RADJAPUBLIKARADJAPUBLIKA

International Journal of Economic, Business, Accounting, Agriculture Management and Sharia Administration (IJEBAS)International Journal of Economic, Business, Accounting, Agriculture Management and Sharia Administration (IJEBAS)The Influence of Financial Knowledge and Personal Net Income on Financial Behaviour of Universitas Malikussaleh Employees with Locus Of Control as Moderation Variable. The purpose of this study was to determine how the model of financial behaviour of civil servants and lecturers in the Malikussaleh University environment and what factors are the most powerful in influencing the financial behaviour of employees in the Malikussaleh University campus environment. The research sample taken from the population in this study were 261 Civil Servants Group II to Group IV in Universitas Malikussaleh. The method used to support this research is quantitative method and in this study using multiple linear regression models. The processing and interpretation of research data using statistical software SmartPLS. The results of data analysis in this study indicate that financial knowledge has a positive and insignificant effect on the financial behaviour of Universitas Malikussaleh employees. Personal net income has a positive and significant effect on the financial behaviour of Universitas Malikussaleh employees. Locus of control does not moderate the effect of financial knowledge on financial behaviour of Universitas Malikussaleh employees. Locus of control does not moderate the effect of personal net income on the financial behaviour of Universitas Malikussaleh employees.

The study concludes that financial knowledge has a positive but insignificant impact on the financial behavior of employees at Malikussaleh University.Conversely, personal net income demonstrates a positive and significant influence on their financial behavior.Furthermore, locus of control does not significantly moderate the relationship between financial knowledge and financial behavior, nor does it moderate the relationship between personal net income and financial behavior.

Future research could explore the influence of behavioral biases, such as loss aversion or overconfidence, on the financial decisions of university employees. This could involve employing experimental designs or incorporating psychological scales to measure these biases. Additionally, investigating the role of financial education programs tailored to the specific needs of this population could provide valuable insights into improving financial well-being. Finally, a longitudinal study tracking the financial behaviors of employees over time, particularly in response to economic shocks or life events, would offer a more dynamic understanding of the factors influencing their financial choices and the effectiveness of interventions aimed at promoting responsible financial management. These studies should involve a larger and more diverse sample to enhance the generalizability of the findings and provide a more comprehensive understanding of the complex interplay between financial knowledge, income, psychological factors, and financial behavior among university employees.

| File size | 384.2 KB |

| Pages | 13 |

| DMCA | Report |

Related /

INTEKOMINTEKOM Penelitian ini bertujuan untuk mengidentifikasi strategi utama yang relevan dengan implementasi nilai-nilai Pancasila dalam pendidikan karakter antikorupsi.Penelitian ini bertujuan untuk mengidentifikasi strategi utama yang relevan dengan implementasi nilai-nilai Pancasila dalam pendidikan karakter antikorupsi.

UTMUTM Mitos merupakan bagian dari sastra lisan yang erat kaitannya dengan budaya. Tanda dalam mitos penting untuk diungkapkan agar masyarakat mengetahui maknaMitos merupakan bagian dari sastra lisan yang erat kaitannya dengan budaya. Tanda dalam mitos penting untuk diungkapkan agar masyarakat mengetahui makna

E JOURNALLPPMUNSAE JOURNALLPPMUNSA Responden dalam penelitian ini adalah petani jagung lahan kering di Desa Pelat, Kecamatan Unter Iwes, yang dipilih melalui teknik accidental sampling danResponden dalam penelitian ini adalah petani jagung lahan kering di Desa Pelat, Kecamatan Unter Iwes, yang dipilih melalui teknik accidental sampling dan

