JOURNALKEBERLANJUTANJOURNALKEBERLANJUTAN

International Journal of Environmental, Sustainability, and Social ScienceInternational Journal of Environmental, Sustainability, and Social ScienceThis research is based on the importance of operational efficiency and incentive schemes in supporting the financial performance of BRILink agents as part of the micro digital financial services ecosystem. This study aims to analyze the influence of digitalization and profit sharing on agents financial performance, both partially and simultaneously. Theoretical concepts discussed include digital transformation, incentive theory, and financial performance based on the balanced scorecard perspective. A quantitative approach with a survey method was used, involving 40 BRILink agents under PT. Syauqia Berkah Makmur. Data were analyzed using multiple linear regression with SPSS version 27. The results indicate that both digitalization and profit sharing have a positive and significant impact on financial performance, either partially or jointly. The coefficient of determination shows that the two variables explain 46.1% of the variation in financial performance. This research concludes that combining technology utilization and a fair profit-sharing system is an effective strategy to improve agent performance.

This research concludes that both digitalization and profit-sharing significantly contribute to the financial performance of BRILink agents at PT.The findings demonstrate that the digitalization variable has a positive and significant influence on financial performance, while profit sharing also has a significant positive effect.Furthermore, the simultaneous effect of digitalization and profit-sharing was confirmed, indicating that a strategic combination of technological advancement and equitable incentive systems is essential for boosting financial outcomes.

Berdasarkan hasil penelitian, terdapat beberapa saran penelitian lanjutan yang dapat dilakukan. Pertama, penelitian lebih lanjut dapat dilakukan untuk mengidentifikasi faktor-faktor lain yang memengaruhi kinerja keuangan agen BRILink, seperti karakteristik demografis agen, tingkat pendidikan, dan pengalaman bisnis. Kedua, penelitian dapat difokuskan pada pengembangan model profit sharing yang lebih optimal, dengan mempertimbangkan berbagai variabel seperti volume transaksi, tingkat retensi pelanggan, dan biaya operasional. Ketiga, studi komparatif dapat dilakukan dengan membandingkan kinerja agen BRILink di berbagai wilayah geografis atau dengan agen dari lembaga keuangan mikro lainnya, untuk mengidentifikasi praktik-praktik terbaik dan tantangan yang dihadapi. Penelitian-penelitian ini diharapkan dapat memberikan wawasan yang lebih mendalam tentang dinamika kinerja agen BRILink dan memberikan rekomendasi yang lebih komprehensif bagi PT. Syauqia Berkah Makmur dan pemangku kepentingan lainnya dalam meningkatkan efisiensi dan keberlanjutan ekosistem keuangan mikro di Indonesia.

| File size | 380.66 KB |

| Pages | 12 |

| Short Link | https://juris.id/p-37q |

| Lookup Links | Google ScholarGoogle Scholar, Semantic ScholarSemantic Scholar, CORE.ac.ukCORE.ac.uk, WorldcatWorldcat, ZenodoZenodo, Research GateResearch Gate, Academia.eduAcademia.edu, OpenAlexOpenAlex, Hollis HarvardHollis Harvard |

| DMCA | Report |

Related /

LAAROIBALAAROIBA Data dianalisis menggunakan regresi linear berganda dan uji hipotesis dengan SPSS 21. Hasil penelitian menunjukkan adanya pengaruh positif dan signifikanData dianalisis menggunakan regresi linear berganda dan uji hipotesis dengan SPSS 21. Hasil penelitian menunjukkan adanya pengaruh positif dan signifikan

LAAROIBALAAROIBA Jenis penelitian ini menggunakan data primer sebagai data yang diperoleh langsung pengisisan kuisoner kepada 100 partisipan. Teknik analisis data yangJenis penelitian ini menggunakan data primer sebagai data yang diperoleh langsung pengisisan kuisoner kepada 100 partisipan. Teknik analisis data yang

