ILOMATAILOMATA

Ilomata International Journal of Tax and AccountingIlomata International Journal of Tax and AccountingThis study aims to determine, analyze, and test Tobins q, market-to-book value of equity and profitability (ROA), on asset growth in property companies on the Indonesia Stock Exchange (IDX). This study uses a quantitative descriptive approach with the support of a panel regression model, which is used as a predictive analysis tool. The sampling technique used a non-probability random sampling approach with a purposive sampling method. The results of this study indicate that the independent variables (Tobins q (TQ), MBV, and ROA) both simultaneously or together and partially or individually have no effect on the dependent variable (asset growth). The R square value, or the coefficient of determination (R2), is 0.54. This shows the ability of Tobins q (TQ), MBV, and ROA to explain the growth of assets of property companies listed on the Indonesia Stock Exchange by 54%, or, in other words, the ability of Tobins q (TQ), MBV, and ROA to have an effect of 54% on asset growth variables. Meanwhile, the remaining 46% is influenced by other variables not discussed in this study.

Based on the research findings, it was concluded that Tobins q, market-to-book value (MBV), and return on assets (ROA) do not simultaneously influence asset growth.Furthermore, these independent variables also do not have a significant partial effect on asset growth.The study suggests that the relationship between these variables and asset growth in property companies may be more complex and influenced by other factors not considered in this research.

Penelitian lebih lanjut perlu dilakukan untuk menginvestigasi faktor-faktor lain yang mungkin mempengaruhi pertumbuhan aset perusahaan properti di Bursa Efek Indonesia, seperti variabel makroekonomi, kondisi pasar properti, dan kebijakan pemerintah terkait sektor properti. Selain itu, studi komparatif dapat dilakukan dengan membandingkan perusahaan properti di Indonesia dengan negara lain untuk mengidentifikasi perbedaan dan persamaan dalam faktor-faktor yang mempengaruhi pertumbuhan aset. Penelitian selanjutnya juga dapat mengeksplorasi penggunaan model analisis yang lebih kompleks, seperti model persamaan struktural (SEM), untuk menguji hubungan kausal antara Tobins Q, MBV, ROA, dan pertumbuhan aset secara lebih mendalam. Terakhir, penelitian kualitatif, seperti studi kasus, dapat dilakukan untuk memahami secara lebih rinci bagaimana manajemen perusahaan properti membuat keputusan investasi yang mempengaruhi pertumbuhan aset, serta bagaimana mereka merespons perubahan lingkungan bisnis.

- Business Perspectives - Innovation risk management in financial institutions. business perspectives innovation... businessperspectives.org/journals/investment-management-and-financial-innovations/issue-373/innovation-risk-management-in-financial-institutionsBusiness Perspectives Innovation risk management in financial institutions business perspectives innovation businessperspectives journals investment management and financial innovations issue 373 innovation risk management in financial institutions

- An Analysis of Local Government Financial Statement Audit Outcomes in a Developing Economy Using Machine... doi.org/10.3390/su15010012An Analysis of Local Government Financial Statement Audit Outcomes in a Developing Economy Using Machine doi 10 3390 su15010012

- Readiness Assessment for IDE Startups: A Pathway toward Sustainable Growth. readiness assessment startups... doi.org/10.3390/su132413687Readiness Assessment for IDE Startups A Pathway toward Sustainable Growth readiness assessment startups doi 10 3390 su132413687

- Analysis of Tobin's Q, Market to Book Value of Equity and Profitability (ROA), on Asset Growth in... ilomata.org/index.php/ijtc/article/view/755Analysis of Tobins Q Market to Book Value of Equity and Profitability ROA on Asset Growth in ilomata index php ijtc article view 755

| File size | 260.93 KB |

| Pages | 11 |

| DMCA | Report |

Related /

UNIVGRESIKUNIVGRESIK Analisis data menunjukkan bahwa rasio debt-to-equity (X1) dan dividend payout ratio (X2) tidak memberikan pengaruh signifikan terhadap nilai pasar perusahaan,Analisis data menunjukkan bahwa rasio debt-to-equity (X1) dan dividend payout ratio (X2) tidak memberikan pengaruh signifikan terhadap nilai pasar perusahaan,

