LAMINTANGLAMINTANG

International Journal of Artificial IntelligenceInternational Journal of Artificial IntelligencePersonal financial literacy is a vital skill for university students, yet many struggle to track their daily expenses due to time constraints and low awareness. This study aims to design and develop a web-based Student Expense Tracking System using Optical Character Recognition (OCR) technology to address this issue. The system allows users to automatically extract and record spending information from receipt images, reducing manual input and improving financial awareness. The development followed the Web Development Life Cycle (WDLC) using the Waterfall model, comprising planning, design, development, and testing phases. Visual Studio Code, Python 3, and Tesseract OCR were employed in system implementation. Wireframes and mockups guided the interface design, while backend development focused on data storage and OCR integration. Functionality testing showed a 100% pass rate across ten scenarios, validating the systems performance in image processing, budget management, and spending visualization. Usability testing using the Post-Study System Usability Questionnaire (PSSUQ) with 30 participants yielded a mean score of 4.45 out of 5, indicating a high level of user satisfaction. The system scored highest on ease of use (4.6), visual design (4.7), and recommendation likelihood (4.8), confirming its intuitive interface and appeal. Slightly lower scores in user confidence (4.1) and data organization (4.2) point to opportunities for interface refinement and improved user guidance. This research concludes that OCR can effectively support financial tracking for students. Future enhancements with NLP and machine learning are recommended to automate expense categorization and improve analytical capabilities.

The development of the Student Expense Tracking System using OCR has successfully met its three main objectives.First, the system was effectively designed with clear visual mockups and wireframes that guided its development.Second, the integration of Optical Character Recognition (OCR) allowed users to extract and convert printed receipt data into digital expense entries, automating what is typically a manual process.Finally, thorough functional testing was conducted using 10 test scenarios, all of which passed successfully, confirming that core functionalities—such as login, image upload, OCR processing, expense input, budget setup, and visualization—worked as intended.The system addresses key challenges in student financial management, such as the lack of routine expense tracking and difficulties in budgeting.By automating data input through OCR and visualizing spending patterns, students can better understand their financial habits.Future development should focus on integrating Natural Language Processing (NLP) and Machine Learning (ML) to enhance system intelligence and provide more meaningful insights into financial habits.

Berdasarkan latar belakang, metode, hasil, keterbatasan, dan saran penelitian lanjutan yang ada, beberapa saran penelitian lanjutan yang potensial dapat dikembangkan. Pertama, penelitian dapat difokuskan pada pengembangan algoritma machine learning untuk secara otomatis mengkategorikan pengeluaran berdasarkan deskripsi teks yang diekstrak dari gambar resi. Hal ini akan mengurangi kebutuhan pengguna untuk secara manual mengkategorikan setiap transaksi, sehingga meningkatkan efisiensi dan akurasi sistem. Kedua, penelitian dapat mengeksplorasi integrasi dengan sumber data keuangan eksternal, seperti rekening bank dan kartu kredit, untuk memberikan gambaran yang lebih komprehensif tentang kondisi keuangan mahasiswa. Integrasi ini dapat dilakukan melalui API atau metode lainnya, dan memerlukan pertimbangan keamanan dan privasi data yang ketat. Ketiga, penelitian dapat menguji efektivitas sistem dalam meningkatkan literasi keuangan dan perilaku pengeluaran mahasiswa melalui studi longitudinal. Studi ini dapat melibatkan kelompok kontrol dan eksperimen, serta pengukuran perubahan dalam pengetahuan, sikap, dan perilaku keuangan mahasiswa dari waktu ke waktu. Dengan menggabungkan ketiga saran ini, penelitian dapat memberikan kontribusi signifikan terhadap pengembangan sistem pelacakan pengeluaran mahasiswa yang lebih cerdas, komprehensif, dan efektif dalam meningkatkan literasi keuangan.

