UnlaUnla

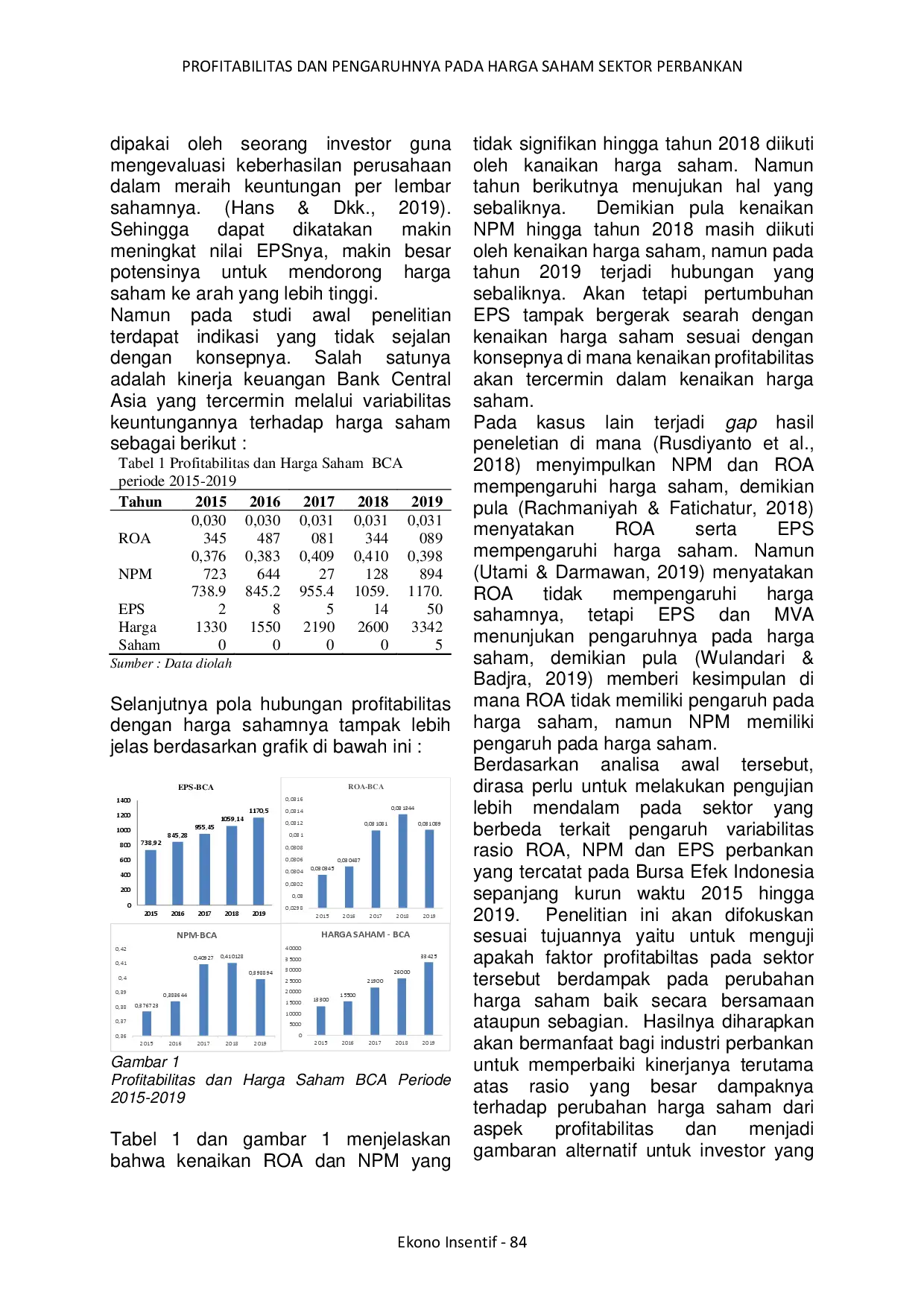

Almana : Jurnal Manajemen dan BisnisAlmana : Jurnal Manajemen dan BisnisThe fluctuation of stock prices in the food and beverage sector reflects investor responses to various financial performance indicators. This study aims to analyze the influence of Net Profit Margin (NPM), Return on Assets (ROA), and Earnings Per Share (EPS) on stock prices in 19 food and beverage companies listed on the Indonesia Stock Exchange (IDX) during the 2019–2023 period. Using a descriptive-verificative approach, the research employs multiple linear regression analysis based on secondary data from audited financial statements. The findings reveal that NPM has a significant negative effect on stock prices, indicating that higher margins do not always attract investor interest. ROA, although positively associated, does not have a statistically significant effect. In contrast, EPS has a significant positive impact, suggesting it is a key factor influencing investor decisions. Simultaneously, NPM, ROA, and EPS together significantly affect stock prices. These results underscore the importance of EPS as a reliable performance measure, while also suggesting that other qualitative or external factors may moderate the relationship between profitability ratios and market valuation. This research provides practical insights for investors, financial analysts, and company management in evaluating and responding to firm performance indicators.

The study concludes that Earnings Per Share (EPS) is the most influential factor affecting stock prices, with an increase in EPS tending to drive stock prices higher.Net Profit Margin (NPM) demonstrates a negative relationship with stock prices, suggesting higher margins do not always equate to increased stock value.Return on Assets (ROA) does not have a statistically significant impact on stock prices, indicating other factors may play a more substantial role in market dynamics.

