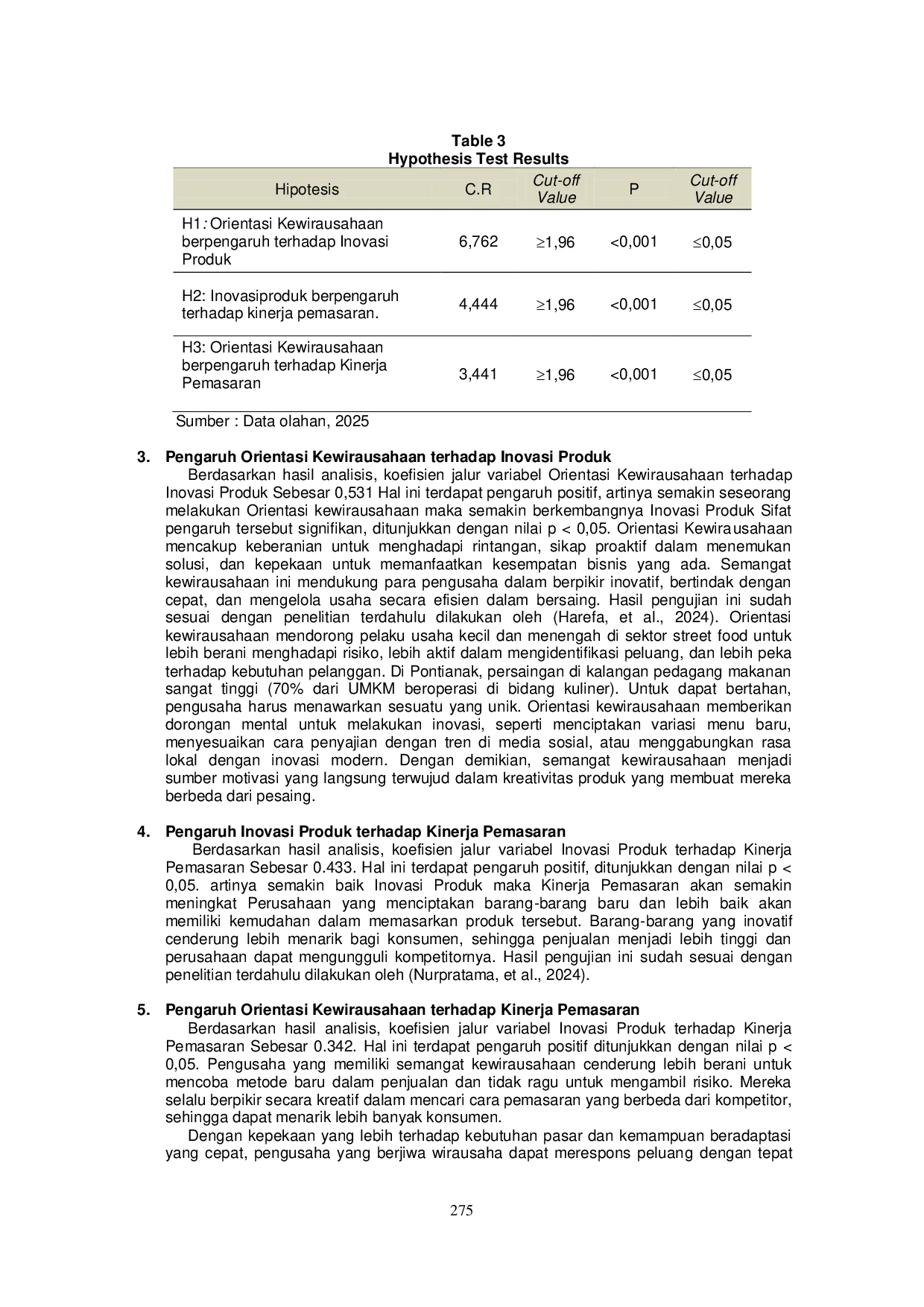

UMPARUMPAR Orientasi kewirausahaan memiliki efek positif signifikan terhadap inovasi produk dan kinerja pemasaran UMKM street food. Inovasi produk berperan sebagaiOrientasi kewirausahaan memiliki efek positif signifikan terhadap inovasi produk dan kinerja pemasaran UMKM street food. Inovasi produk berperan sebagai

