UNTARUNTAR

International Journal of Application on Economics and BusinessInternational Journal of Application on Economics and BusinessInstruments in the capital market consist of stocks, mutual funds, bonds, derivative instruments, Exchange Traded Funds (ETF) and other securities. In investing, investors and potential investors must first understand the risk profile so that they can then decide which instruments are suitable for investing. Starting at the end of 2019 the world was shocked by a global epidemic. This outbreak is called Coronavirus Disease (Covid-19). Due to the significant increase in positive cases, Large-Scale Social Restrictions (PSBB) were implemented starting from April 10 2020 until April 23 2020. This condition has had an impact on the investment world, especially in the capital market. This impact is reflected in the fluctuations in the share price of the investment instrument. Other factors that can affect stock prices in the capital market, namely stock trading volume and market capitalization. This study was conducted with the aim of knowing and proving whether there is an influence of daily growth in positive Covid-19 confirmed cases, stock trading volume and market capitalization on stock returns contained in the LQ-45 index on the Indonesia Stock Exchange (IDX) starting from February 3, 2020 to January 31, 2022. In this study, it used a non-probability sampling method to determine the sample to be used. This study used 35 samples of companies that had been selected through the criteria specified in this study. In this study, collecting secondary data and the data that has been obtained will be processed using Microsoft Excel and also Eviews software version 10. The results of this study show that the growth of positive daily cases of Covid-19, trading volume and market capitalization negatively affects stock returns.

The results of the tests conducted indicate that the daily growth of positive Covid-19 confirmation cases, trading volume, and market capitalization have a negative effect on stock returns.This research has limitations in terms of the research period and the variables used.For further research, it is recommended to update the research period, increase the number of independent variables, and categorize the analysis by industrial sector to provide a more comprehensive understanding of the factors influencing stock returns.

Penelitian lanjutan dapat dilakukan dengan memperluas cakupan periode waktu penelitian, minimal hingga tahun 2024, untuk menganalisis dampak jangka panjang pandemi Covid-19 terhadap pasar saham Indonesia. Selain itu, studi dapat diperkaya dengan memasukkan variabel-variabel makroekonomi seperti tingkat inflasi, suku bunga, dan nilai tukar rupiah, untuk melihat bagaimana faktor-faktor tersebut berinteraksi dengan variabel yang telah diteliti dalam mempengaruhi return saham. Penelitian lebih lanjut juga dapat difokuskan pada analisis sektoral, dengan membedakan pengaruh pandemi dan variabel lainnya terhadap return saham di berbagai sektor industri, seperti sektor perbankan, sektor ritel, dan sektor infrastruktur. Hal ini akan memberikan pemahaman yang lebih mendalam mengenai dampak spesifik pandemi terhadap kinerja saham di masing-masing sektor. Terakhir, penelitian dapat menginvestigasi peran investor perilaku (behavioral finance) dalam pengambilan keputusan investasi selama pandemi, termasuk bagaimana sentimen investor dan bias kognitif mempengaruhi fluktuasi harga saham dan return saham.

- PANDEMIC COVID-19, STOCK TRADE VOLUME, AND MARKET CAPITALIZATION ON SHARE RETURN | International Journal... journal.untar.ac.id/index.php/ijaeb/article/view/34078PANDEMIC COVID 19 STOCK TRADE VOLUME AND MARKET CAPITALIZATION ON SHARE RETURN International Journal journal untar ac index php ijaeb article view 34078

- Trading Volume and Stock Returns Volatility: Evidence from Industrial Firms of Oman | Samman | Asian... ccsenet.org/journal/index.php/ass/article/view/47930Trading Volume and Stock Returns Volatility Evidence from Industrial Firms of Oman Samman Asian ccsenet journal index php ass article view 47930

