AZZUKHRUFCENDIKIAAZZUKHRUFCENDIKIA

Journal of Accounting and AuditingJournal of Accounting and AuditingThis study aims to examine the impact of Return on Asset (ROA) and inflation on stock prices in the banking sub-sector companies listed on the Indonesia Stock Exchange from 2017 to 2022. The study employs a quantitative research method. A sample of 25 banking companies listed on the Indonesia Stock Exchange was selected. The analysis was conducted using multiple regression techniques, and the data was analyzed using Eviews9 software to test the hypotheses. The findings reveal that both Return on Asset and inflation variables have a positive, but statistically insignificant, effect on stock prices.

The research concludes that Return on Asset has a positive and statistically significant effect on stock prices, indicating that effective asset management contributes to increased stock value.However, inflation demonstrates a positive yet statistically insignificant impact on stock prices, suggesting its influence is not consistently reliable within the studys context.These findings provide valuable insights for investors and policymakers in the Indonesian banking sector, informing investment strategies and economic policy decisions.

Penelitian lebih lanjut dapat dilakukan dengan memperluas cakupan sampel ke sektor-sektor lain di luar perbankan untuk menguji apakah pengaruh Return on Asset dan inflasi terhadap harga saham konsisten di berbagai industri. Selain itu, studi longitudinal yang lebih panjang, mencakup periode waktu yang lebih ekstensif, dapat memberikan gambaran yang lebih komprehensif tentang dinamika hubungan antara variabel-variabel tersebut, terutama dalam menghadapi perubahan kondisi ekonomi makro yang signifikan. Sebagai pengembangan, penelitian dapat menggabungkan variabel-variabel lain yang berpotensi memengaruhi harga saham, seperti suku bunga, nilai tukar, dan indikator kinerja keuangan perusahaan lainnya, untuk membangun model yang lebih akurat dan holistik. Terakhir, penelitian kualitatif, seperti wawancara dengan investor dan analis pasar, dapat memberikan wawasan mendalam tentang persepsi dan perilaku mereka terhadap pengaruh Return on Asset dan inflasi terhadap keputusan investasi, melengkapi temuan kuantitatif yang telah diperoleh.

- PENGARUH NET PROFIT MARGIN (NPM) DAN RETURN ON ASSET (ROA)TERHADAP HARGA SAHAM PADA PT. MAYORA INDAH... Doi.Org/10.53654/Mv.V5i01.324PENGARUH NET PROFIT MARGIN NPM DAN RETURN ON ASSET ROA TERHADAP HARGA SAHAM PADA PT MAYORA INDAH Doi Org 10 53654 Mv V5i01 324

- Pengaruh Debt To Equity Ratio, Return On Equity, Price To Book Value Dan Earning Per Share Terhadap Harga... ejournal3.undip.ac.id/index.php/jiab/article/view/30704Pengaruh Debt To Equity Ratio Return On Equity Price To Book Value Dan Earning Per Share Terhadap Harga ejournal3 undip ac index php jiab article view 30704

- PENGARUH RETURN ON EQUITY (ROE), EARNING PER SHARE (EPS), DAN DEBT TO EQUITY RATIO (DER) TERHADAP HARGA... Doi.Org/10.22515/Academica.V3i1.2001PENGARUH RETURN ON EQUITY ROE EARNING PER SHARE EPS DAN DEBT TO EQUITY RATIO DER TERHADAP HARGA Doi Org 10 22515 Academica V3i1 2001

- Pengaruh Return on Assets, Equity dan Earning Per Share Terhadap Harga Saham Sektor Perbankan di Bursa... Doi.Org/10.33395/Owner.V6i2.862Pengaruh Return on Assets Equity dan Earning Per Share Terhadap Harga Saham Sektor Perbankan di Bursa Doi Org 10 33395 Owner V6i2 862

| File size | 444.28 KB |

| Pages | 16 |

| Short Link | https://juris.id/p-3fy |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

