TRANSPUBLIKATRANSPUBLIKA

TRANSEKONOMIKA: AKUNTANSI, BISNIS DAN KEUANGANTRANSEKONOMIKA: AKUNTANSI, BISNIS DAN KEUANGANThe application of Financial Accounting Standards for Entities Without Public Accountability (SAK ETAP) in the financial statements of the Civil Servants Cooperative of West Java Province (KPPP West Java) is essential to reflect accountability in managing the cooperative so that stakeholders can understand its financial condition. The primary objective of this research is to evaluate the suitability of adopting the SAK ETAP standards for the preparation of financial statements by KPPP West Java. The approach employed for this study is descriptive qualitative, involving the collection of data through interviews, observations, document analysis, and literature review. The information gathered from interviews and observations was systematically analyzed and compared to determine the compliance of the 2024 and 2023 financial statements of KPPP West Java with the SAK ETAP guidelines. The results found that the application of SAK ETAP was substantial deviation, accompanied by explanations of the deficiencies and suggestions for improvements in the financial statement presentation. The conclusion drawn is that the implementation of SAK ETAP in the financial statements of KPPP West Java is not yet appropriate, as it does not meet the minimum information requirements needed to fulfill the principles of transparency and accountability. Therefore, the recommended improvements are expected to assist KPPP West Java in preparing future financial statements in strict adherence to SAK ETAP, thereby enhancing transparency and stakeholder confidence.

This study concludes that the application of SAK ETAP in the financial statements of KPPP West Java does not fully comply with applicable standards.The internal assessment result of 81% (category compliant) and the formal comparison of 73.33% (category fairly compliant) indicate significant weaknesses in presentation, particularly in the absence of cash flow statements, statements of changes in equity, and notes to the financial statements that have not been presented in detail.This condition indicates that the transparency and accountability of the financial statements are not yet optimal, influenced by the limited competence of human resources managers and the low participation of members in providing technical input.The implications of these findings confirm that partial compliance with accounting standards can reduce the credibility of financial statements and undermine stakeholder confidence in the cooperatives performance.

To address the challenges identified in this study, future research could explore the development of a comprehensive training program for cooperative accounting human resources, focusing on SAK ETAP compliance. This program should aim to enhance their understanding and application of accountability principles, ensuring that financial reports not only meet formal requirements but also contribute to the transparency and accountability of the organization. Additionally, further investigation into the role of organizational governance and leadership commitment in improving SAK ETAP compliance is warranted. By examining the impact of effective governance structures and leadership engagement, researchers can provide insights into how cooperatives can achieve full compliance with SAK ETAP while strengthening good governance practices. Finally, a comparative analysis of the socio-cultural factors influencing the quality of cooperative financial reporting, such as member literacy levels and their participation in decision-making, would be valuable. This research direction can contribute to a deeper understanding of the unique context of civil servant cooperatives and inform practical implications for their governance and financial management.

- Implementation of Accounting Standards for Non-Public Entities in Cooperative Financial Reporting | TRANSEKONOMIKA:... transpublika.co.id/ojs/index.php/Transekonomika/article/view/1020Implementation of Accounting Standards for Non Public Entities in Cooperative Financial Reporting TRANSEKONOMIKA transpublika ojs index php Transekonomika article view 1020

- Financial reporting by charities: a matched case study analysis from four countries: Public Money &... doi.org/10.1080/09540962.2017.1281638Financial reporting by charities a matched case study analysis from four countries Public Money doi 10 1080 09540962 2017 1281638