- Full article: The role of Covid-19 for Chinese stock returns: evidence from a GARCHX model. full article... tandfonline.com/doi/full/10.1080/16081625.2020.1816185Full article The role of Covid 19 for Chinese stock returns evidence from a GARCHX model full article tandfonline doi full 10 1080 16081625 2020 1816185

| File size | 468.1 KB |

| Pages | 11 |

| DMCA | Report |

Related /

ADI JOURNALADI JOURNAL Selain itu, teknologi ini berkontribusi pada peningkatan kepercayaan komunitas dan ketahanan ekonomi usaha mikro. Penelitian ini menyimpulkan bahwa orangeSelain itu, teknologi ini berkontribusi pada peningkatan kepercayaan komunitas dan ketahanan ekonomi usaha mikro. Penelitian ini menyimpulkan bahwa orange

POLNESPOLNES Hasilnya menunjukkan bahwa hotel secara umum sudah menegakkan prinsip syariah, namun masih perlu penyesuaian, misalnya penggunaan bank syariah dan prosesHasilnya menunjukkan bahwa hotel secara umum sudah menegakkan prinsip syariah, namun masih perlu penyesuaian, misalnya penggunaan bank syariah dan proses

MYJOURNALMYJOURNAL Penelitian ini bersifat kuantitatif dengan sampel sebanyak delapan puluh empat karyawan PT Ciptaniaga Roda Berdikari. Analisis data dilakukan menggunakanPenelitian ini bersifat kuantitatif dengan sampel sebanyak delapan puluh empat karyawan PT Ciptaniaga Roda Berdikari. Analisis data dilakukan menggunakan

JOURNALKEBERLANJUTANJOURNALKEBERLANJUTAN Penelitian ini bertujuan untuk mengkaji pengaruh pengungkapan keberlanjutan terhadap kinerja perusahaan, dengan fokus pada sektor minyak dan gas NigeriaPenelitian ini bertujuan untuk mengkaji pengaruh pengungkapan keberlanjutan terhadap kinerja perusahaan, dengan fokus pada sektor minyak dan gas Nigeria