| File size | 801.12 KB |

| Pages | 10 |

| DMCA | Report |

Related /

ALMARHALAHALMARHALAH Dukungan intensif dari guru, mahasiswa MBKM, dan penggunaan buku pendamping serta jadwal konsisten meningkatkan motivasi dan memungkinkan koreksi langsung,Dukungan intensif dari guru, mahasiswa MBKM, dan penggunaan buku pendamping serta jadwal konsisten meningkatkan motivasi dan memungkinkan koreksi langsung,

STIE AASSTIE AAS Faktor sosial dan perilaku, ditambah dengan koordinasi antarlembaga yang lemah, memperparah risiko penipuan daring dan mengikis kepercayaan publik. OlehFaktor sosial dan perilaku, ditambah dengan koordinasi antarlembaga yang lemah, memperparah risiko penipuan daring dan mengikis kepercayaan publik. Oleh

YANAYANA Penelitian ini bertujuan untuk meneliti pelaksanaan pembelajaran tahfidz Al‑Quran bagi siswa berkebutuhan khusus di SLB Negeri Seduri Mojokerto denganPenelitian ini bertujuan untuk meneliti pelaksanaan pembelajaran tahfidz Al‑Quran bagi siswa berkebutuhan khusus di SLB Negeri Seduri Mojokerto dengan

UNIKSUNIKS Seperti Pemerintah Desa Pulau Lancang yang meningkatkan kesejateraan masyarakatnya melalui program swasembada pangan. Program swasembada pangan ini diSeperti Pemerintah Desa Pulau Lancang yang meningkatkan kesejateraan masyarakatnya melalui program swasembada pangan. Program swasembada pangan ini di

UNIKSUNIKS Dimana data sekunder berupa laporan keuangan dan sejarah singkat timbangan jual beli sawit sedangkan data primer merupakan data hasil observasi dan wawancaraDimana data sekunder berupa laporan keuangan dan sejarah singkat timbangan jual beli sawit sedangkan data primer merupakan data hasil observasi dan wawancara

UNIKSUNIKS Penulis menemukan ada permasalahan bahwa belum efektifnya Optimalisasi Pelayanan Pegawai Di Loket perbendahraan dan kas daerah Kantor Badan Pengelola KeunganPenulis menemukan ada permasalahan bahwa belum efektifnya Optimalisasi Pelayanan Pegawai Di Loket perbendahraan dan kas daerah Kantor Badan Pengelola Keungan