- Supreme audit institutions and public value: Demonstrating relevance - Cordery - 2019 - Financial Accountability... onlinelibrary.wiley.com/doi/10.1111/faam.12185Supreme audit institutions and public value Demonstrating relevance Cordery 2019 Financial Accountability onlinelibrary wiley doi 10 1111 faam 12185

| File size | 726.73 KB |

| Pages | 18 |

| DMCA | Report |

Related /

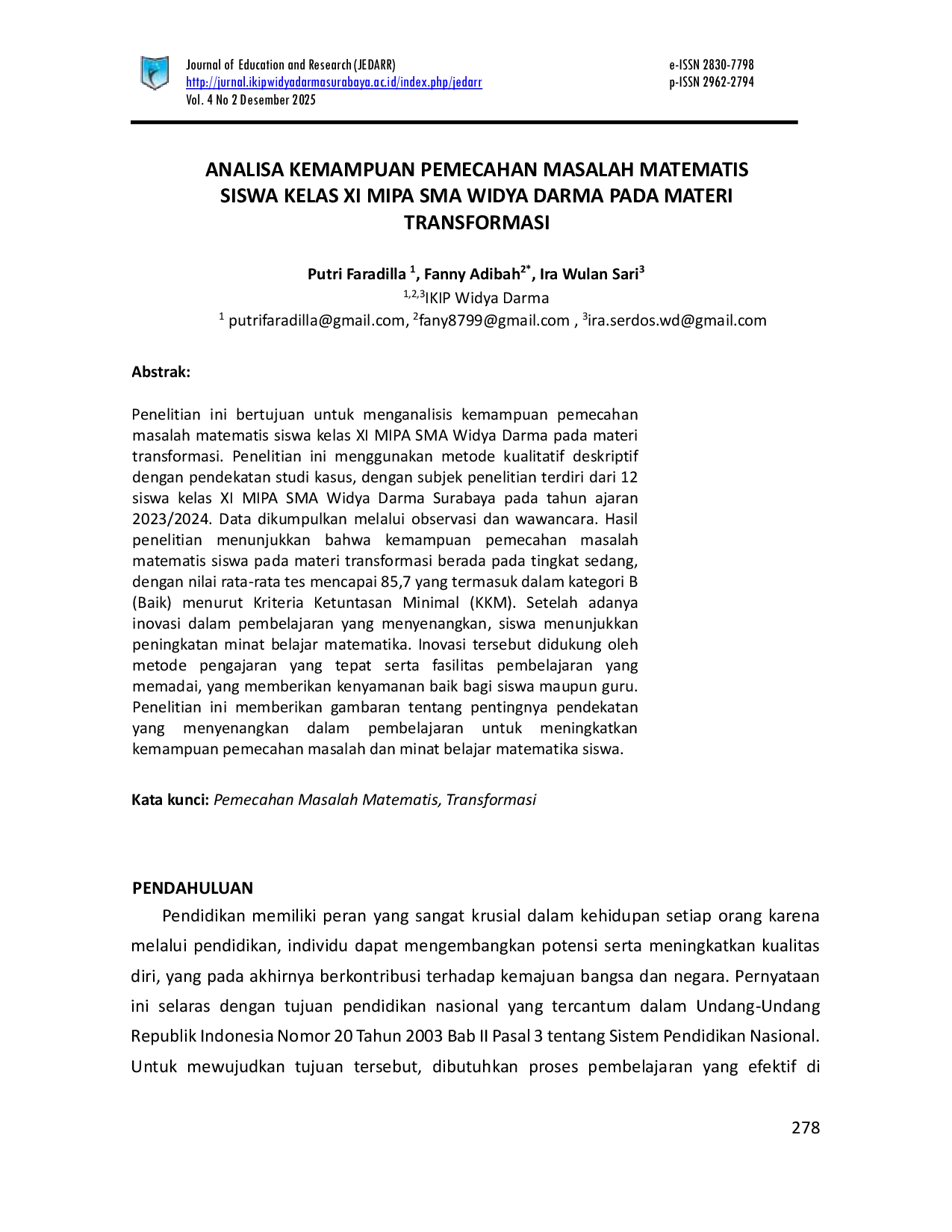

IKIPWIDYADARMASURABAYAIKIPWIDYADARMASURABAYA Penelitian ini memberikan gambaran tentang pentingnya pendekatan yang menyenangkan dalam pembelajaran untuk meningkatkan kemampuan pemecahan masalah danPenelitian ini memberikan gambaran tentang pentingnya pendekatan yang menyenangkan dalam pembelajaran untuk meningkatkan kemampuan pemecahan masalah dan