UNIBAUNIBA Metode penelitian menggunakan pendekatan kualitatif deskriptif dengan pengumpulan data melalui studi literatur dan analisis dokumen kebijakan pendidikanMetode penelitian menggunakan pendekatan kualitatif deskriptif dengan pengumpulan data melalui studi literatur dan analisis dokumen kebijakan pendidikan

UNIBAUNIBA Data diperoleh melalui wawancara mendalam dan observasi terhadap tujuh informan UMKM, kemudian dianalisis melalui reduksi data, penyajian, dan penarikanData diperoleh melalui wawancara mendalam dan observasi terhadap tujuh informan UMKM, kemudian dianalisis melalui reduksi data, penyajian, dan penarikan

UNRAMUNRAM Pengembangan Energi Baru dan Terbarukan (EBT) merupakan salah satu pilar penting dalam mendukung transisi energi nasional yang berkelanjutan. Dalam rangkaPengembangan Energi Baru dan Terbarukan (EBT) merupakan salah satu pilar penting dalam mendukung transisi energi nasional yang berkelanjutan. Dalam rangka

UNRAMUNRAM Pakan alternatif pengganti yang dapat digunakan adalah dengan memanfaatkan sumber daya yang ada di sekitar lokasi budidaya. Potensi kelimpahan jenis ikanPakan alternatif pengganti yang dapat digunakan adalah dengan memanfaatkan sumber daya yang ada di sekitar lokasi budidaya. Potensi kelimpahan jenis ikan

STOK BINAGUNASTOK BINAGUNA Berdasarkan hasil penilaian didapatkan bahwa model pemanasan pasca cedera ankle bagi pemain sepak bola dapat dinyatakan layak untuk digunakan karena nilaiBerdasarkan hasil penilaian didapatkan bahwa model pemanasan pasca cedera ankle bagi pemain sepak bola dapat dinyatakan layak untuk digunakan karena nilai