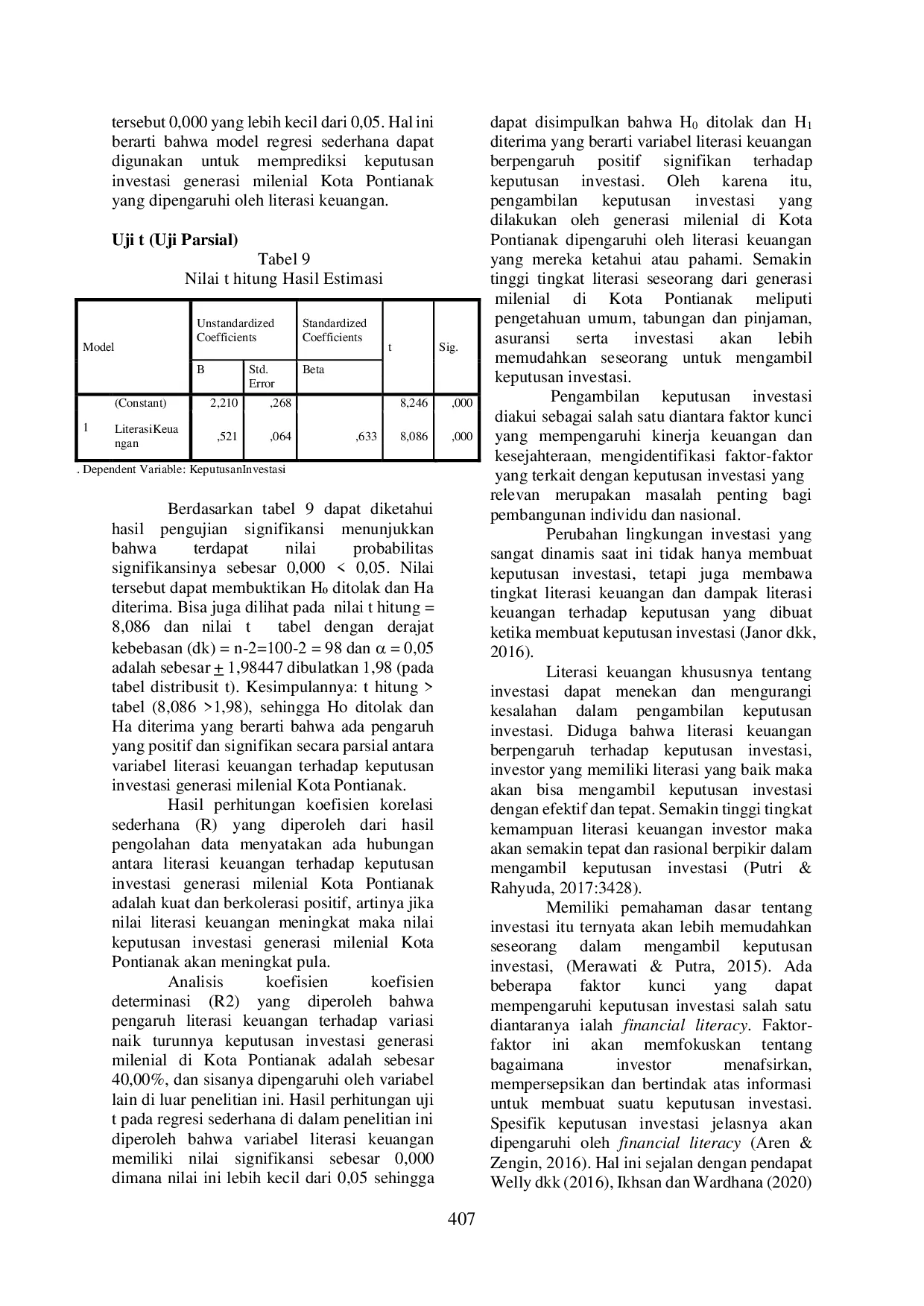

STIE MUTTAQIENSTIE MUTTAQIEN The results of the Simultaneous Test (Test F) show the value of 65.383 (F count) > 3. 94 (F table) with a significance value of F which is 0. 000 whichThe results of the Simultaneous Test (Test F) show the value of 65.383 (F count) > 3. 94 (F table) with a significance value of F which is 0. 000 which

STIE MUTTAQIENSTIE MUTTAQIEN Hasil penelitian ini menunjukkan bahwa secara parsial terdapat pengaruh positif dan signifikan dari financial literacy terhadap keberlangsungan usaha UMKM,Hasil penelitian ini menunjukkan bahwa secara parsial terdapat pengaruh positif dan signifikan dari financial literacy terhadap keberlangsungan usaha UMKM,

