USBIUSBI

Journal of Business And EntrepreneurshipJournal of Business And EntrepreneurshipThe aims examine the effect of bonus mechanism, effective tax rate, and debt covenant on transfer pricing in consumer non cyclicals and industrial sector companies on the Indonesia Stock Exchange in 2020-2022. The sample in this study used purposive sampling method and obtained 16 companies listed in 2020-2022 period. The analysis method used in quantitative method with multiple linear regression analysis and using SPSS 26 software. This study uses secondary data in the form of financial report obtained from www.idx.co.id. The result of multiple linear regression is that the variable of bonus mechanism and effective tax rate has no significant effect on transfer pricing, while debt covenant has positive and significant effect on transfer pricing. The variable of bonus mechanism and effective tax rate have not been proven to give significant influence. For this reason, it is expected that future research can provide result and use more appropriate proxies for each independent variable in this study.

Based on the research conducted, it was found that the variables of bonus mechanism and effective tax rate do not have an effect on transfer pricing in consumer non-cyclicals and industrial companies listed on the Indonesia Stock Exchange from 2020 to 2022.However, debt covenant has a positive and significant effect on transfer pricing.These findings contribute to the field of accounting related to transfer pricing and suggest areas for future research.

Penelitian lanjutan dapat dilakukan dengan menguji pengaruh variabel lain yang berpotensi memengaruhi transfer pricing, seperti ukuran perusahaan, aset tidak berwujud, insentif tunneling, profitabilitas, dan nilai tukar. Selain itu, penelitian dapat memperluas cakupan sampel dengan melibatkan lebih banyak perusahaan dari berbagai sektor industri dan periode waktu yang lebih panjang untuk meningkatkan generalisasi hasil. Lebih lanjut, studi kualitatif dapat dilakukan untuk menggali lebih dalam motivasi dan strategi manajemen dalam praktik transfer pricing, serta dampaknya terhadap kinerja perusahaan dan kepatuhan pajak. Penelitian ini diharapkan dapat memberikan wawasan yang lebih komprehensif tentang kompleksitas transfer pricing dan memberikan rekomendasi yang lebih akurat bagi pembuat kebijakan dan praktisi bisnis.

| File size | 373.58 KB |

| Pages | 14 |

| DMCA | Report |

Related /

IPINTERNASIONALIPINTERNASIONAL Selain itu, kegiatan ini meningkatkan kesadaran UMKM akan peran pajak dalam pembangunan nasional dan keberlanjutan bisnis. Pelaksanaan Core Tax di IndonesiaSelain itu, kegiatan ini meningkatkan kesadaran UMKM akan peran pajak dalam pembangunan nasional dan keberlanjutan bisnis. Pelaksanaan Core Tax di Indonesia

UMNUMN Sampel dalam penelitian ini dipilih menggunakan metode purposive sampling. Data yang digunakan dalam penelitian ini adalah data sekunder. Data yang digunakanSampel dalam penelitian ini dipilih menggunakan metode purposive sampling. Data yang digunakan dalam penelitian ini adalah data sekunder. Data yang digunakan