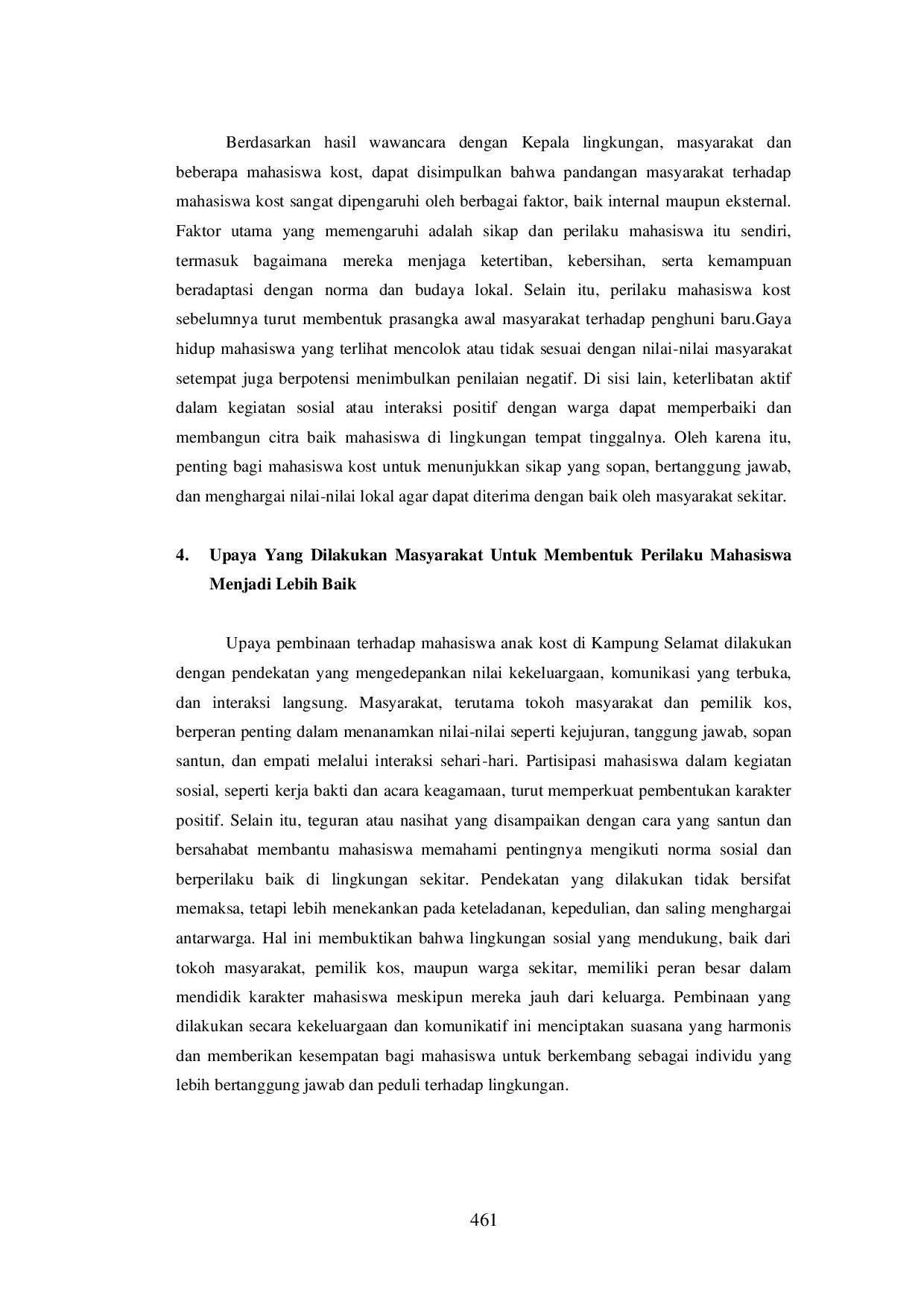

IPTSIPTS Mahasiswa dinilai sopan, santun, dan memiliki semangat belajar tinggi, meskipun keterlibatan mereka dalam kegiatan sosial masih terbatas. Hubungan sosialMahasiswa dinilai sopan, santun, dan memiliki semangat belajar tinggi, meskipun keterlibatan mereka dalam kegiatan sosial masih terbatas. Hubungan sosial

UIN MATARAMUIN MATARAM Selanjutnya, pendidikan agama inklusif, partisipasi aktif dalam pembangunan desa, serta pelestarian budaya lokal yang disesuaikan dengan nilai‑nilaiSelanjutnya, pendidikan agama inklusif, partisipasi aktif dalam pembangunan desa, serta pelestarian budaya lokal yang disesuaikan dengan nilai‑nilai

POLIMEDIAPOLIMEDIA Adapun metode yang dilakukan penulis yakni sosialisasi dan penyuluhan dalam suatu kegiatan rukun sosial kemasyarakatan. Mitranya yaitu kelompok masyarakatAdapun metode yang dilakukan penulis yakni sosialisasi dan penyuluhan dalam suatu kegiatan rukun sosial kemasyarakatan. Mitranya yaitu kelompok masyarakat