AZZUKHRUFCENDIKIAAZZUKHRUFCENDIKIA (2) Kompetensi berpengaruh negatif tetapi tidak signifikan terhadap kecurangan akuntansi. (3) Tekanan tidak memperkuat hubungan antara religiositas dan(2) Kompetensi berpengaruh negatif tetapi tidak signifikan terhadap kecurangan akuntansi. (3) Tekanan tidak memperkuat hubungan antara religiositas dan

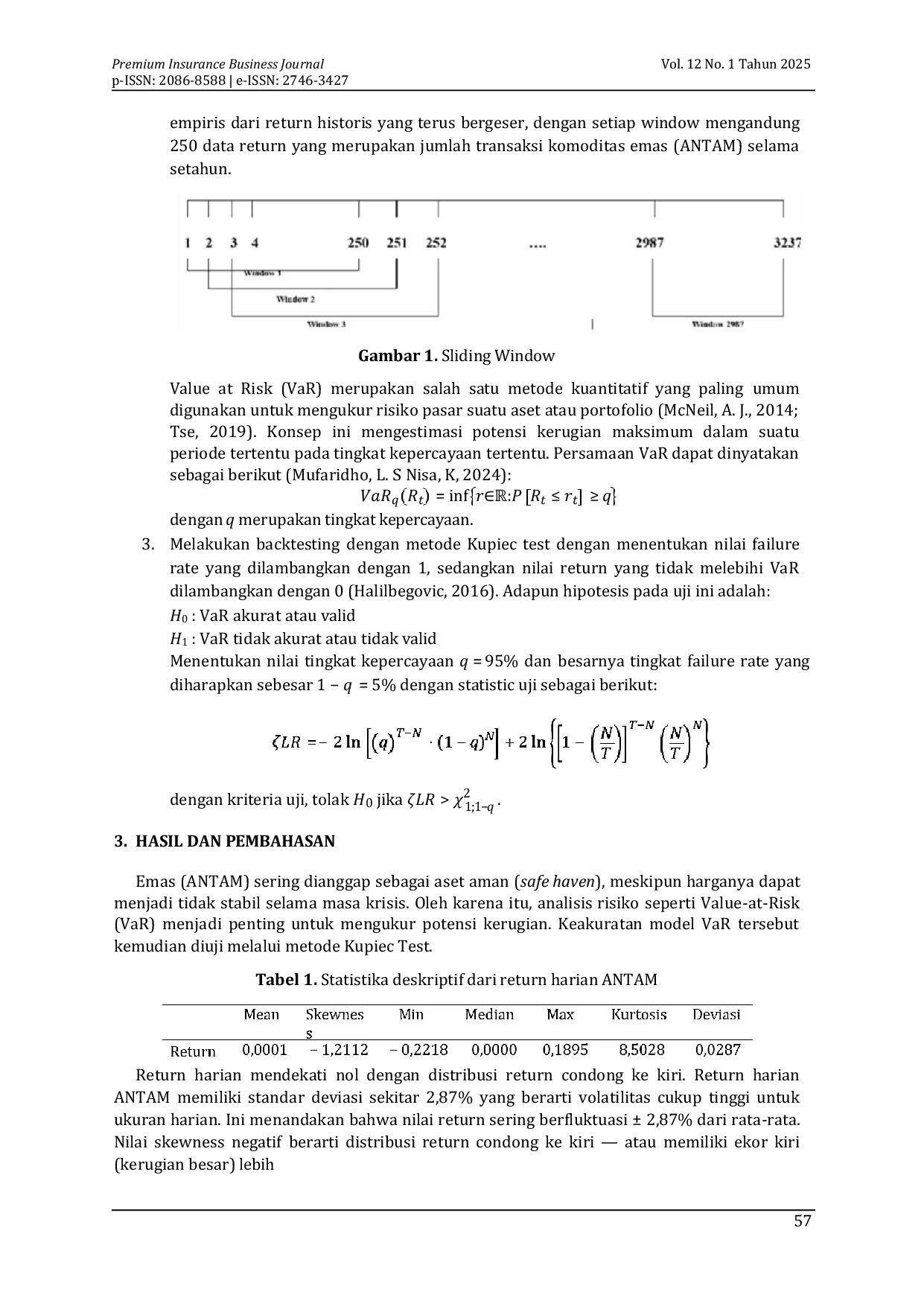

STMA TRISAKTISTMA TRISAKTI Hasil penelitian menunjukkan bahwa pendekatan Value-at-Risk (VaR) berbasis moving window mampu menangkap dinamika risiko pasar secara lebih adaptif danHasil penelitian menunjukkan bahwa pendekatan Value-at-Risk (VaR) berbasis moving window mampu menangkap dinamika risiko pasar secara lebih adaptif dan

UINSIUINSI Hasil penelitian menyarankan perlunya regulasi yang lebih jelas, peningkatan edukasi masyarakat, dan pemanfaatan teknologi yang lebih efektif untuk meningkatkanHasil penelitian menyarankan perlunya regulasi yang lebih jelas, peningkatan edukasi masyarakat, dan pemanfaatan teknologi yang lebih efektif untuk meningkatkan

UNSUDAUNSUDA Kesimpulan penelitian menunjukkan bahwa strategi pengajaran Bahasa Arab yang melibatkan lingkungan berbicara, percakapan, penggunaan Al‑Quran dan bukuKesimpulan penelitian menunjukkan bahwa strategi pengajaran Bahasa Arab yang melibatkan lingkungan berbicara, percakapan, penggunaan Al‑Quran dan buku

UKSWUKSW Dengan menggunakan moderated regression analysis terhadap 119 sampel perusahaan publik non‑finansial dari tahun 2013 sampai 2017, penelitian ini menemukanDengan menggunakan moderated regression analysis terhadap 119 sampel perusahaan publik non‑finansial dari tahun 2013 sampai 2017, penelitian ini menemukan