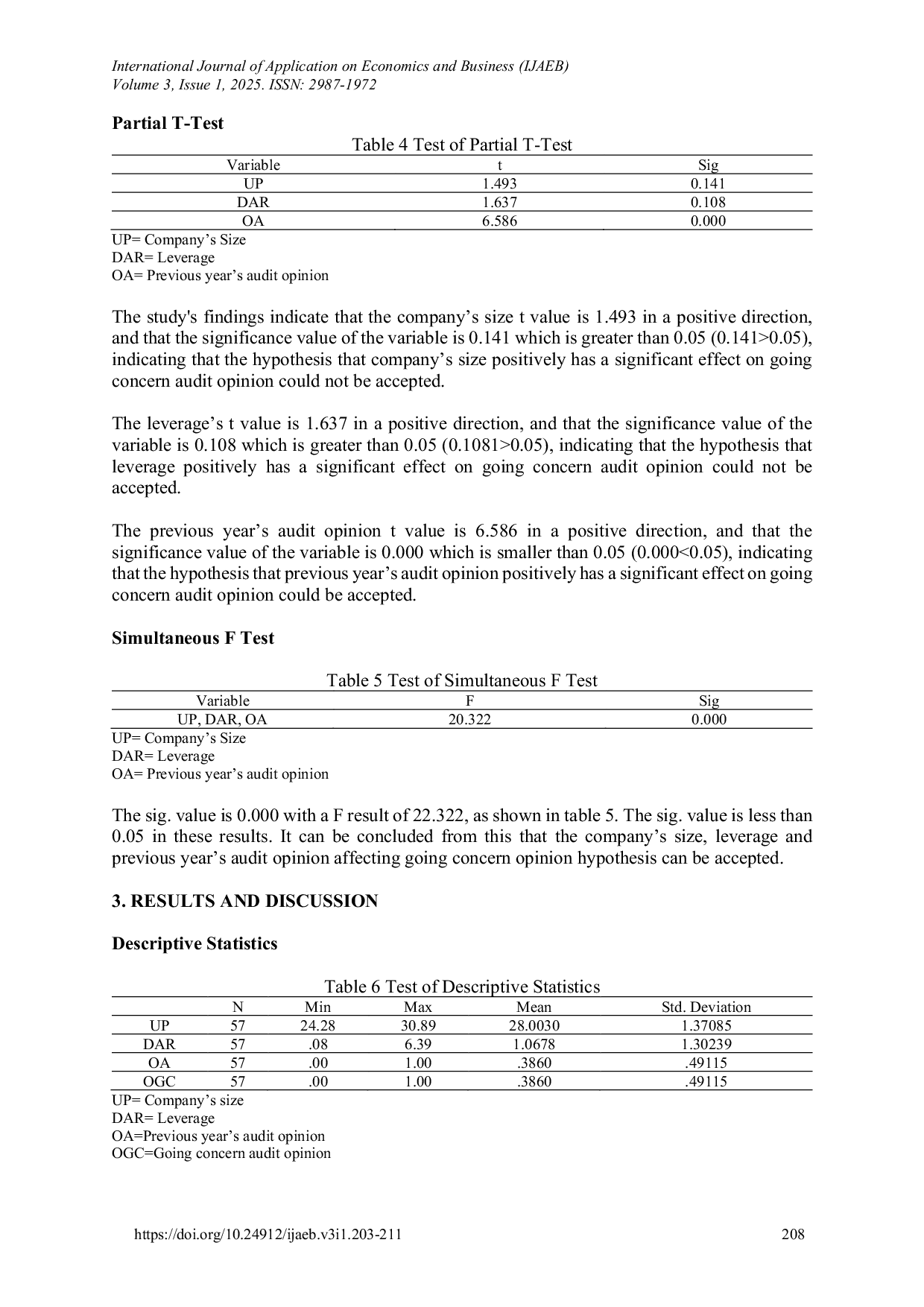

UNTARUNTAR Berdasarkan hasil penelitian, dapat disimpulkan bahwa opini audit tahun sebelumnya memiliki pengaruh yang signifikan terhadap opini going concern. Namun,Berdasarkan hasil penelitian, dapat disimpulkan bahwa opini audit tahun sebelumnya memiliki pengaruh yang signifikan terhadap opini going concern. Namun,