Penelitian selanjutnya dapat memperluas analisis dengan memasukkan variabel-variabel lain yang mungkin memengaruhi harga saham, seperti tingkat utang perusahaan, rasio lancar, atau faktor-faktor makroekonomi seperti inflasi dan suku bunga. Hal ini akan memberikan gambaran yang lebih komprehensif mengenai faktor-faktor yang memengaruhi valuasi perusahaan di sektor makanan dan minuman. Selain itu, studi yang lebih mendalam dapat dilakukan untuk menguji pengaruh moderasi dari faktor-faktor eksternal, seperti sentimen pasar atau perubahan regulasi pemerintah, terhadap hubungan antara rasio keuangan dan harga saham. Dengan memahami bagaimana faktor-faktor ini berinteraksi, investor dan manajer perusahaan dapat membuat keputusan yang lebih tepat. Terakhir, penelitian dapat difokuskan pada analisis perbandingan antara perusahaan-perusahaan dengan kinerja tinggi dan rendah di sektor makanan dan minuman untuk mengidentifikasi praktik-praktik terbaik yang dapat meningkatkan nilai perusahaan dan menarik investor.

- The Effect of ECB Unconventional Monetary Policy on Firms’ Performance during the Global Financial... doi.org/10.3390/jrfm16050258The Effect of ECB Unconventional Monetary Policy on FirmsAo Performance during the Global Financial doi 10 3390 jrfm16050258

- Exploring the Influence of Earnings Management on the Value Relevance of Financial Statements: Evidence... mdpi.com/2227-7072/12/3/72Exploring the Influence of Earnings Management on the Value Relevance of Financial Statements Evidence mdpi 2227 7072 12 3 72

- The Influence of NPM, ROA, and EPS on Stock Prices in Food and Beverage Firms | Almana : Jurnal Manajemen... journalfeb.unla.ac.id/index.php/almana/article/view/2847The Influence of NPM ROA and EPS on Stock Prices in Food and Beverage Firms Almana Jurnal Manajemen journalfeb unla ac index php almana article view 2847

| File size | 447.22 KB |

| Pages | 11 |

| DMCA | Report |

Related /

PIPI The growth of a countrys economy is also influenced by investment activities. The aim of this study is to analyze the effects of Return On Equity (ROE),The growth of a countrys economy is also influenced by investment activities. The aim of this study is to analyze the effects of Return On Equity (ROE),