YBPINDOYBPINDO PKM ini berhasil mencapai target jumlah peserta dan tujuan pelatihan, namun keterbatasan waktu mengakibatkan tidak semua materi praktis, khususnya pembuatanPKM ini berhasil mencapai target jumlah peserta dan tujuan pelatihan, namun keterbatasan waktu mengakibatkan tidak semua materi praktis, khususnya pembuatan

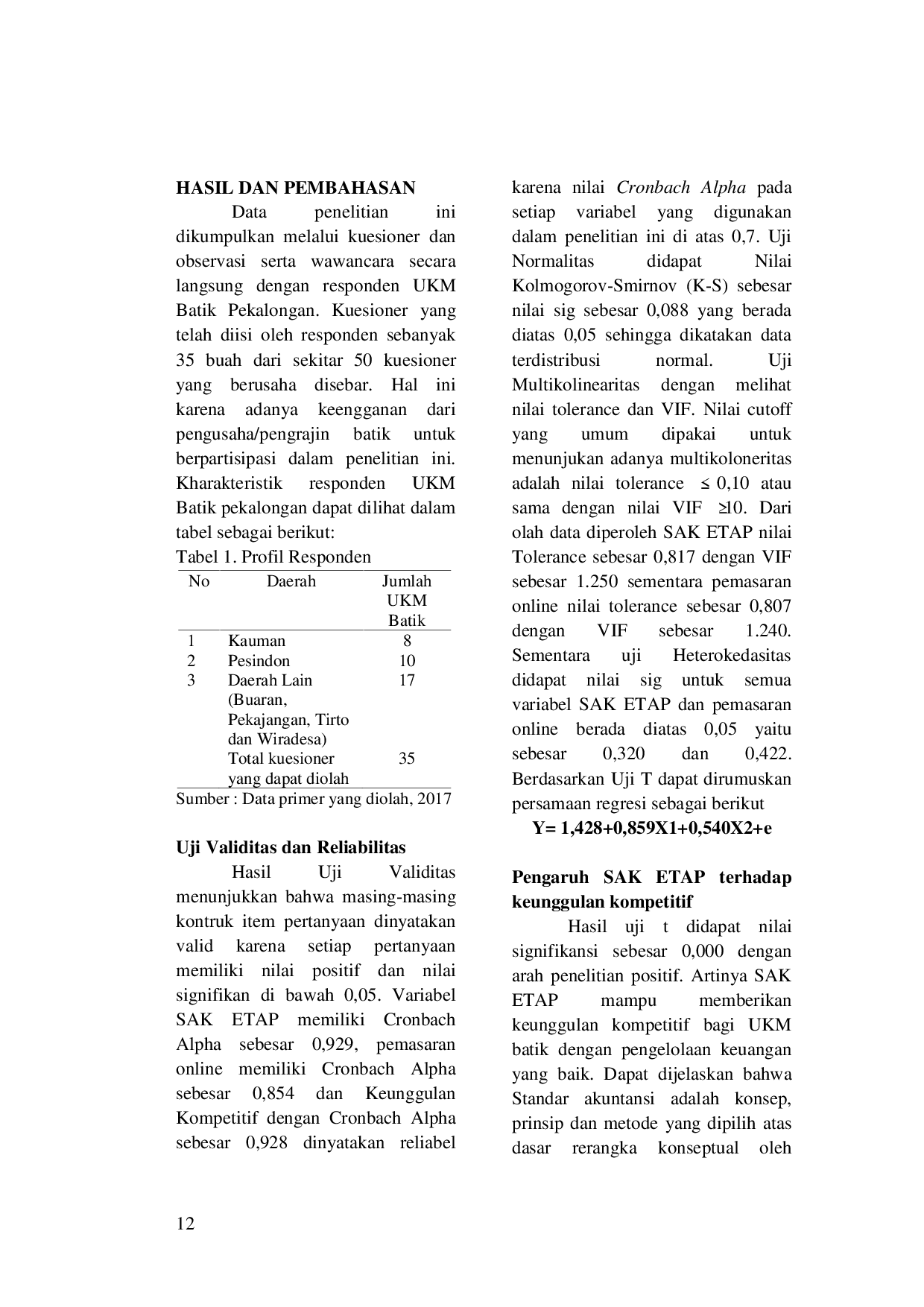

PUSKOMCERIAPUSKOMCERIA Kedua, pemasaran online terbukti berkontribusi positif terhadap keunggulan kompetitif UKM Batik dengan memudahkan identifikasi produk dan akses transaksiKedua, pemasaran online terbukti berkontribusi positif terhadap keunggulan kompetitif UKM Batik dengan memudahkan identifikasi produk dan akses transaksi