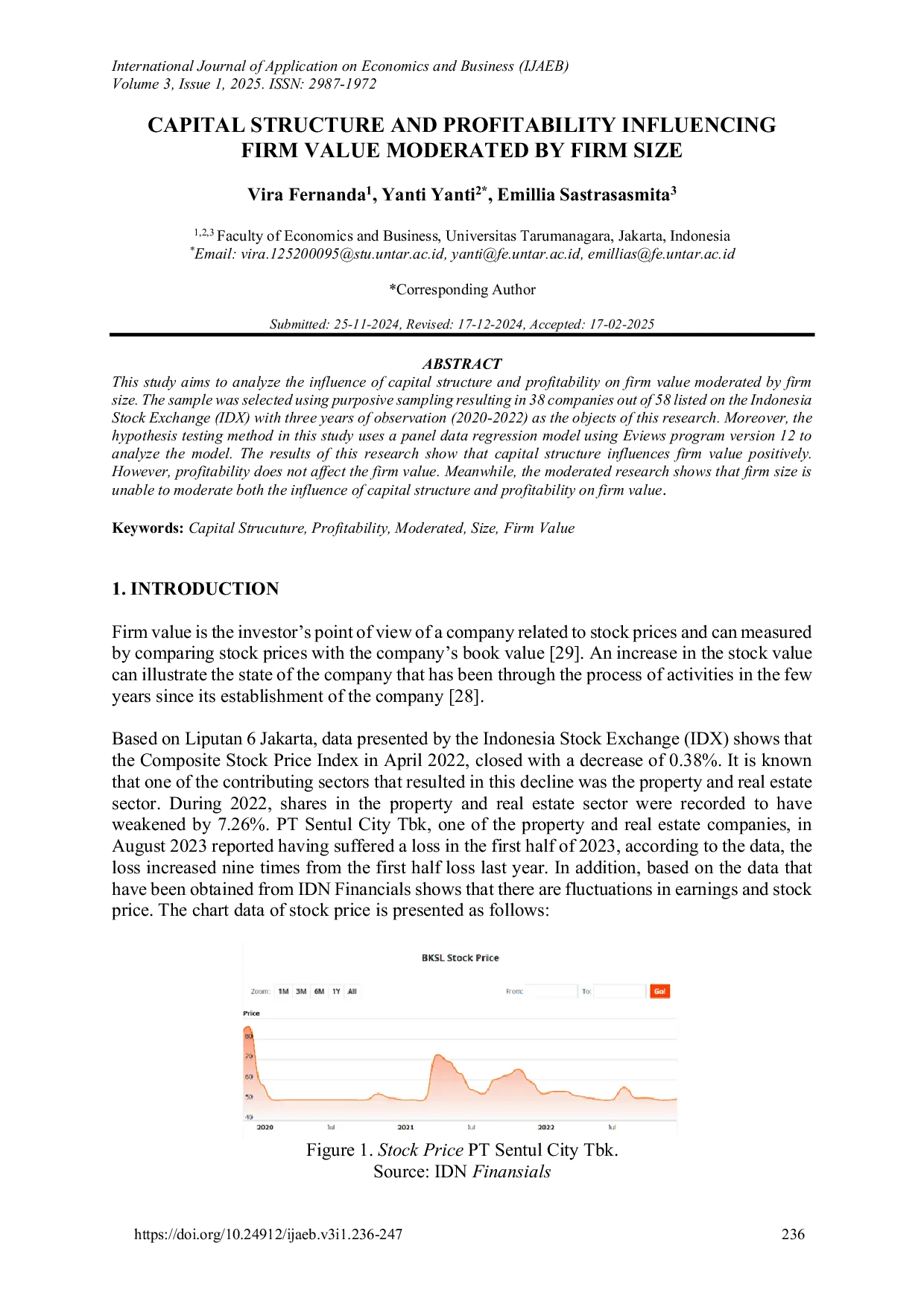

UNTARUNTAR Sementara itu, pengujian moderasi menunjukkan bahwa ukuran perusahaan tidak mampu memoderasi pengaruh struktur modal maupun profitabilitas terhadap nilaiSementara itu, pengujian moderasi menunjukkan bahwa ukuran perusahaan tidak mampu memoderasi pengaruh struktur modal maupun profitabilitas terhadap nilai