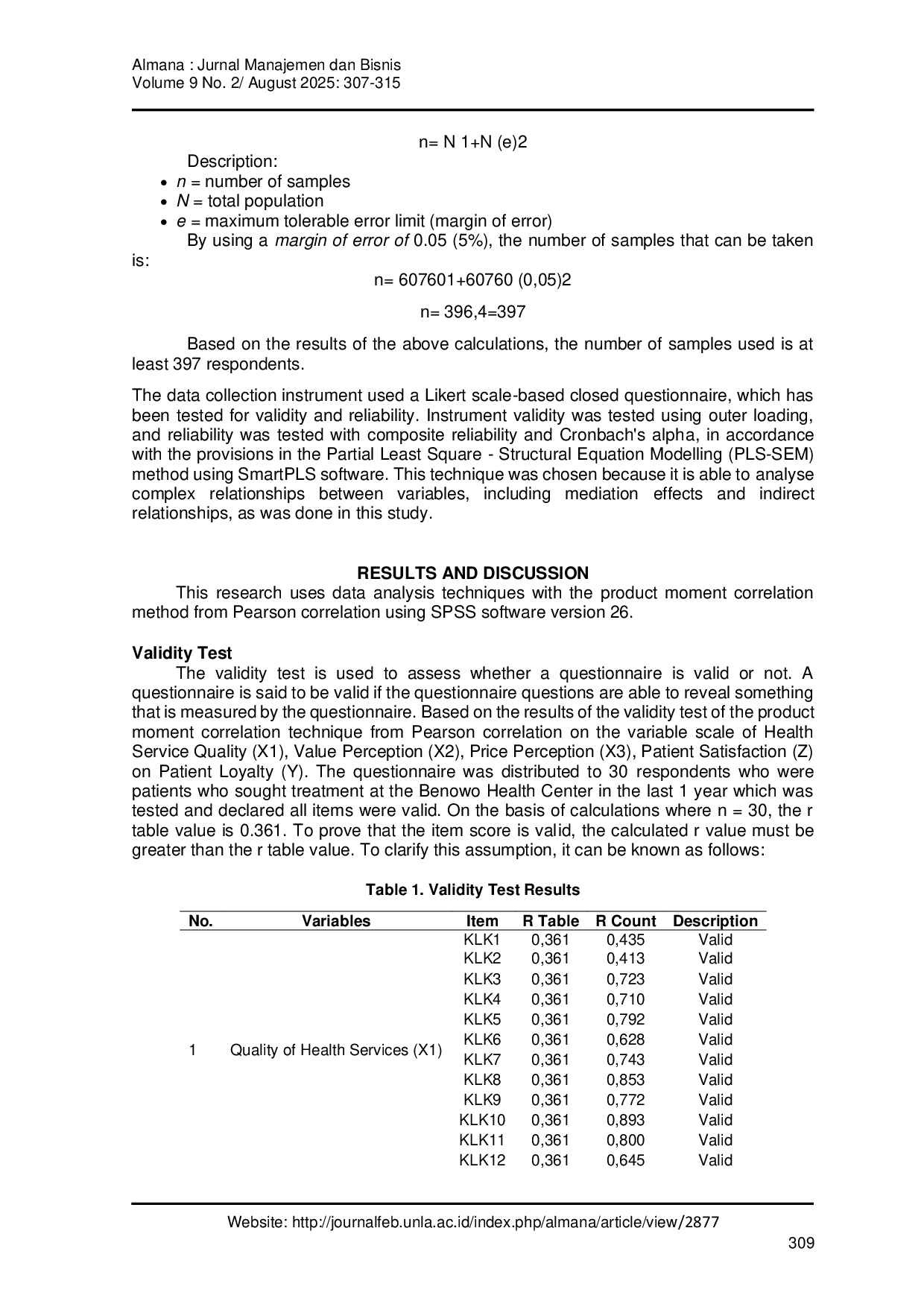

UnlaUnla Using a quantitative explanatory approach, data were collected from 397 respondents selected through purposive sampling from the 2023 patient population.Using a quantitative explanatory approach, data were collected from 397 respondents selected through purposive sampling from the 2023 patient population.