Useful /

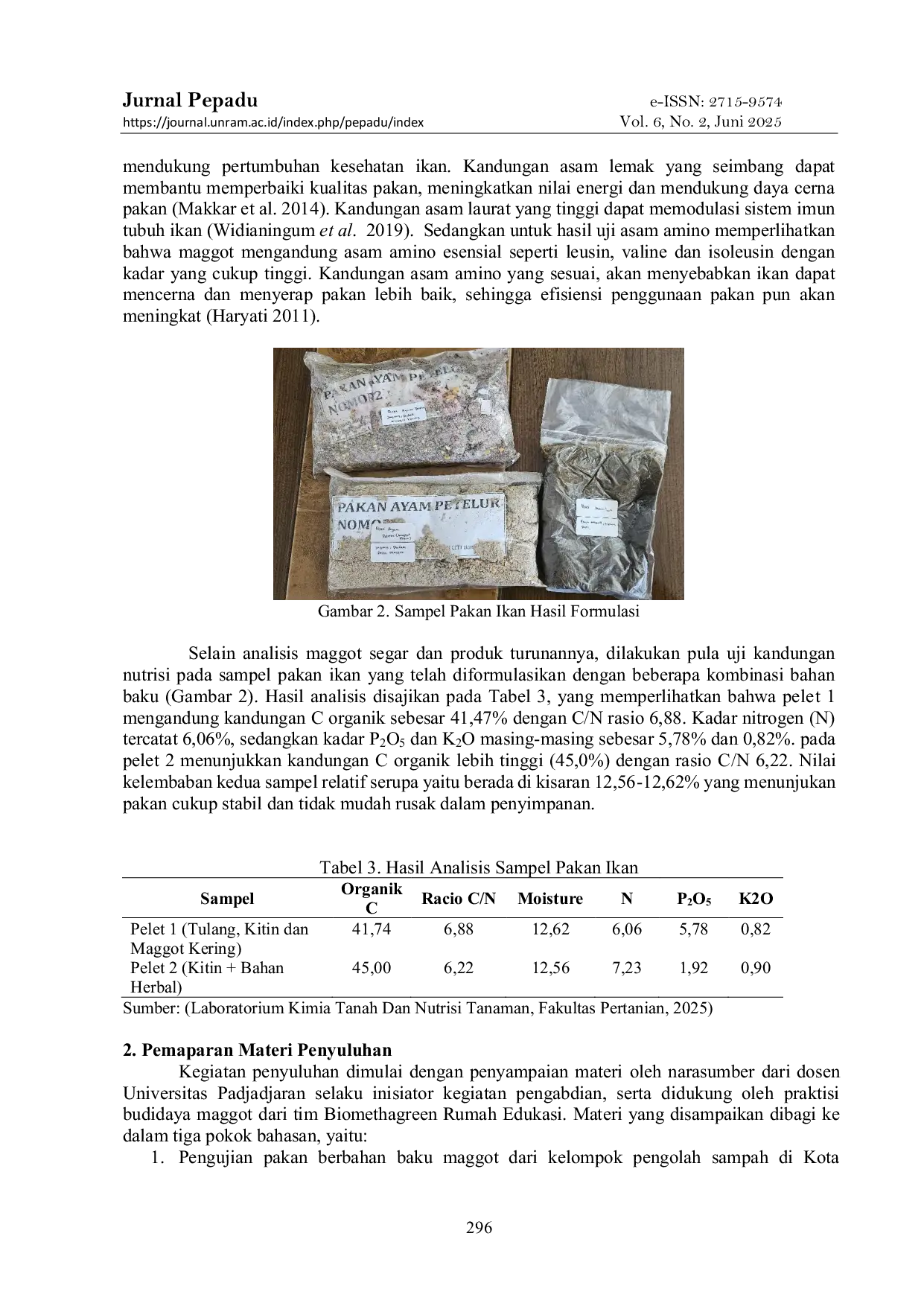

UNRAMUNRAM Meskipun produksi maggot telah berjalan secara rutin, kelompok pengolah sampah Kota Bandung belum memiliki kapasitas teknis untuk menguji kualitas produkMeskipun produksi maggot telah berjalan secara rutin, kelompok pengolah sampah Kota Bandung belum memiliki kapasitas teknis untuk menguji kualitas produk

UNRAMUNRAM Pendekatan Butterfly Effect melibatkan individu-individu kunci sebagai duta budaya untuk menyebarkan nilai-nilai ini melalui tindakan kecil yang berdampakPendekatan Butterfly Effect melibatkan individu-individu kunci sebagai duta budaya untuk menyebarkan nilai-nilai ini melalui tindakan kecil yang berdampak

UNRAMUNRAM Ekosistem mangrove memiliki peranan penting dalam menjaga keseimbangan lingkungan pesisir, menyediakan habitat bagi biota laut, serta mendukung ekonomiEkosistem mangrove memiliki peranan penting dalam menjaga keseimbangan lingkungan pesisir, menyediakan habitat bagi biota laut, serta mendukung ekonomi