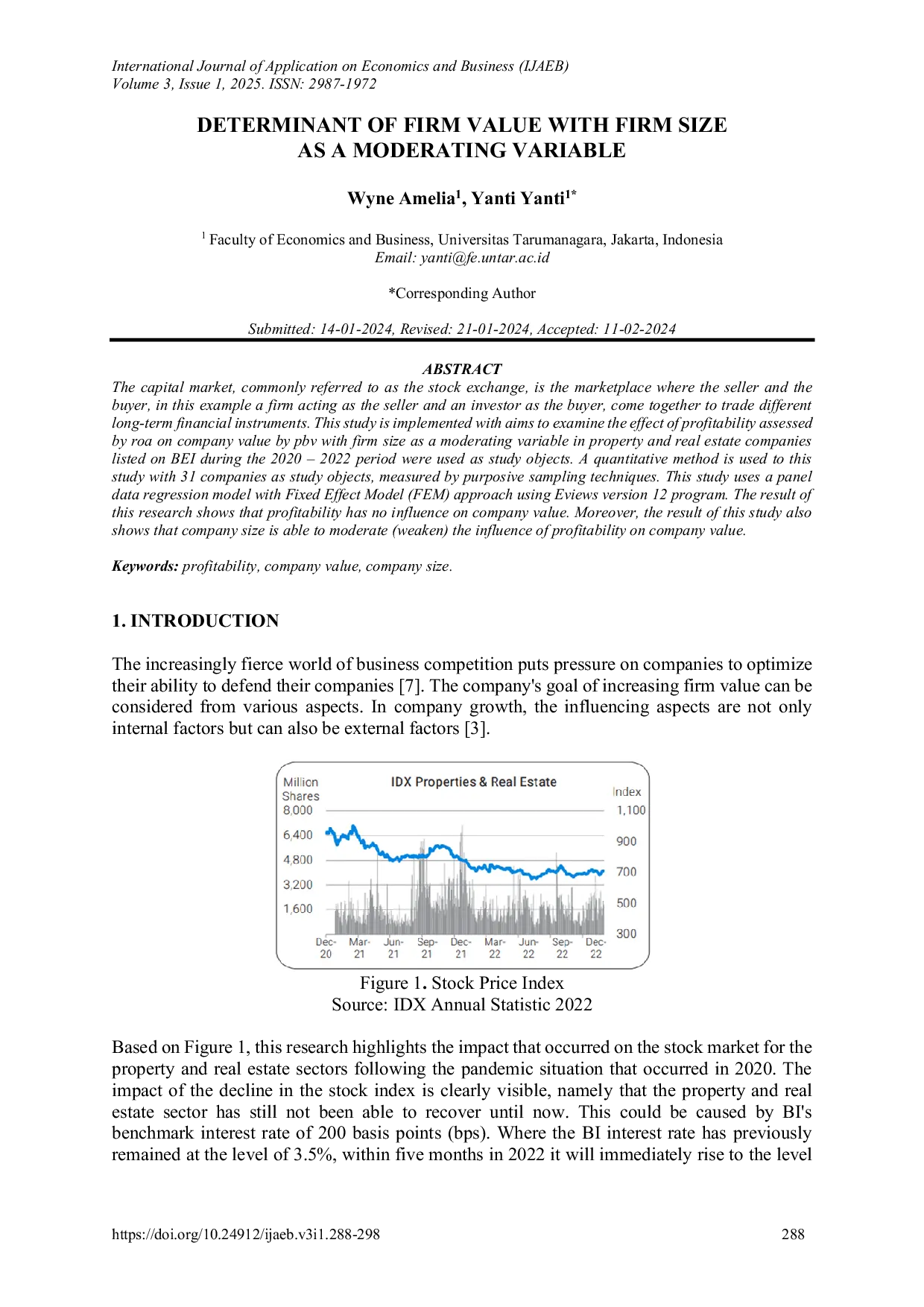

UNTARUNTAR Berdasarkan hasil penelitian, dapat disimpulkan bahwa profitabilitas tidak memiliki pengaruh signifikan terhadap nilai perusahaan. Lebih lanjut, ukuranBerdasarkan hasil penelitian, dapat disimpulkan bahwa profitabilitas tidak memiliki pengaruh signifikan terhadap nilai perusahaan. Lebih lanjut, ukuran

STIEMAHARDHIKASTIEMAHARDHIKA Skenario terburuk yang dapat terjadi adalah perusahaan mengalami financial distress yang berujung pada kebangkrutan. Penelitian ini bertujuan untuk menganalisisSkenario terburuk yang dapat terjadi adalah perusahaan mengalami financial distress yang berujung pada kebangkrutan. Penelitian ini bertujuan untuk menganalisis

UWIKAUWIKA Faktor utama penyebab rendahnya penyaluran kredit karena permintaan masyarakat sebagai pelaku usaha yang masih relatif terbatas di tengah pandemic CovidFaktor utama penyebab rendahnya penyaluran kredit karena permintaan masyarakat sebagai pelaku usaha yang masih relatif terbatas di tengah pandemic Covid

