UGMUGM

Gadjah Mada International Journal of BusinessGadjah Mada International Journal of BusinessThis study empirically examines the behaviour of Indonesian stock market under the efficient market hypothesis framework by emphasizing on the random walk behaviour and nonlinearity over the period of April 1983 - December 2010. In the first step, the standard linear unit root test, namely the augmented Dickey-Fuller (ADF) test, Phillip-Perron (PP) test and Kwiatkowski-Philllips-Schmidt-Shin (KPSS) test identify the random walk behaviour in the indices. To account for possible breaks in the index series, Zivot and Andrews (1992) one break and Lumsdaine and Papell (1997) two breaks unit root tests are employed to observe whether the presence of breaks in the data series will prevent the stocks from randomly pricing or vice versa. In the third step, Harvey et al. (2008) test is used to examine the presence of nonlinear behaviour in Indonesian stock indices. The evidence of nonlinear behaviour motivates the use of nonlinear unit root test procedures developed by Kapetanios et al. (2003) and Kruse (2010). Generally, the results from standard linear unit root tests, Zivot and Andrews (ZA) test, and Lumsdaine and Papell (LP) test provide evidence that the Jakarta Composite Index is characterized by a unit root. Additionally, structural breaks identified by ZA and LP tests correspond to the events of financial market liberalization and financial crisis. The nonlinear unit root test procedure fails to reject the null hypothesis of a unit root for all indices, suggesting that the Jakarta Composite Index is characterized by a random walk process, supporting the theory of the efficient market hypothesis.

The study investigates the behavior of the Indonesian stock market using various statistical tools.The results from conventional unit root tests, with and without structural breaks, indicate that the stock market is characterized by a unit root process.Further nonlinear tests reveal that Indonesian stock market prices follow nonlinear dynamic processes.The findings support the efficient market hypothesis, suggesting that stock prices reflect all available information.

Penelitian lanjutan dapat dilakukan dengan mengeksplorasi pengaruh faktor-faktor makroekonomi global terhadap volatilitas pasar saham Indonesia, terutama setelah periode krisis keuangan. Selain itu, studi lebih lanjut dapat menginvestigasi dampak dari inovasi teknologi keuangan (fintech) dan perdagangan algoritmik terhadap efisiensi pasar saham Indonesia, dengan mempertimbangkan potensi pembentukan gelembung (bubbles) atau perilaku irasional lainnya. Terakhir, penelitian dapat difokuskan pada analisis perilaku investor ritel di pasar saham Indonesia, termasuk bias kognitif dan sentimen pasar, serta bagaimana faktor-faktor ini memengaruhi pengambilan keputusan investasi dan stabilitas pasar secara keseluruhan. Penelitian-penelitian ini penting untuk memberikan pemahaman yang lebih komprehensif tentang dinamika pasar saham Indonesia dan membantu para pembuat kebijakan dalam merumuskan strategi yang efektif untuk meningkatkan efisiensi dan stabilitas pasar.

| File size | 331.24 KB |

| Pages | 18 |

| DMCA | Report |

Related /

JOURNALKEBERLANJUTANJOURNALKEBERLANJUTAN Hasil pengujian hipotesis menunjukkan bahwa Pengungkapan Emisi GRK dan Umur Perusahaan tidak memengaruhi Nilai Perusahaan. Sementara itu, Kinerja KarbonHasil pengujian hipotesis menunjukkan bahwa Pengungkapan Emisi GRK dan Umur Perusahaan tidak memengaruhi Nilai Perusahaan. Sementara itu, Kinerja Karbon

STIEMAHARDHIKASTIEMAHARDHIKA Objek penelitian adalah perusahaan sektor makanan dan minuman yang terdaftar di Bursa Efek Indonesia periode 2019–2021. Sampel terdiri dari 50 perusahaanObjek penelitian adalah perusahaan sektor makanan dan minuman yang terdaftar di Bursa Efek Indonesia periode 2019–2021. Sampel terdiri dari 50 perusahaan