UNJUNJ Sehingga diperlukan alat deteksi kebocoran gas yang cepat dan andal dengan pendekatan berbasis Internet of Things (IoT) sebagai salah satu solusi yangSehingga diperlukan alat deteksi kebocoran gas yang cepat dan andal dengan pendekatan berbasis Internet of Things (IoT) sebagai salah satu solusi yang

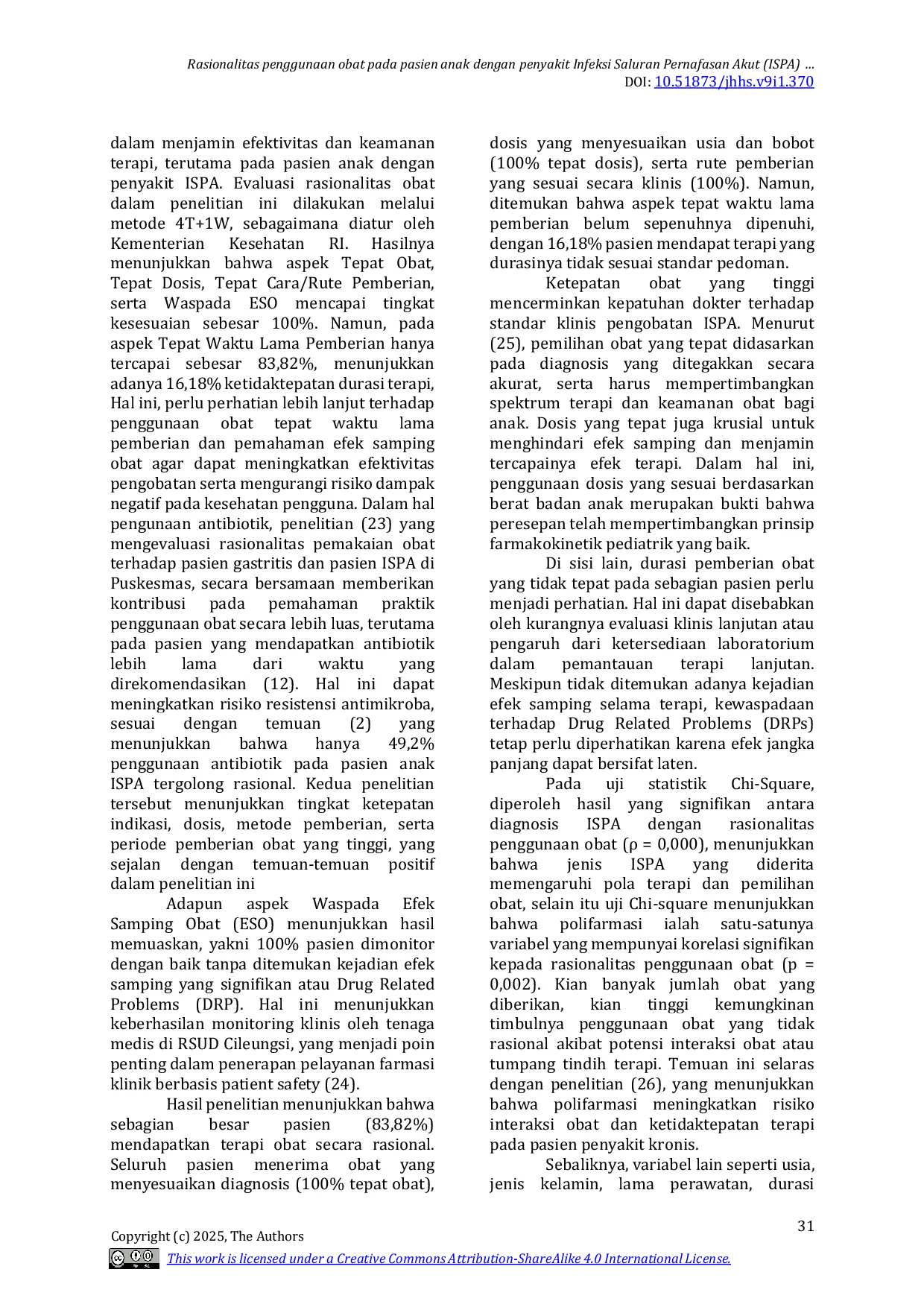

STIKES HOLISTICSTIKES HOLISTIC Tujuan: Mengevaluasi dan mengetahui pengaruh karakteristik pasien anak terhadap rasionalitas penggunaan obat pada penyakit ISPA di unit rawat inap RSUDTujuan: Mengevaluasi dan mengetahui pengaruh karakteristik pasien anak terhadap rasionalitas penggunaan obat pada penyakit ISPA di unit rawat inap RSUD

YBPINDOYBPINDO Kegiatan pengabdian masyarakat ini dilaksanakan di Desa Tembesi, Pengetahuan dan praktik pengelolaan sampah masyarakat Desa Tembesi masih terbatas. FasilitasKegiatan pengabdian masyarakat ini dilaksanakan di Desa Tembesi, Pengetahuan dan praktik pengelolaan sampah masyarakat Desa Tembesi masih terbatas. Fasilitas

UWIKAUWIKA Selain pengetahuan UMKM tidak memiliki keahlian khusus dalam pencatatan akuntansi. Kendala dalam pelaksanaan SAK ETAP dikarenakan pemberian informasi danSelain pengetahuan UMKM tidak memiliki keahlian khusus dalam pencatatan akuntansi. Kendala dalam pelaksanaan SAK ETAP dikarenakan pemberian informasi dan