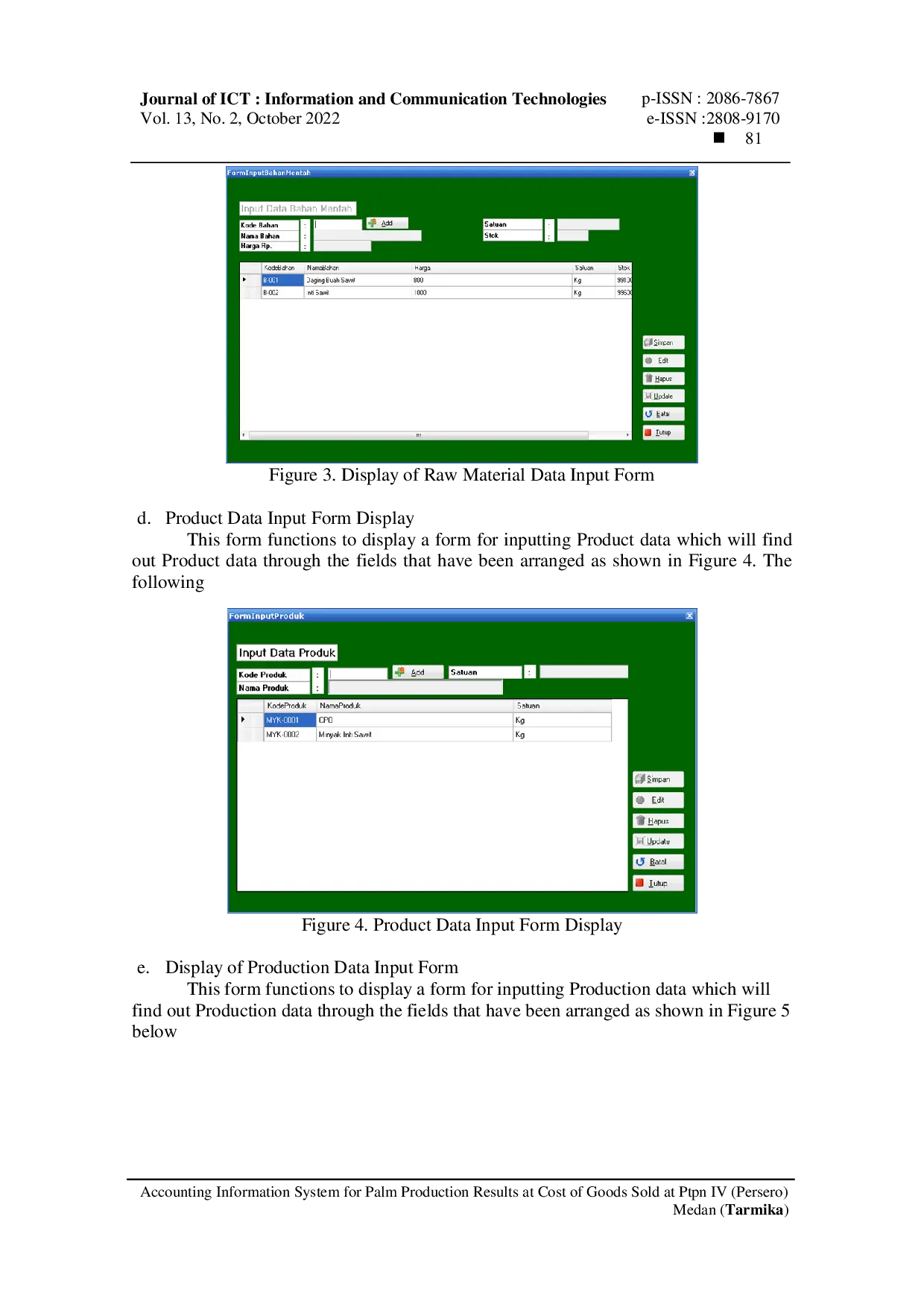

MARQCHAINSTITUTEMARQCHAINSTITUTE PTPN IV adalah Badan Usaha Milik Negara (BUMN) yang bergerak di bidang bisnis agroindustri. PTPN IV (Persero) Medan mengelola perkebunan dan mengelolaPTPN IV adalah Badan Usaha Milik Negara (BUMN) yang bergerak di bidang bisnis agroindustri. PTPN IV (Persero) Medan mengelola perkebunan dan mengelola

UNIGRESUNIGRES Penelitian ini mengungkap bahwa diversifikasi investasi pada reksadana dilakukan karena lebih mudah dan terbantu dengan peran manajer investasi yang melakukanPenelitian ini mengungkap bahwa diversifikasi investasi pada reksadana dilakukan karena lebih mudah dan terbantu dengan peran manajer investasi yang melakukan

Useful /

AKMICIREBONAKMICIREBON CWT sering terhambat oleh faktor-faktor seperti persyaratan dokumen yang tidak lengkap dan kurangnya kemahiran berbahasa Inggris di kalangan pelamar. HambatanCWT sering terhambat oleh faktor-faktor seperti persyaratan dokumen yang tidak lengkap dan kurangnya kemahiran berbahasa Inggris di kalangan pelamar. Hambatan

ILOMATAILOMATA Kuesioner dianalisis menggunakan statistik deskriptif dan hipotesis diuji dengan regresi linier berganda. Hasil menunjukkan korelasi positif dan signifikanKuesioner dianalisis menggunakan statistik deskriptif dan hipotesis diuji dengan regresi linier berganda. Hasil menunjukkan korelasi positif dan signifikan

UDBUDB Hasil penelitian menunjukan bahwa dari 154 dokumen diperoleh ketepatan kode dengan persentase 70% lebih besar dibandingkan ketidaktepatan kode dengan persentaseHasil penelitian menunjukan bahwa dari 154 dokumen diperoleh ketepatan kode dengan persentase 70% lebih besar dibandingkan ketidaktepatan kode dengan persentase

ILOMATAILOMATA Selain itu, penelitian ini menemukan bahwa persepsi biaya memiliki dimensi negatif, di mana responden merasa adanya hambatan finansial dan tingginya biayaSelain itu, penelitian ini menemukan bahwa persepsi biaya memiliki dimensi negatif, di mana responden merasa adanya hambatan finansial dan tingginya biaya