LIMM PUBLIMM PUB Penelitian ini menunjukkan bahwa perusahaan yang mengelola likuiditasnya dengan baik cenderung memiliki stabilitas keuangan yang lebih baik, mengurangiPenelitian ini menunjukkan bahwa perusahaan yang mengelola likuiditasnya dengan baik cenderung memiliki stabilitas keuangan yang lebih baik, mengurangi

ARSILMEDIAARSILMEDIA Program KUR ini diluncurkan berdasarkan instruksi presiden Nomor 6 Tahun 2007. KUR dijalankan oleh beberapa bank, seperti BRI, BNI, dan Mandiri, dan menargetkanProgram KUR ini diluncurkan berdasarkan instruksi presiden Nomor 6 Tahun 2007. KUR dijalankan oleh beberapa bank, seperti BRI, BNI, dan Mandiri, dan menargetkan

LLDIKTI4LLDIKTI4 Studi ini menggunakan pendekatan kuatitatif, di mana sampel diambil secara purposive dan dihasilkan delapan belas sampel perusahaan. Dengan menggunakanStudi ini menggunakan pendekatan kuatitatif, di mana sampel diambil secara purposive dan dihasilkan delapan belas sampel perusahaan. Dengan menggunakan

UPDMUPDM Metode penelitian yang digunakan dalam penelitian ini adalah metode kausal. Peneliti menggunakan metode analisis regresi linier berganda dengan menggunakanMetode penelitian yang digunakan dalam penelitian ini adalah metode kausal. Peneliti menggunakan metode analisis regresi linier berganda dengan menggunakan

POLTEKKES PALUPOLTEKKES PALU Tujuan penelitian ini untuk mengetahui hubungan status gizi dengan usia Menarche di SMP Negeri 6 Palu. Metode: Penelitian ini menggunakan pendekatan crossTujuan penelitian ini untuk mengetahui hubungan status gizi dengan usia Menarche di SMP Negeri 6 Palu. Metode: Penelitian ini menggunakan pendekatan cross

IAINSORONGIAINSORONG Saad ibn Abi Waqqas, seorang sahabat Nabi, datang ke daratan Cina untuk menyampaikan pesan Nabi dan memperkenalkan Islam kepada rakyat negeri tersebut.Saad ibn Abi Waqqas, seorang sahabat Nabi, datang ke daratan Cina untuk menyampaikan pesan Nabi dan memperkenalkan Islam kepada rakyat negeri tersebut.