LAAROIBALAAROIBA Variabel kemasan (X1) berpengaruh positif dan signifikan terhadap keputusan pembelian Susu Cair Dalam Kemasan Kotak 250 ml Indomilk di Alfamart PondokVariabel kemasan (X1) berpengaruh positif dan signifikan terhadap keputusan pembelian Susu Cair Dalam Kemasan Kotak 250 ml Indomilk di Alfamart Pondok

LAAROIBALAAROIBA Penelitian ini bertujuan untuk menganalisis dua perspektif kontroversial tersebut. Penelitian ini menggunakan metode kualitatif dengan pendekatan deskriptif.Penelitian ini bertujuan untuk menganalisis dua perspektif kontroversial tersebut. Penelitian ini menggunakan metode kualitatif dengan pendekatan deskriptif.

LAAROIBALAAROIBA Data yang didapatkan tersebut dianalisis dengan tahapan pengumpulan data, seleksi data, reduksi data, dan penarikan kesimpulan. Hasil penelitian menunjukkanData yang didapatkan tersebut dianalisis dengan tahapan pengumpulan data, seleksi data, reduksi data, dan penarikan kesimpulan. Hasil penelitian menunjukkan

LAAROIBALAAROIBA Hasil penelitian menunjukkan bahwa: Pertama, dalam pelaksanaan akad kafalah bil ujrah pada pembiayaan multijasa di BTN KC Syariah Medan telah harmonisHasil penelitian menunjukkan bahwa: Pertama, dalam pelaksanaan akad kafalah bil ujrah pada pembiayaan multijasa di BTN KC Syariah Medan telah harmonis

LAAROIBALAAROIBA Menurut Departemen Perdagangan Republik Indonesia, ekonomi kreatif merupakan sebuah industri yang berasal dari pemanfaatan kreativitas, keterampilan, sertaMenurut Departemen Perdagangan Republik Indonesia, ekonomi kreatif merupakan sebuah industri yang berasal dari pemanfaatan kreativitas, keterampilan, serta