UMPOUMPO Analisis kerentanan berasal dari indeks kerentanan terhadap ancaman COVID-19, yang dikumpulkan dari semua indikator nilai aspek kerentanan usaha mikro,Analisis kerentanan berasal dari indeks kerentanan terhadap ancaman COVID-19, yang dikumpulkan dari semua indikator nilai aspek kerentanan usaha mikro,

STIEBALIKPAPANSTIEBALIKPAPAN Penelitian ini mengidentifikasi pola dan perangkat retoris yang sering digunakan dalam promosi Shopee di Instagram, seperti superlatif, promosi berbasisPenelitian ini mengidentifikasi pola dan perangkat retoris yang sering digunakan dalam promosi Shopee di Instagram, seperti superlatif, promosi berbasis

DINASTIPUBDINASTIPUB Hasil penelitian menunjukkan bahwa GCG, VAIC, ROA, NPF, dan MSI memiliki pengaruh positif signifikan terhadap FSR di sektor perbankan syariah IndonesiaHasil penelitian menunjukkan bahwa GCG, VAIC, ROA, NPF, dan MSI memiliki pengaruh positif signifikan terhadap FSR di sektor perbankan syariah Indonesia

STIE MUTTAQIENSTIE MUTTAQIEN Analisis dilakukan menggunakan regresi linier berganda dengan software IBM SPSS versi 23. Hasil penelitian menunjukkan bahwa suku bunga memiliki pengaruhAnalisis dilakukan menggunakan regresi linier berganda dengan software IBM SPSS versi 23. Hasil penelitian menunjukkan bahwa suku bunga memiliki pengaruh