IRPIIRPI Oleh karena itu, penelitian ini penting untuk mengidentifikasi faktor usability yang dapat meningkatkan pengalaman pengguna dan memberikan wawasan bagiOleh karena itu, penelitian ini penting untuk mengidentifikasi faktor usability yang dapat meningkatkan pengalaman pengguna dan memberikan wawasan bagi

UNPAMUNPAM Hasil menunjukkan bahwa kertas dari kulit pisang dengan konsentrasi NaOH 4% menghasilkan gramatur 120 g/m², kekuatan tarik 35 MPa, dan permukaan yangHasil menunjukkan bahwa kertas dari kulit pisang dengan konsentrasi NaOH 4% menghasilkan gramatur 120 g/m², kekuatan tarik 35 MPa, dan permukaan yang

UKIPUKIP This study aims to determine how human relations influence the spirit work of employees at PT. Victory International Futures Makassar Branch. Human relationsThis study aims to determine how human relations influence the spirit work of employees at PT. Victory International Futures Makassar Branch. Human relations

UKIPUKIP Berdasarkan hasil analisis, PT Adhi Karya (Persero) Tbk memiliki kinerja keuangan yang kurang sehat pada tahun 2015-2020. Hal ini ditunjukkan oleh skorBerdasarkan hasil analisis, PT Adhi Karya (Persero) Tbk memiliki kinerja keuangan yang kurang sehat pada tahun 2015-2020. Hal ini ditunjukkan oleh skor

ILOMATAILOMATA Pandemi Covid-19 mempercepat perkembangan teknologi informasi (TI) yang memungkinkan pengguna berinteraksi dengan lingkungan daring berisi alat dan dataPandemi Covid-19 mempercepat perkembangan teknologi informasi (TI) yang memungkinkan pengguna berinteraksi dengan lingkungan daring berisi alat dan data

ILOMATAILOMATA Populasi 22 bank, sampel 10 bank. Analisis menggunakan regresi linear sederhana dan Moderated Regression Analysis (MRA). Hasil menunjukkan CAR berpengaruhPopulasi 22 bank, sampel 10 bank. Analisis menggunakan regresi linear sederhana dan Moderated Regression Analysis (MRA). Hasil menunjukkan CAR berpengaruh

ILOMATAILOMATA Penggunaan blockchain dapat membantu memberikan kejelasan atas kepemilikan aset dan eksistensi kewajiban, serta secara signifikan meningkatkan efisiensiPenggunaan blockchain dapat membantu memberikan kejelasan atas kepemilikan aset dan eksistensi kewajiban, serta secara signifikan meningkatkan efisiensi