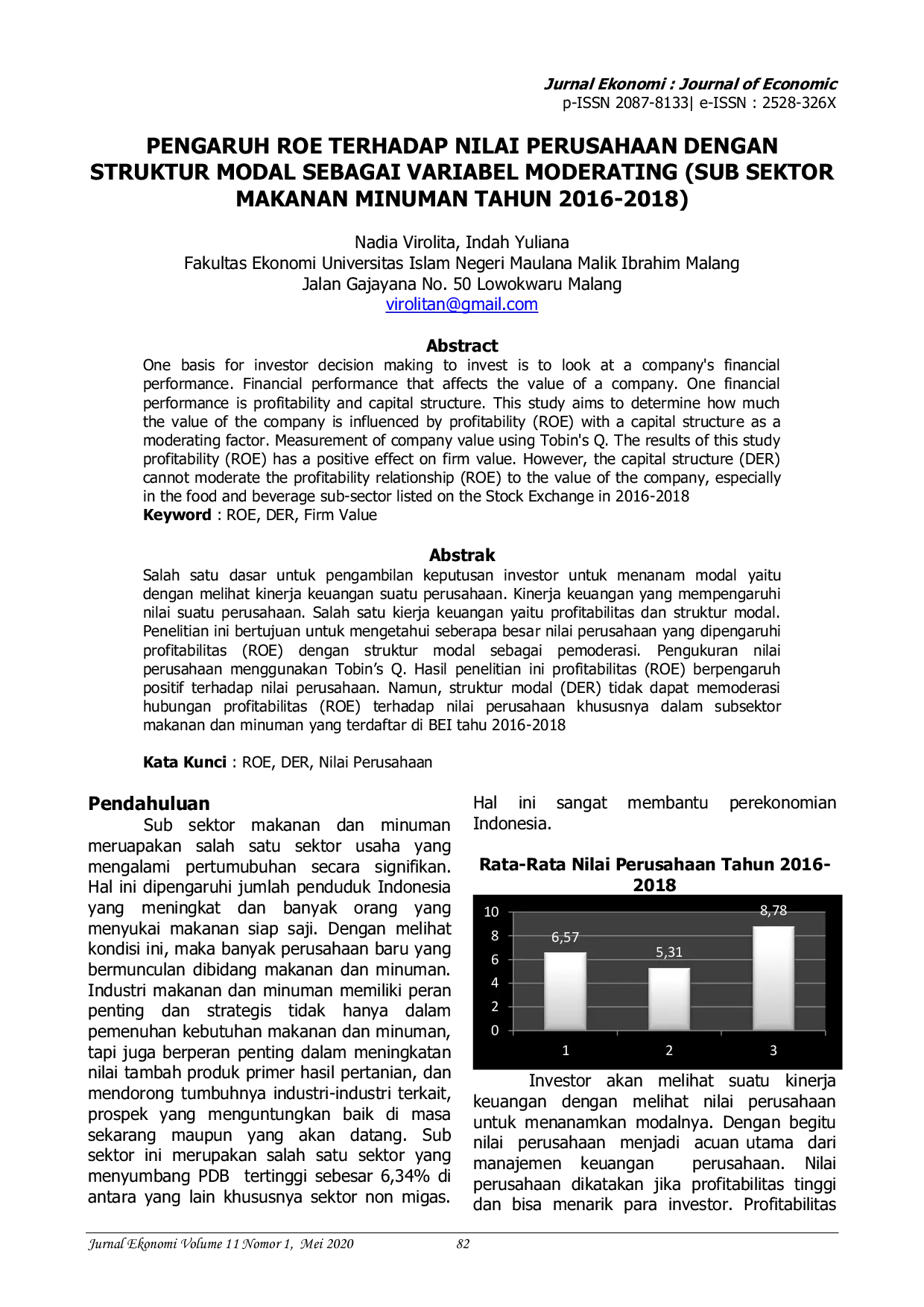

UEUUEU Penelitian ini bertujuan untuk mengetahui seberapa besar nilai perusahaan yang dipengaruhi profitabilitas (ROE) dengan struktur modal sebagai pemoderasi.Penelitian ini bertujuan untuk mengetahui seberapa besar nilai perusahaan yang dipengaruhi profitabilitas (ROE) dengan struktur modal sebagai pemoderasi.

Useful /

IPINTERNASIONALIPINTERNASIONAL Penelitian ini memberikan wawasan berbasis bukti tentang pendekatan komunitas dalam mengatasi kesenjangan digital di kota-kota sumber daya terbatas danPenelitian ini memberikan wawasan berbasis bukti tentang pendekatan komunitas dalam mengatasi kesenjangan digital di kota-kota sumber daya terbatas dan