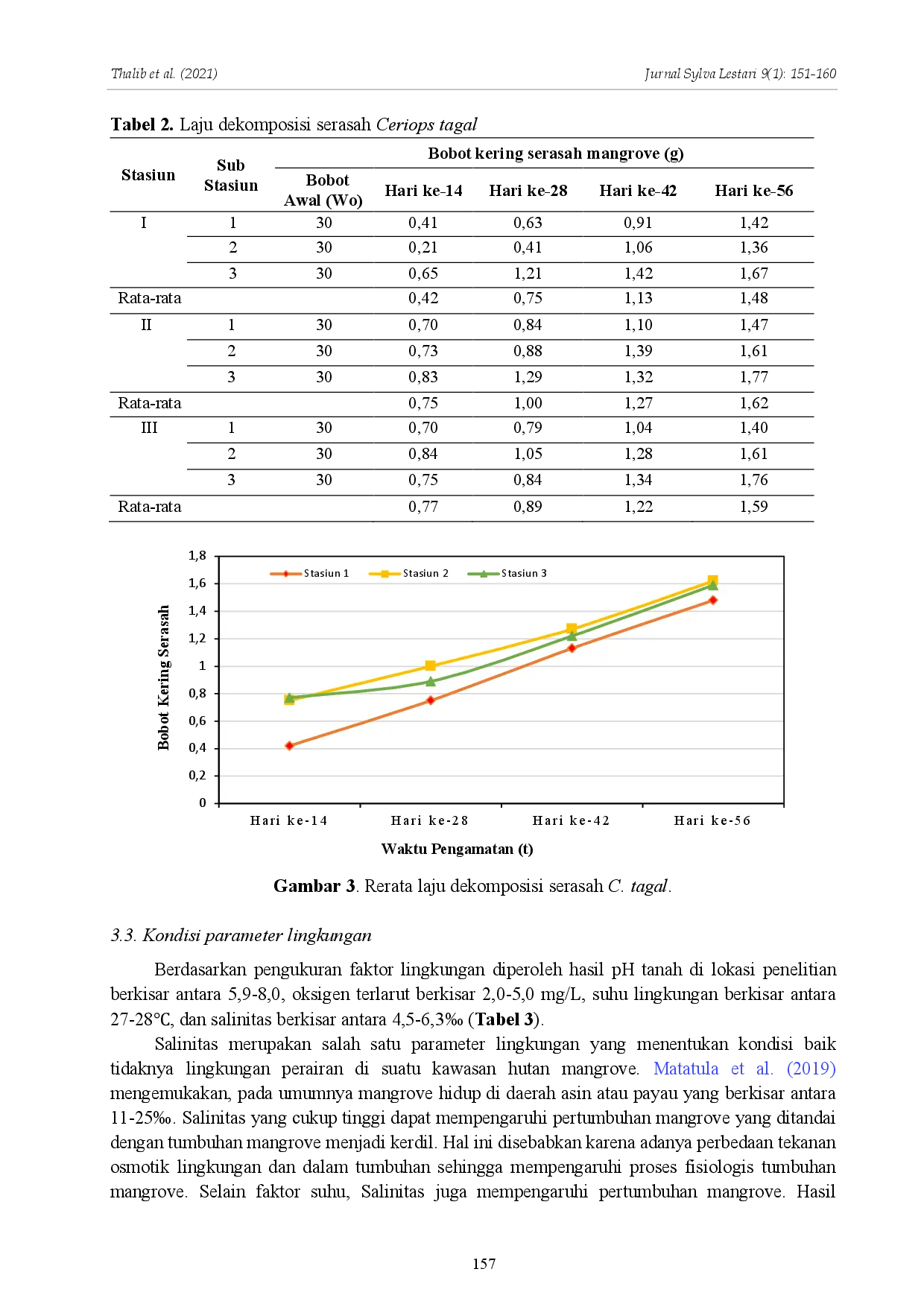

UNILAUNILA Laju dekomposisi (R) serasah mangrove Ceriops tagal menunjukkan peningkatan pada hari ke-56 secara berturut-turut sebesar 1,48 g, 1,62 g, dan 1,59 g diLaju dekomposisi (R) serasah mangrove Ceriops tagal menunjukkan peningkatan pada hari ke-56 secara berturut-turut sebesar 1,48 g, 1,62 g, dan 1,59 g di

UGMUGM Penelitian ini bertujuan untuk menganalisis pengaruh dari ketidaksesuaian (misfit) antara lingkungan kompetitif, strategi bisnis dan struktur pengendalianPenelitian ini bertujuan untuk menganalisis pengaruh dari ketidaksesuaian (misfit) antara lingkungan kompetitif, strategi bisnis dan struktur pengendalian

Useful /

STIE MUTTAQIENSTIE MUTTAQIEN Temuan ini mendukung model hierarki efek (HOE) yang menyatakan bahwa persepsi konsumen dan proses komunikasi memengaruhi keputusan pembelian. Brand awarenessTemuan ini mendukung model hierarki efek (HOE) yang menyatakan bahwa persepsi konsumen dan proses komunikasi memengaruhi keputusan pembelian. Brand awareness