UNIMAUNIMA Koperasi Karya Citra Abadi, Koperasi Setia Karya dan Koperasi Jivent Matuari menggunakan jurnal memorial untuk peringkasan dan neraca percobaan untuk pengikhtisaranKoperasi Karya Citra Abadi, Koperasi Setia Karya dan Koperasi Jivent Matuari menggunakan jurnal memorial untuk peringkasan dan neraca percobaan untuk pengikhtisaran

Useful /

TRANSPUBLIKATRANSPUBLIKA 000) dan Historical VaR 95% (p = 0. 028). Rata-rata VaR kripto mencapai 23.17%, sedangkan indeks saham hanya 6. 10%, menunjukkan potensi kerugian maksimum000) dan Historical VaR 95% (p = 0. 028). Rata-rata VaR kripto mencapai 23.17%, sedangkan indeks saham hanya 6. 10%, menunjukkan potensi kerugian maksimum

TRANSPUBLIKATRANSPUBLIKA Penelitian ini menunjukkan bahwa strategi tata kelola perusahaan berdampak positif terhadap kinerja finansial. Ukuran dewan, kemandirian dewan, komitePenelitian ini menunjukkan bahwa strategi tata kelola perusahaan berdampak positif terhadap kinerja finansial. Ukuran dewan, kemandirian dewan, komite

MES BOGORMES BOGOR Hasil penelitian menunjukkan bahwa dengan pendekatan yang kreatif, bangunan rumah sakit dapat diadaptasi untuk menjadi pusat kebugaran dan kafe yang modernHasil penelitian menunjukkan bahwa dengan pendekatan yang kreatif, bangunan rumah sakit dapat diadaptasi untuk menjadi pusat kebugaran dan kafe yang modern

PUSKOMCERIAPUSKOMCERIA Penelitian menggunakan metode eksperimen kuantitatif dengan instrumen tes pemahaman konsep. Analisis data dilakukan menggunakan uji Anova satu jalan denganPenelitian menggunakan metode eksperimen kuantitatif dengan instrumen tes pemahaman konsep. Analisis data dilakukan menggunakan uji Anova satu jalan dengan