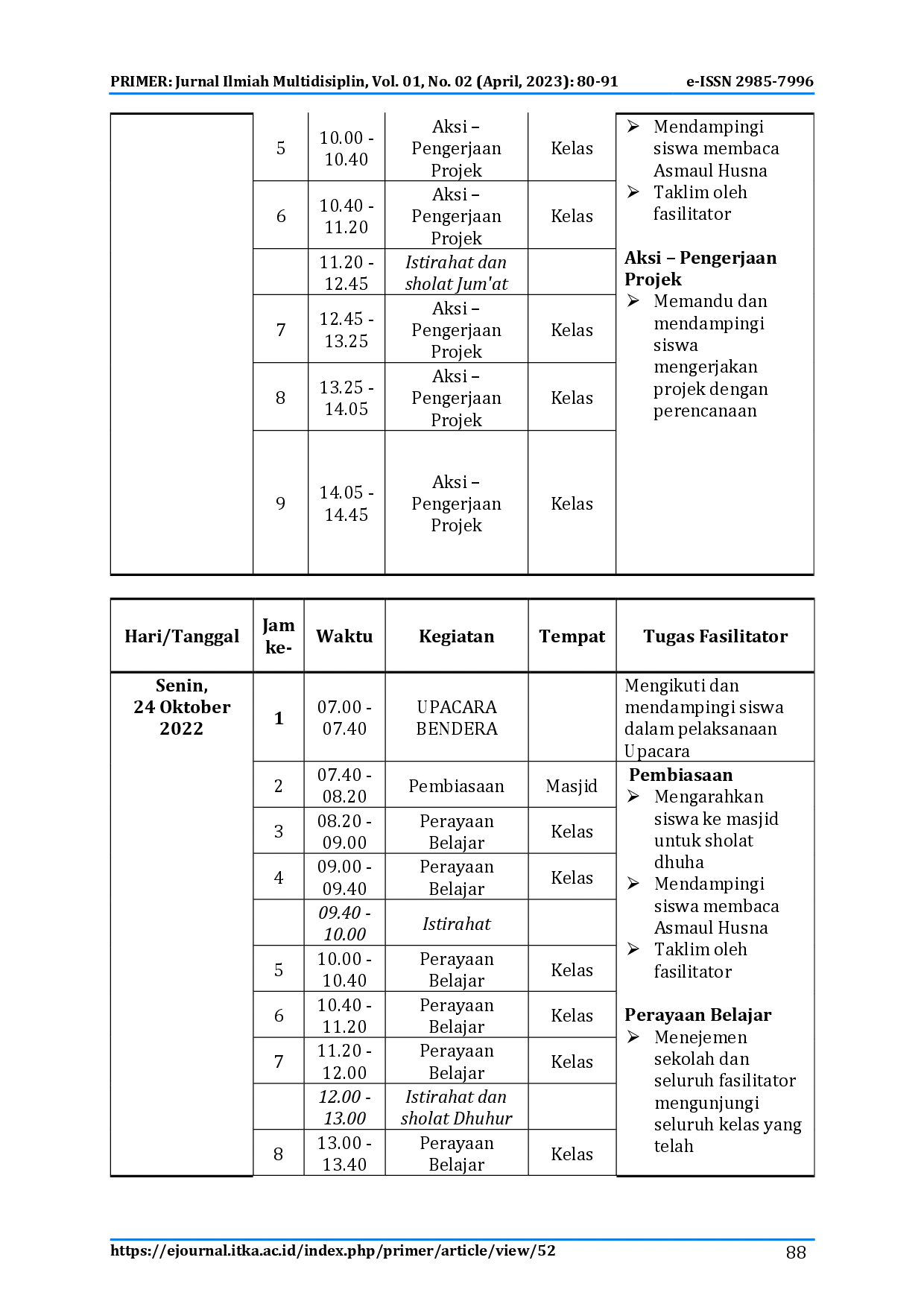

ITKAITKA Dari kegiatan yang telah dilakukan diperoleh kesimpulan siswa siswi SMAN 1 Ponorogo dalam kegiatan P5 dengan Tema Gaya Hidup Berkelanjutan berjudul AksiDari kegiatan yang telah dilakukan diperoleh kesimpulan siswa siswi SMAN 1 Ponorogo dalam kegiatan P5 dengan Tema Gaya Hidup Berkelanjutan berjudul Aksi

STAIMTASTAIMTA Gotong royong adalah budaya asli Indonesia yang terbukti mampu mewujudkan cita-cita kolektif sejak masa kerajaan hingga awal kemerdekaan. Degradasi budayaGotong royong adalah budaya asli Indonesia yang terbukti mampu mewujudkan cita-cita kolektif sejak masa kerajaan hingga awal kemerdekaan. Degradasi budaya