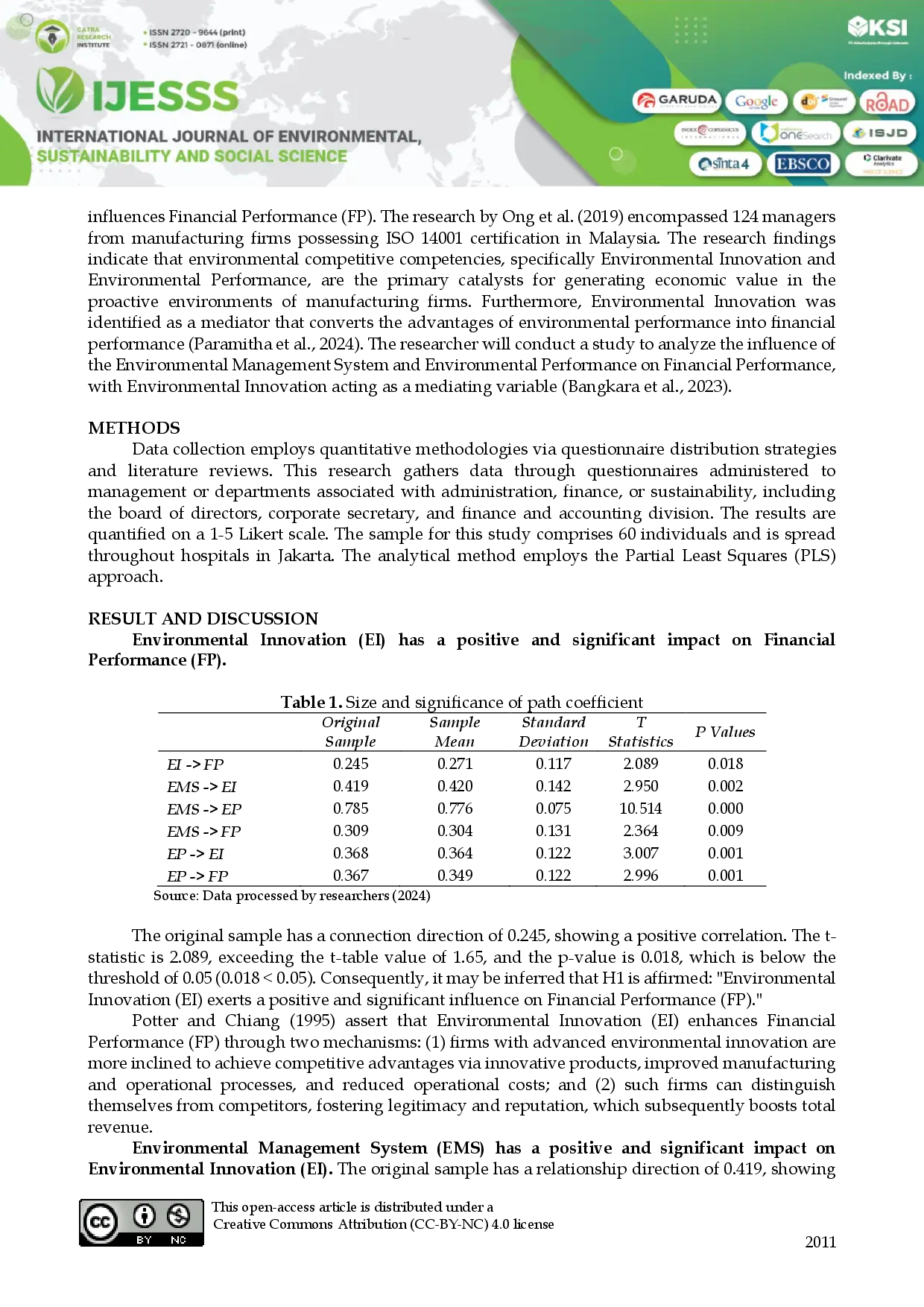

JOURNALKEBERLANJUTANJOURNALKEBERLANJUTAN Sistem Manajemen Lingkungan (EMS) memiliki pengaruh positif yang signifikan terhadap Inovasi Lingkungan (EI). Selain itu, EMS juga memiliki pengaruh positifSistem Manajemen Lingkungan (EMS) memiliki pengaruh positif yang signifikan terhadap Inovasi Lingkungan (EI). Selain itu, EMS juga memiliki pengaruh positif

UIN SUSKAUIN SUSKA Data yang diperoleh dianalisis menggunakan teknik statistik regresi linear berganda. Hasil penelitian menunjukkan bahwa persepsi terhadap dukungan organisasiData yang diperoleh dianalisis menggunakan teknik statistik regresi linear berganda. Hasil penelitian menunjukkan bahwa persepsi terhadap dukungan organisasi

UMJAMBIUMJAMBI Penelitian ini dilakukan di Kantor Kecamatan Rupat yang terletak di Kecamatan Rupat Kabupaten Bengkalis. Tujuan penelitian ini adalah untuk mengetahuiPenelitian ini dilakukan di Kantor Kecamatan Rupat yang terletak di Kecamatan Rupat Kabupaten Bengkalis. Tujuan penelitian ini adalah untuk mengetahui

UMJAMBIUMJAMBI Studi ini bertujuan untuk memetakan dan mengidentifikasi unit bisnis UMKM industri kreatif yang unggul untuk dikembangkan di Kota Jambi. Masalah penelitianStudi ini bertujuan untuk memetakan dan mengidentifikasi unit bisnis UMKM industri kreatif yang unggul untuk dikembangkan di Kota Jambi. Masalah penelitian