Useful /

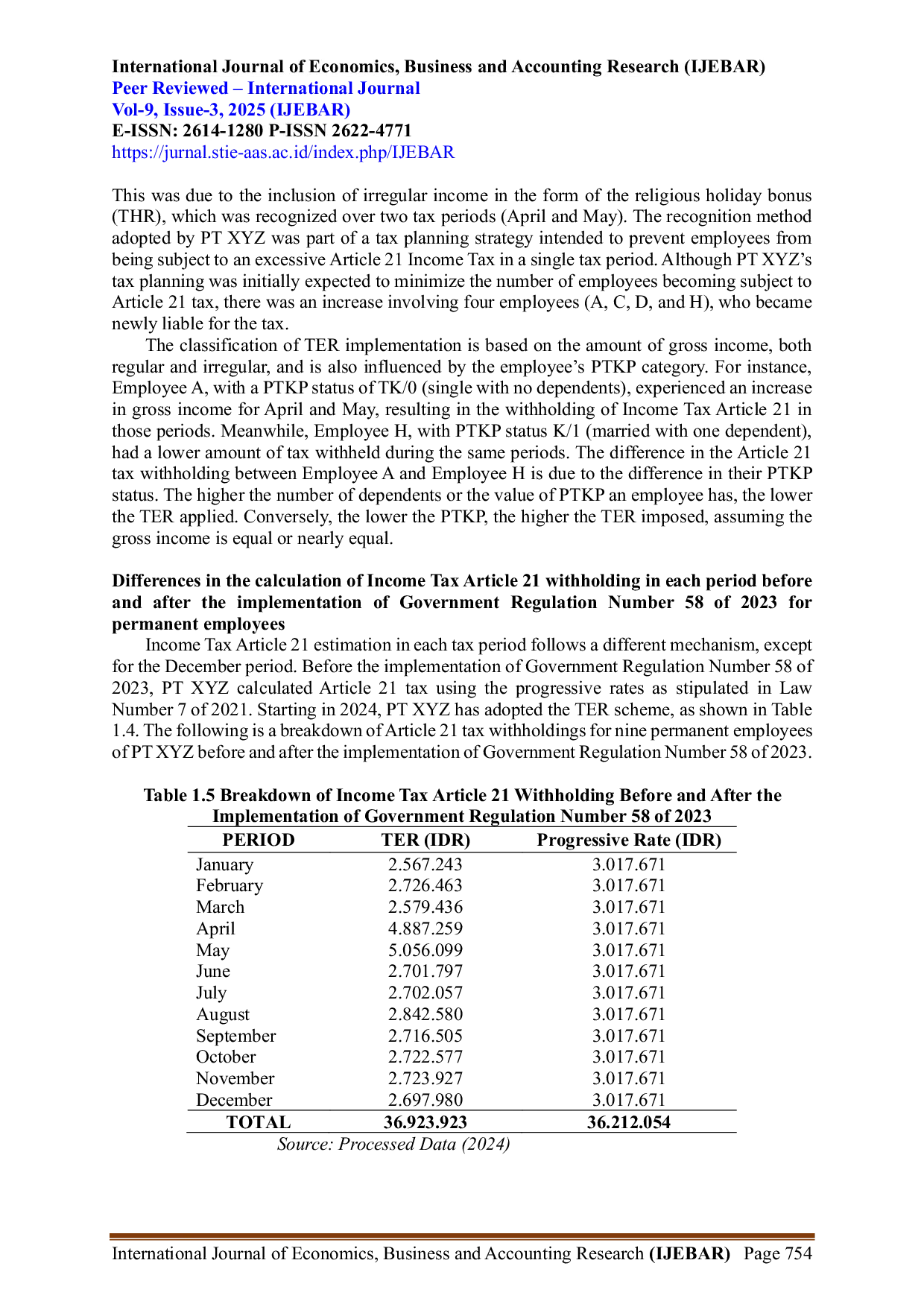

STIE AASSTIE AAS Peralihan sistem perhitungan pemotongan Pajak Penghasilan Pasal 21 dari tarif progresif ke skema Tarif Efektif Rata‑Rata (TER) memberikan kemudahan administratifPeralihan sistem perhitungan pemotongan Pajak Penghasilan Pasal 21 dari tarif progresif ke skema Tarif Efektif Rata‑Rata (TER) memberikan kemudahan administratif