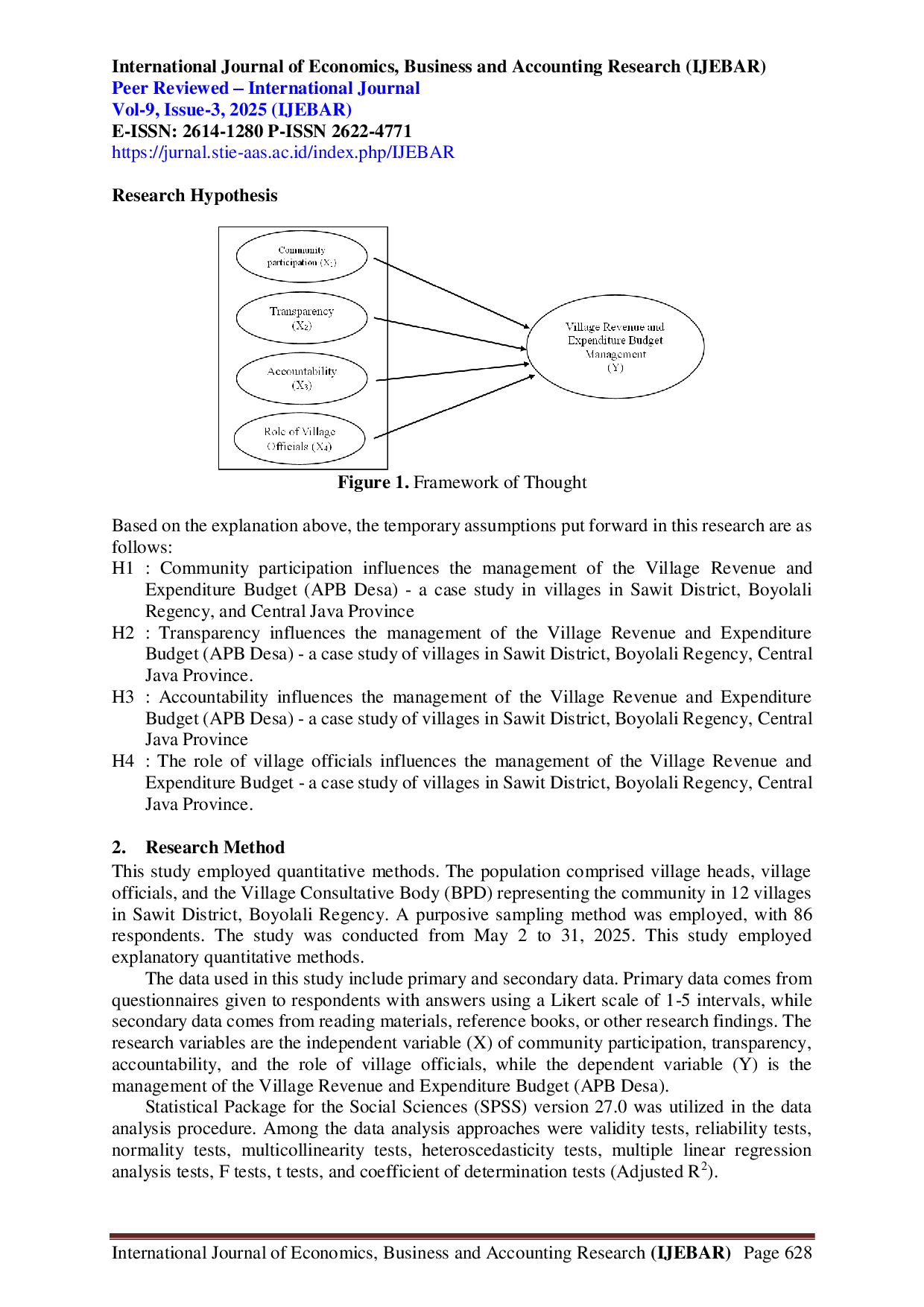

STIE AASSTIE AAS Temuan penelitian menunjukkan bahwa di desa‑desa Kecamatan Sawit, Kabupaten Boyolali, pengelolaan APB Desa dipengaruhi secara signifikan oleh partisipasiTemuan penelitian menunjukkan bahwa di desa‑desa Kecamatan Sawit, Kabupaten Boyolali, pengelolaan APB Desa dipengaruhi secara signifikan oleh partisipasi

Useful /

TAUTAU Strategi penamaan merek yang fluent, yaitu mudah diucapkan, pendek, dan familiar, secara signifikan memengaruhi persepsi publik dan keberhasilan brandingStrategi penamaan merek yang fluent, yaitu mudah diucapkan, pendek, dan familiar, secara signifikan memengaruhi persepsi publik dan keberhasilan branding

TAUTAU Penelitian ini menggunakan pendekatan kuantitatif dengan metode survei dan analisis regresi linear sederhana. Populasi dalam penelitian ini adalah seluruhPenelitian ini menggunakan pendekatan kuantitatif dengan metode survei dan analisis regresi linear sederhana. Populasi dalam penelitian ini adalah seluruh

LAAROIBALAAROIBA Komunikasi pemasaran berpengaruh positif dan signifikan terhadap loyalitas pelanggan Dua Coffee. Inovasi produk memiliki pengaruh negatif namun tidak signifikanKomunikasi pemasaran berpengaruh positif dan signifikan terhadap loyalitas pelanggan Dua Coffee. Inovasi produk memiliki pengaruh negatif namun tidak signifikan

IAIN LANGSAIAIN LANGSA Antara lain zona pendidikan, kesehatan, ekonomi serta sosial. Selain itu, dengan bekerjanya istri secara otomatis kedudukan istri jadi ganda, yakni sebagaiAntara lain zona pendidikan, kesehatan, ekonomi serta sosial. Selain itu, dengan bekerjanya istri secara otomatis kedudukan istri jadi ganda, yakni sebagai