Useful /

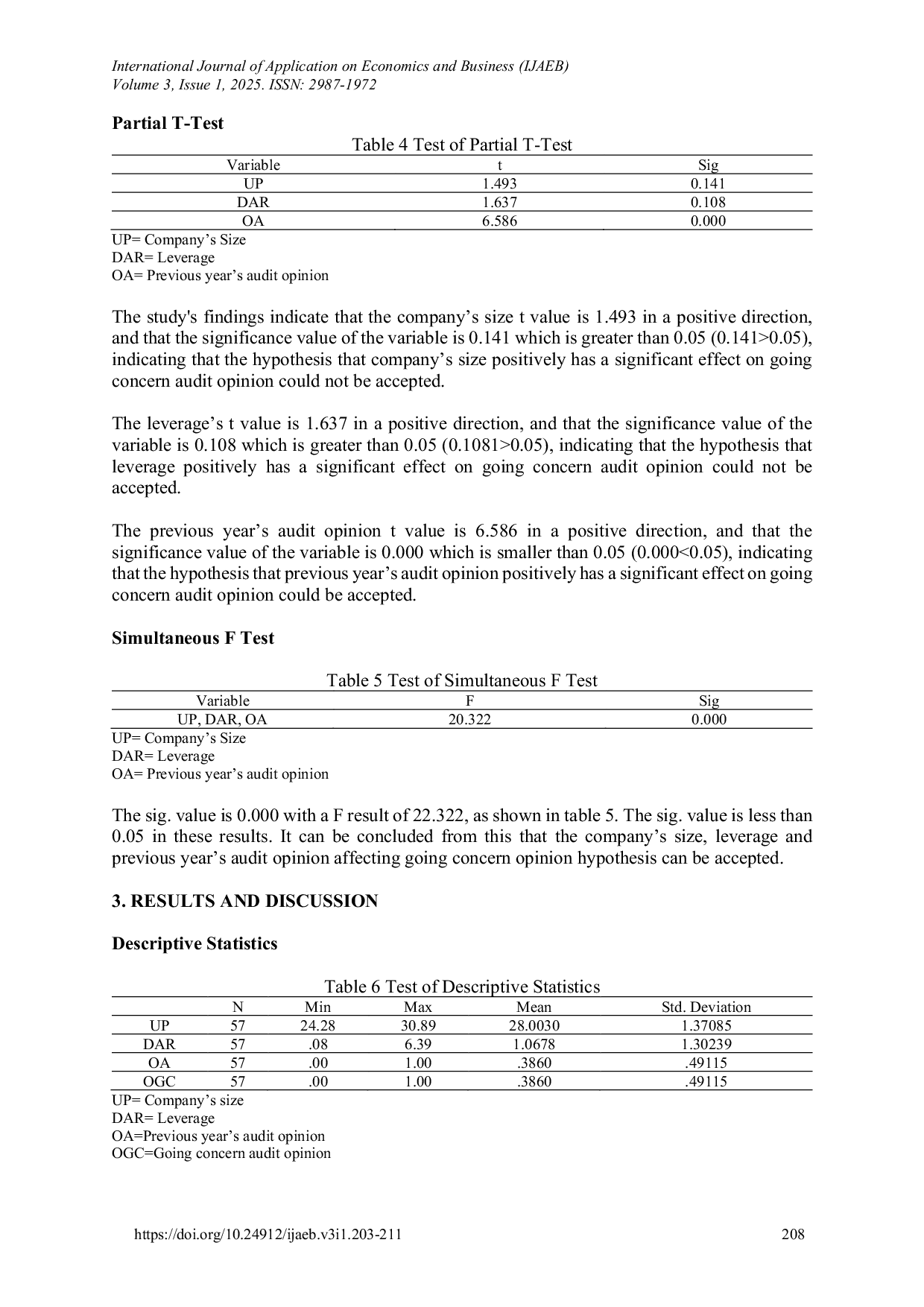

UNTARUNTAR Penelitian ini memberikan informasi berharga bagi pihak-pihak yang memiliki kepentingan dalam perusahaan, terutama investor. Manajemen perlu merencanakanPenelitian ini memberikan informasi berharga bagi pihak-pihak yang memiliki kepentingan dalam perusahaan, terutama investor. Manajemen perlu merencanakan

UNTARUNTAR The results indicated a positive effect between happiness and re-participation intention; specifically, higher psychological and emotional happiness amongThe results indicated a positive effect between happiness and re-participation intention; specifically, higher psychological and emotional happiness among

UNTARUNTAR Sementara itu, pengujian moderasi menunjukkan bahwa ukuran perusahaan tidak mampu memoderasi pengaruh struktur modal maupun profitabilitas terhadap nilaiSementara itu, pengujian moderasi menunjukkan bahwa ukuran perusahaan tidak mampu memoderasi pengaruh struktur modal maupun profitabilitas terhadap nilai