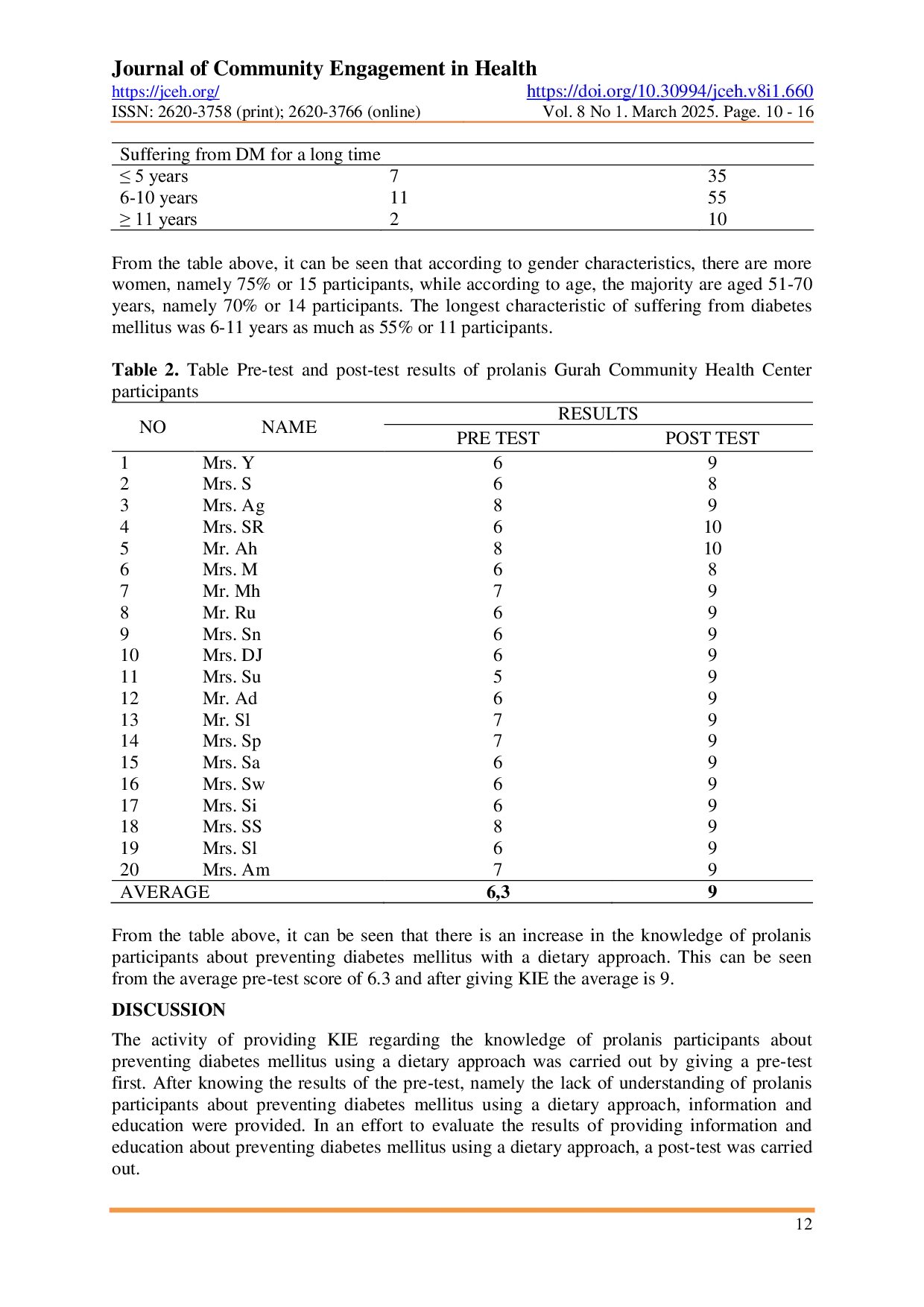

JCEHJCEH The program ran smoothly and achieved its target outcome of increasing understanding about preventing diabetes mellitus through dietary assistance. ItThe program ran smoothly and achieved its target outcome of increasing understanding about preventing diabetes mellitus through dietary assistance. It

STIE MUTTAQIENSTIE MUTTAQIEN Studi empiris dilakukan pada perusahaan konsumsi yang terdaftar di Bursa Efek Indonesia pada tahun 2018-2020. Metode sampling yang digunakan adalah purposiveStudi empiris dilakukan pada perusahaan konsumsi yang terdaftar di Bursa Efek Indonesia pada tahun 2018-2020. Metode sampling yang digunakan adalah purposive

STIE MUTTAQIENSTIE MUTTAQIEN Melalui penelitian ini, dapat disediakan gambaran aspek-aspek yang perlu ditingkatkan oleh organisasi guna meningkatkan employee engagement. Untuk tujuanMelalui penelitian ini, dapat disediakan gambaran aspek-aspek yang perlu ditingkatkan oleh organisasi guna meningkatkan employee engagement. Untuk tujuan