Useful /

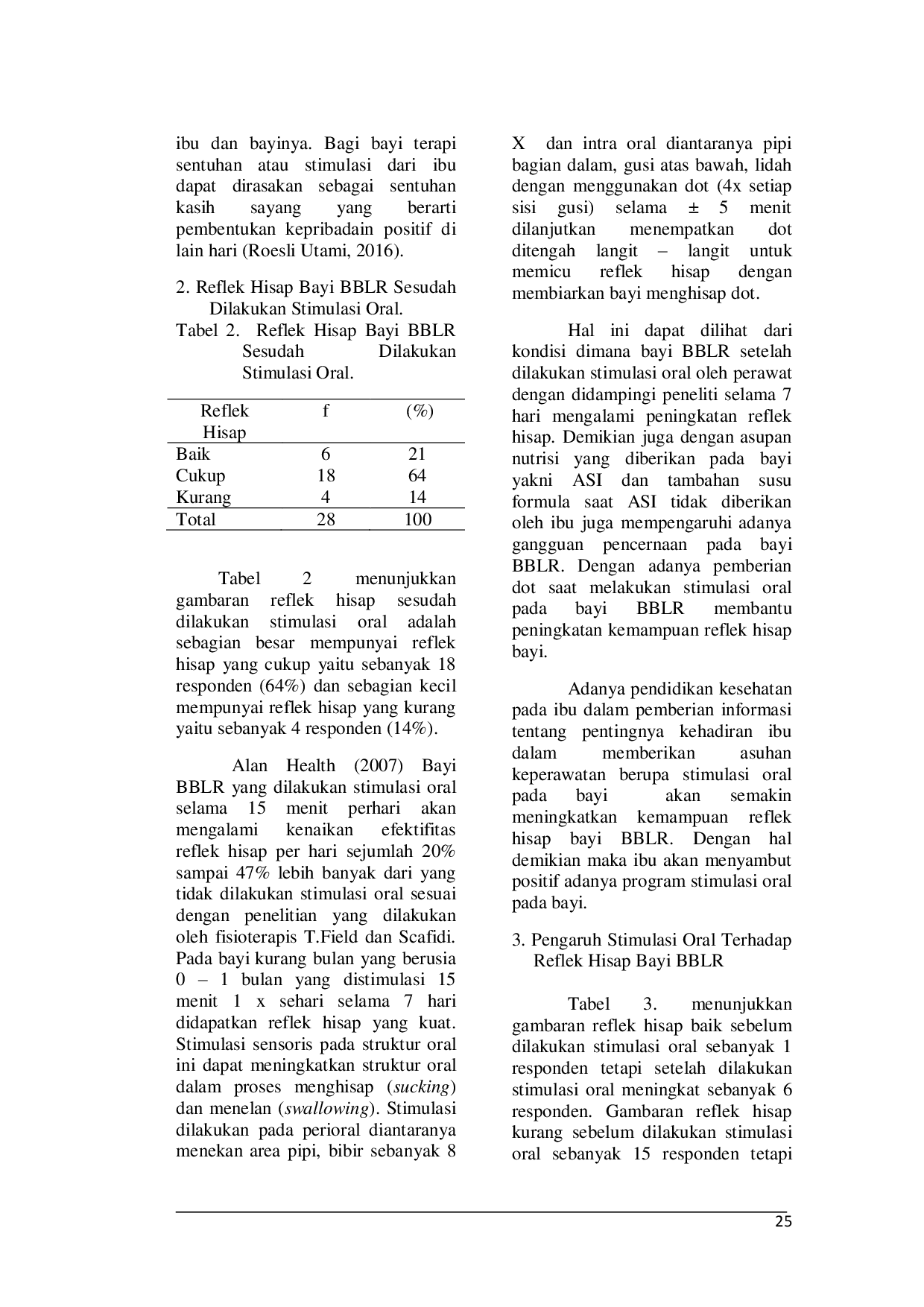

UNIGRESUNIGRES Hasil penelitian menunjukkan bahwa reflek hisap sebelum pemberian stimulasi oral menunjukkan reflek hisap kurang yaitu sebanyak 15 responden (54%) danHasil penelitian menunjukkan bahwa reflek hisap sebelum pemberian stimulasi oral menunjukkan reflek hisap kurang yaitu sebanyak 15 responden (54%) dan

UNIGRESUNIGRES Pasien diambil menggunakan teknik consequtive sampling dan didapatkan 26 pasien yang sesuai dengan criteria inklusi melakukan HBET senam lutut selama 2Pasien diambil menggunakan teknik consequtive sampling dan didapatkan 26 pasien yang sesuai dengan criteria inklusi melakukan HBET senam lutut selama 2

IAINSORONGIAINSORONG Pemerintah Islam khilafah dipelopori oleh Nabi, dan khulafaurrasyidin. Dalam konsep pemikiran Islam, sudah sepantasnya mendapat perhatian, karena hanyaPemerintah Islam khilafah dipelopori oleh Nabi, dan khulafaurrasyidin. Dalam konsep pemikiran Islam, sudah sepantasnya mendapat perhatian, karena hanya

IAINSORONGIAINSORONG Peristiwa di Paris pada tahun 1848 menyingkap karakter sosialis kaum proletar, sementara kaum liberal borjuis takut pada gerakan kelas ini dibandingkanPeristiwa di Paris pada tahun 1848 menyingkap karakter sosialis kaum proletar, sementara kaum liberal borjuis takut pada gerakan kelas ini dibandingkan