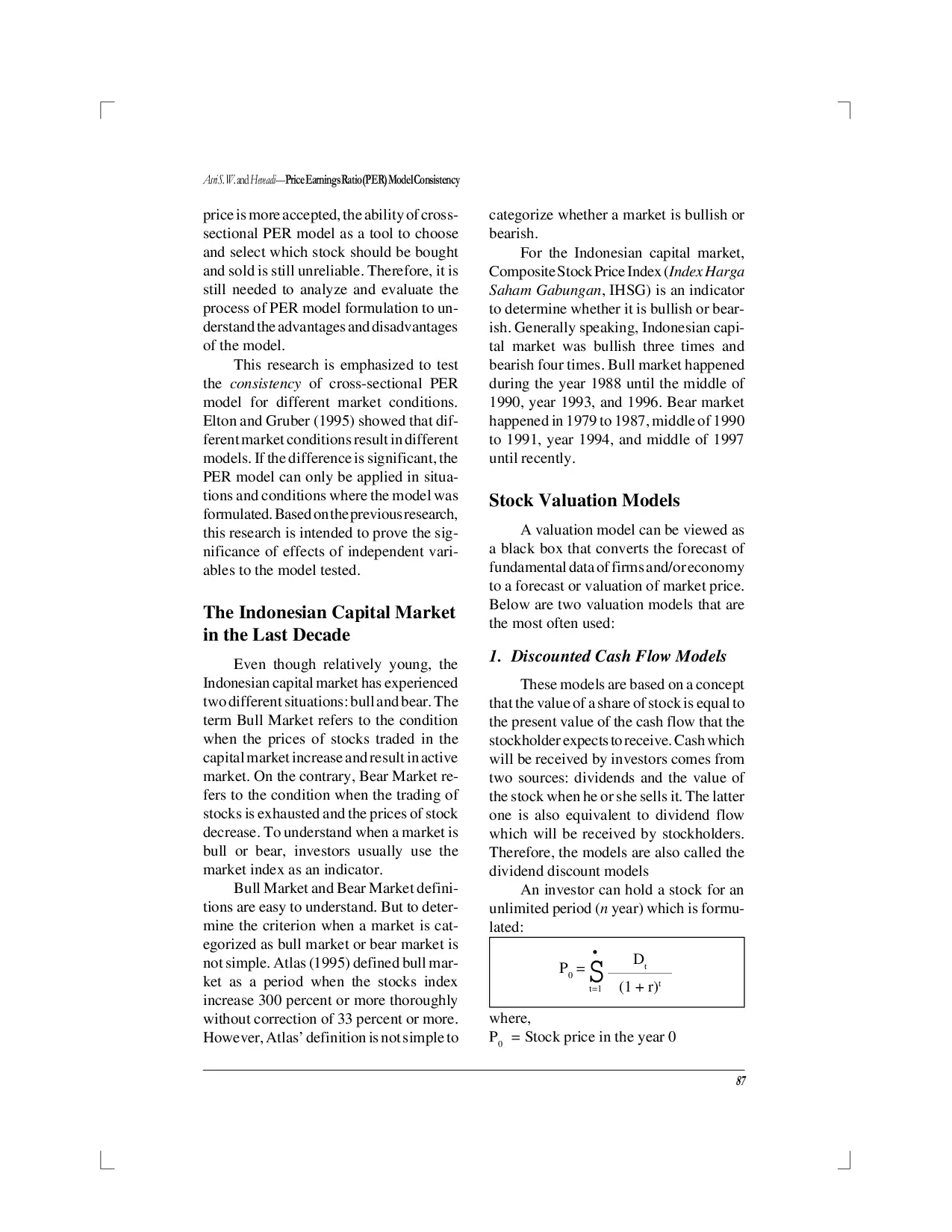

UGMUGM Penelitian ini bertujuan untuk memberikan bukti empiris apakah model PER cross-sectional dapat digunakan dalam menentukan keadilan harga saham yang diperdagangkanPenelitian ini bertujuan untuk memberikan bukti empiris apakah model PER cross-sectional dapat digunakan dalam menentukan keadilan harga saham yang diperdagangkan

Useful /

KALBISKALBIS Tidak menutup diri terhadap jabatannya sebagai Presiden di Indonesia. Jokowi memiliki perhatian dan apresiasi terhadap masyarakatnya yang ikut serta membangunTidak menutup diri terhadap jabatannya sebagai Presiden di Indonesia. Jokowi memiliki perhatian dan apresiasi terhadap masyarakatnya yang ikut serta membangun