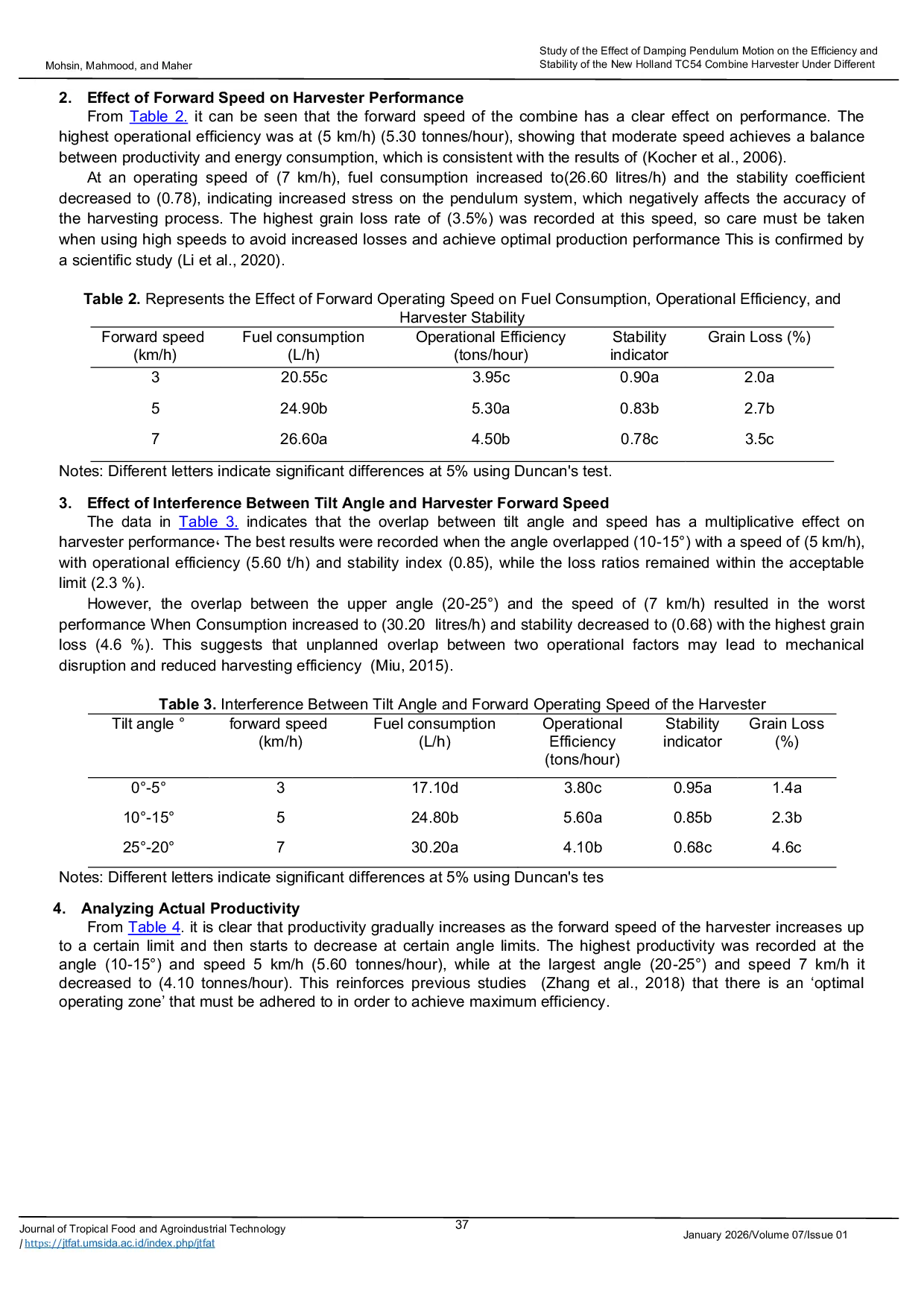

UMSIDAUMSIDA This study investigates the effect of slope angle and forward operating speed on the optimal performance of the harvesting process of a combine equippedThis study investigates the effect of slope angle and forward operating speed on the optimal performance of the harvesting process of a combine equipped

UMNUMN Hasil penelitian menunjukkan bahwa pengalaman auditor tidak berpengaruh terhadap audit judgement, sedangkan keahlian auditor, independensi, dan kompleksitasHasil penelitian menunjukkan bahwa pengalaman auditor tidak berpengaruh terhadap audit judgement, sedangkan keahlian auditor, independensi, dan kompleksitas

UMNUMN Penelitian ini mengeksplorasi program Tax Amnesty 2016 yang diterapkan Direktorat Jenderal Pajak untuk meningkatkan penerimaan negara dan kepatuhan wajibPenelitian ini mengeksplorasi program Tax Amnesty 2016 yang diterapkan Direktorat Jenderal Pajak untuk meningkatkan penerimaan negara dan kepatuhan wajib