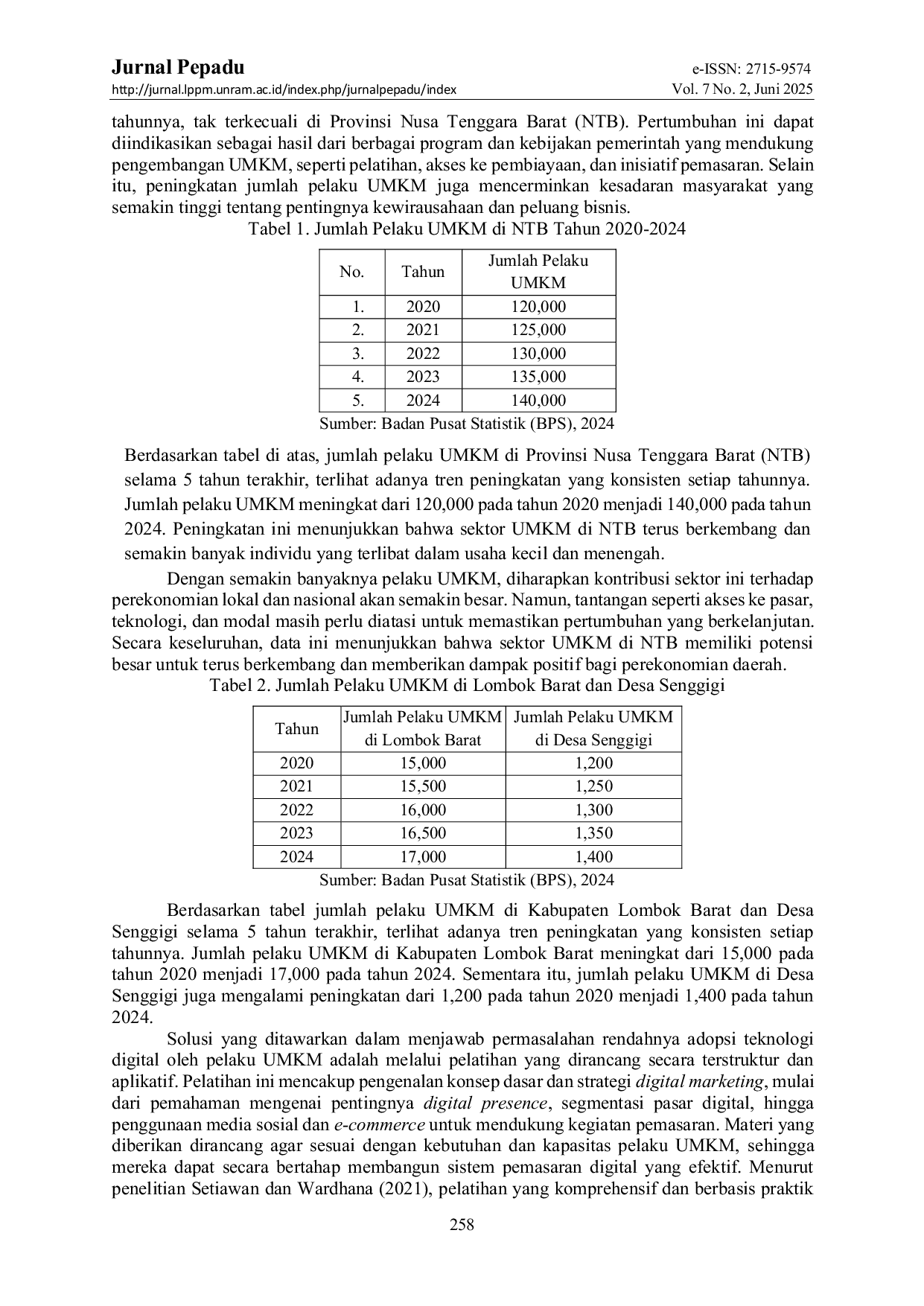

UNRAMUNRAM Kesimpulan dari kegiatan ini adalah bahwa pelatihan Digital marketing memberikan kontribusi nyata terhadap peningkatan kapasitas usaha pelaku UMKM danKesimpulan dari kegiatan ini adalah bahwa pelatihan Digital marketing memberikan kontribusi nyata terhadap peningkatan kapasitas usaha pelaku UMKM dan