Useful /

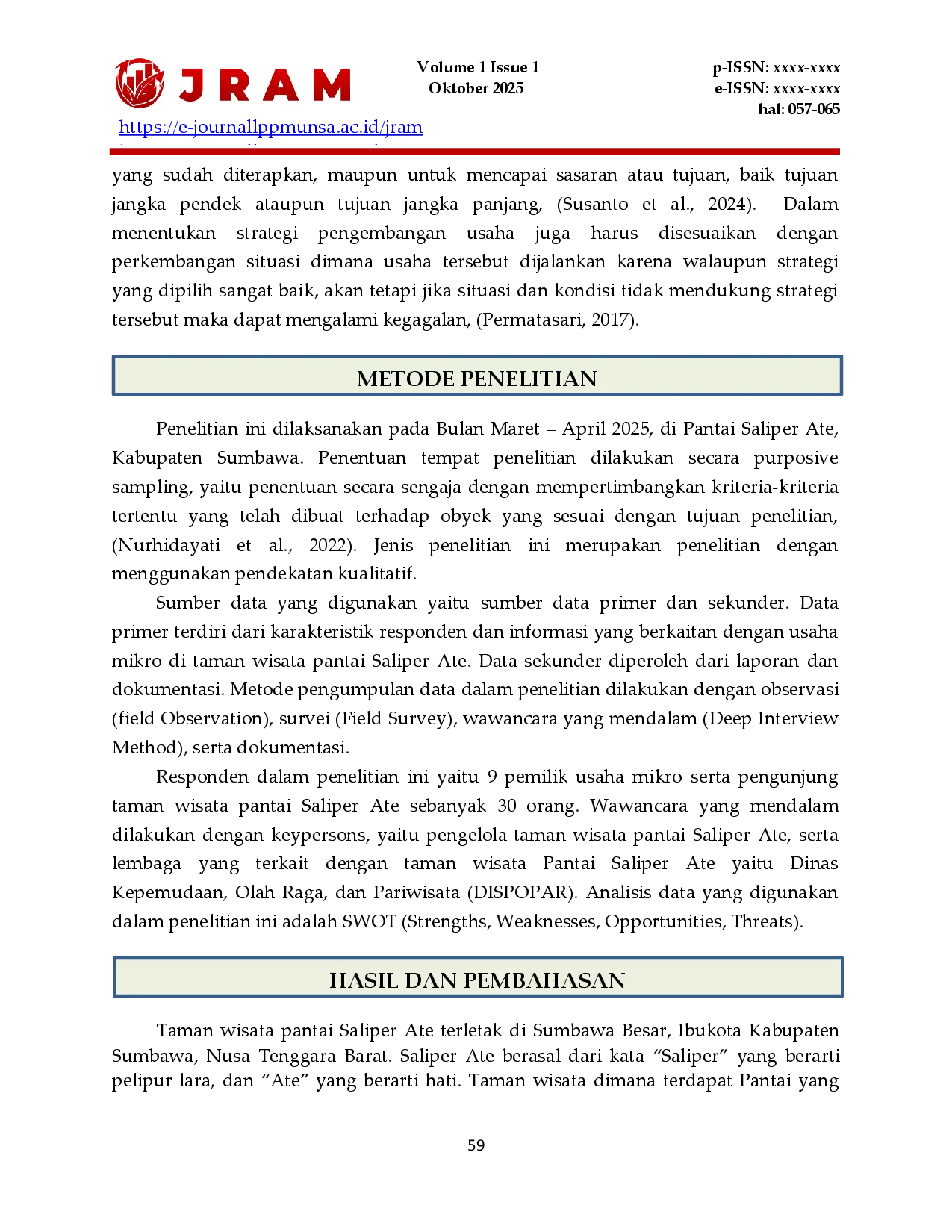

E JOURNALLPPMUNSAE JOURNALLPPMUNSA Penentuan tempat penelitian dilakukan secara purposive sampling. Jenis penelitian ini merupakan penelitian dengan menggunakan pendekatan kualitatif. SumberPenentuan tempat penelitian dilakukan secara purposive sampling. Jenis penelitian ini merupakan penelitian dengan menggunakan pendekatan kualitatif. Sumber

E JOURNALLPPMUNSAE JOURNALLPPMUNSA Kredit Usaha Rakyat (KUR) berpengaruh signifikan terhadap peningkatan pendapatan petani jagung di Kecamatan Utan Kabupaten Sumbawa, dengan hubungan positifKredit Usaha Rakyat (KUR) berpengaruh signifikan terhadap peningkatan pendapatan petani jagung di Kecamatan Utan Kabupaten Sumbawa, dengan hubungan positif

PHPMARCHIVEPHPMARCHIVE Data dianalisis dengan model Cox proportional hazard untuk mengidentifikasi faktor prediktor peningkatan status gizi. Hasil: Sebanyak 65,22% pasien HIV/AIDSData dianalisis dengan model Cox proportional hazard untuk mengidentifikasi faktor prediktor peningkatan status gizi. Hasil: Sebanyak 65,22% pasien HIV/AIDS

RADJAPUBLIKARADJAPUBLIKA Analisis data menggunakan regresi linier berganda melalui program SPSS 25. Hasil uji hipotesis menunjukkan bahwa penggunaan laba berpengaruh positif danAnalisis data menggunakan regresi linier berganda melalui program SPSS 25. Hasil uji hipotesis menunjukkan bahwa penggunaan laba berpengaruh positif dan