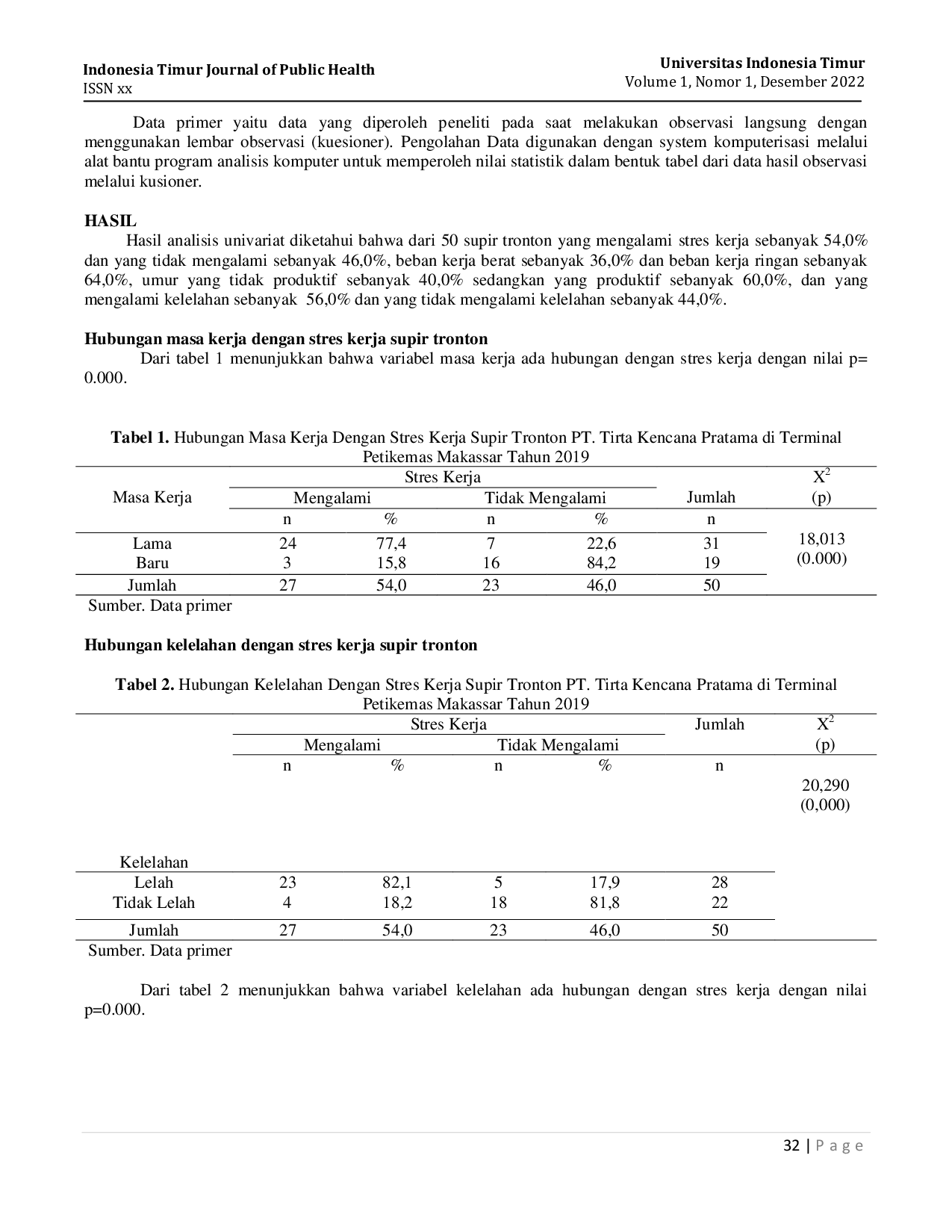

JURNALFKMUITJURNALFKMUIT Pengemudi yang stres dapat menyebabkan kurangnya tingkat konsentrasi, peningkatan kecelakaan, dan perilaku mengemudi yang agresif. Penelitian ini bertujuanPengemudi yang stres dapat menyebabkan kurangnya tingkat konsentrasi, peningkatan kecelakaan, dan perilaku mengemudi yang agresif. Penelitian ini bertujuan

UNUSAUNUSA Penelitian ini bertujuan untuk mengetahui pengaruh model pembelajaran Problem Based Learning (PBL) terhadap kemampuan berpikir kritis siswa SMA pada mataPenelitian ini bertujuan untuk mengetahui pengaruh model pembelajaran Problem Based Learning (PBL) terhadap kemampuan berpikir kritis siswa SMA pada mata

UNMUNM Mahasiswa sering menghadapi kesulitan dalam menyelesaikan tes membaca TOEFL. Penelitian kuantitatif ini menyelidiki kesulitan mahasiswa sarjana dan strategiMahasiswa sering menghadapi kesulitan dalam menyelesaikan tes membaca TOEFL. Penelitian kuantitatif ini menyelidiki kesulitan mahasiswa sarjana dan strategi