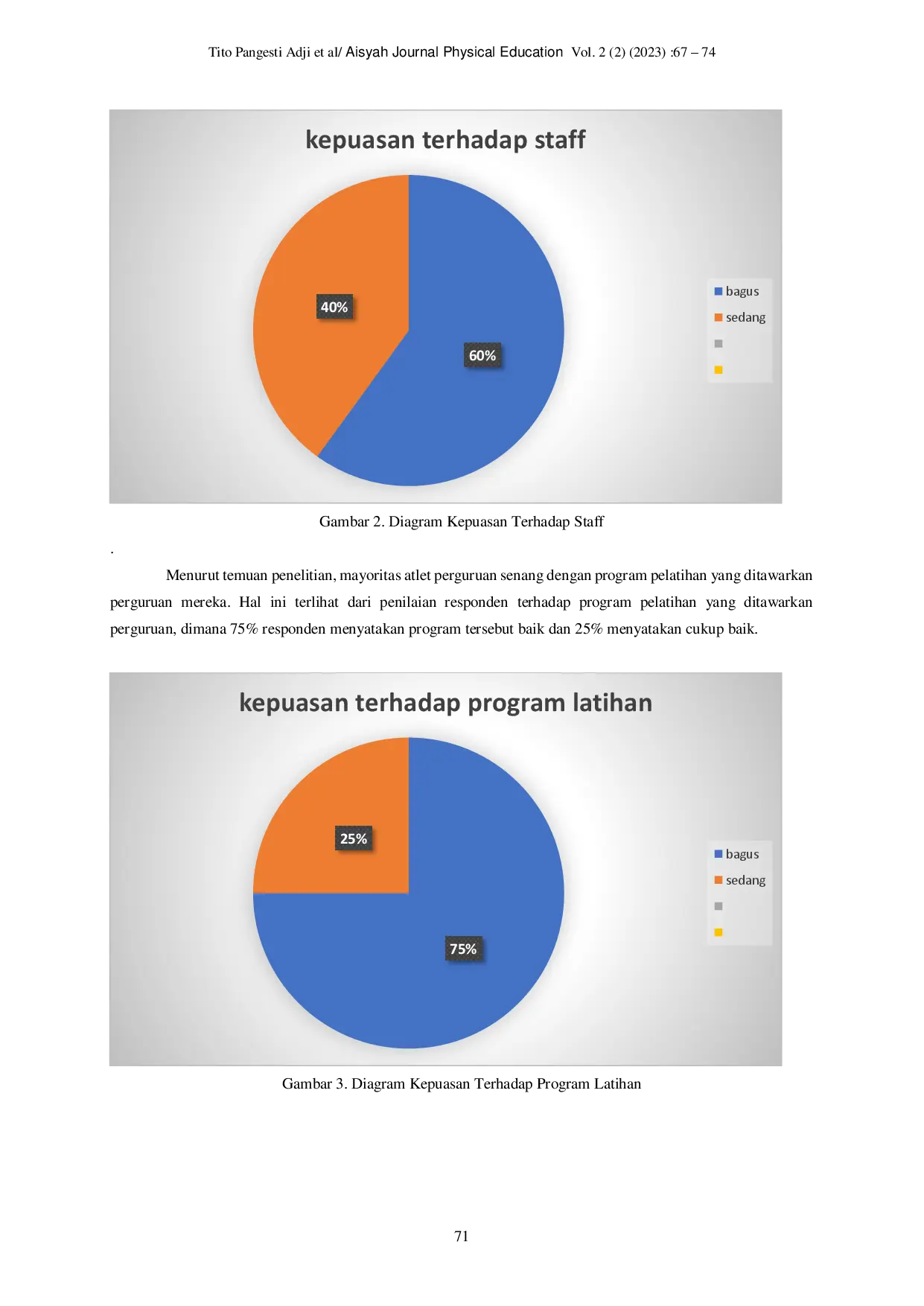

AISYAHUNIVERSITYAISYAHUNIVERSITY Populasi penelitian adalah dua puluh atlet Perguruan Pencak Silat Garuda Nusantara Kudus, dan sampel dipilih secara acak. SPSS. 21 digunakan untuk analisisPopulasi penelitian adalah dua puluh atlet Perguruan Pencak Silat Garuda Nusantara Kudus, dan sampel dipilih secara acak. SPSS. 21 digunakan untuk analisis