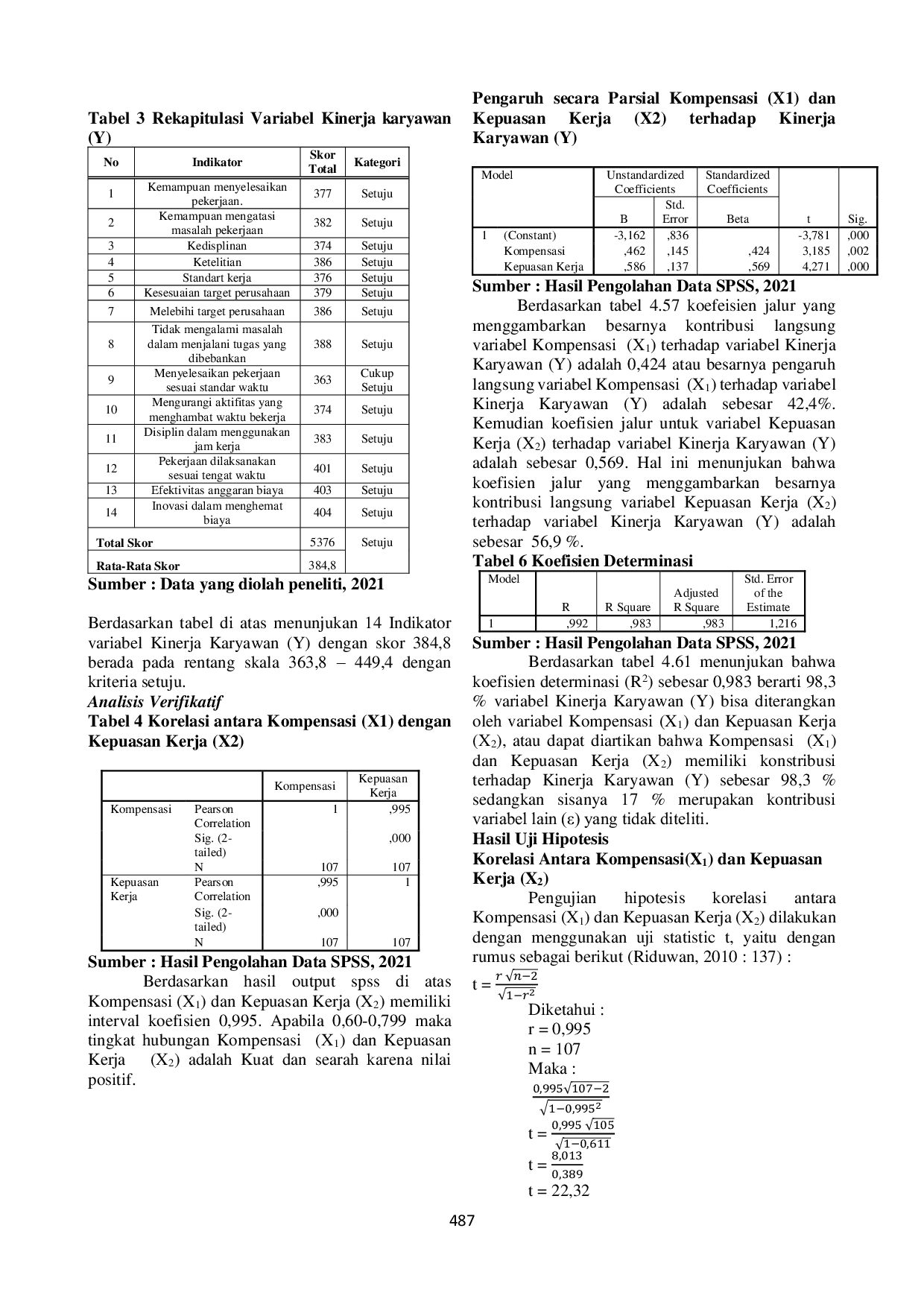

STIE MUTTAQIENSTIE MUTTAQIEN 3%, dengan 17% yang dipengaruhi oleh variabel lain. Penelitian ini menunjukkan bahwa kompensasi yang diterima oleh karyawan di PT Surya Madistrindo Tbk3%, dengan 17% yang dipengaruhi oleh variabel lain. Penelitian ini menunjukkan bahwa kompensasi yang diterima oleh karyawan di PT Surya Madistrindo Tbk

ISI YogyakartaISI Yogyakarta Kesenian rapai Aceh pascatsunami cukup berkembang pesat, baik berupa tradisional maupun berupa hasil rekonstruksi dan revitalisasi seniman-seniman Aceh.Kesenian rapai Aceh pascatsunami cukup berkembang pesat, baik berupa tradisional maupun berupa hasil rekonstruksi dan revitalisasi seniman-seniman Aceh.

ISI YogyakartaISI Yogyakarta Guru melakukan eksternalisasi, sementara murid mengalami internalisasi. Proses ini umumnya terjadi dalam setting informal kehidupan masyarakat Dayak Benuaq,Guru melakukan eksternalisasi, sementara murid mengalami internalisasi. Proses ini umumnya terjadi dalam setting informal kehidupan masyarakat Dayak Benuaq,