DINASTIPUBDINASTIPUB

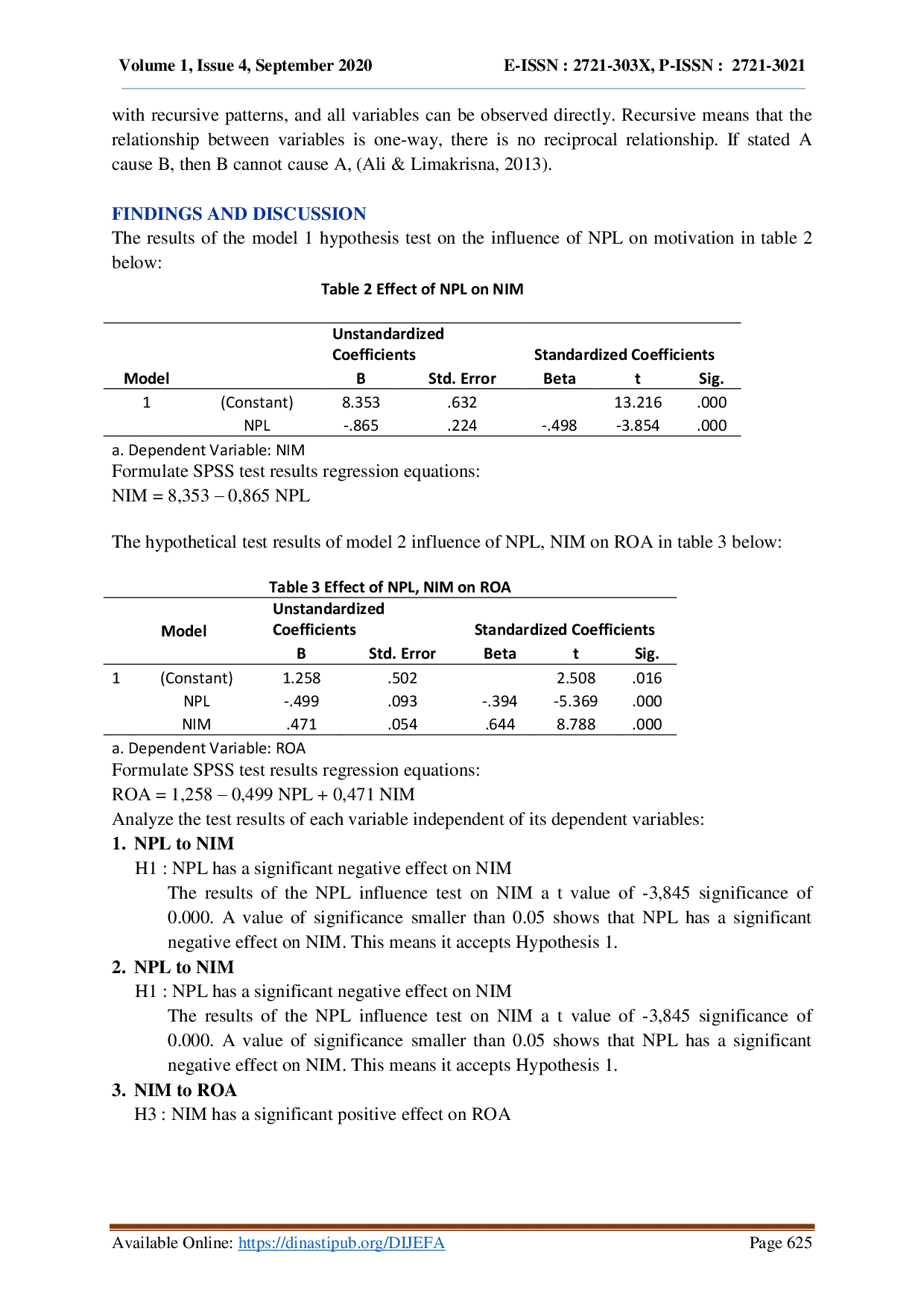

Dinasti International Journal of Economics, Finance & AccountingDinasti International Journal of Economics, Finance & AccountingThis study aims to analyze the effect of Loan to Deposit Ratio (LDR) and Net Interest Margin (NIM) on Return on Assets (ROA) and the influence of Loan to Deposit Ratio (LDR), Net Interest Margin (NIM) and Return on Assets (ROA) to the Capital Adequacy Ratio (CAR) of the five largest private banks in Indonesia in the 2009 - 2018 period. The sample used in this study consisted of 5 conventional private banks listed on the IDX. This study uses panel data obtained from Bank Indonesia reports and annual financial reports that have been audited and published by sample banks on the IDX By using the Fixed Effect Model with the help of Eviews 10, the F test shows that the LDR and NIM variables together have a significant effect on ROA of 77.69% while the remaining 22.31% is influenced by other factors not included in the research model. LDR, NIM and ROA variables together have a significant effect on CAR of 42.85% while the remaining 57.15% are influenced by other factors not included in this study where previously classical assumption tests such as Stationary, Multicollinearity, Test Heteroscedasticity and Autocorrelation test were conducted. Based on the results of the t test it was found that the LDR and NIM partially had no significant effect on ROA. LDR has a significant effect on CAR. Meanwhile, NIM and ROA partially had no significant effect on CAR.

The results of data testing using the E-views 10.0 tool obtained the FEM (Fixed Effect Model) model, after the F test was carried out, the independent variables together had a significant effect on the dependent variable.The LDR and NIM variables simultaneously have a significant effect on ROA at the five largest private banks in Indonesia in 2009-2018.Furthermore, the LDR variable has a significant effect on CAR at the five largest private banks in Indonesia in 2009-2018.

Penelitian selanjutnya dapat dilakukan dengan memperluas cakupan sampel tidak hanya terbatas pada lima bank terbesar, tetapi mencakup lebih banyak bank swasta di Indonesia untuk mendapatkan hasil yang lebih representatif dan generalisasi yang lebih kuat. Selain itu, penelitian dapat menggali lebih dalam mengenai faktor-faktor lain yang mungkin mempengaruhi ROA dan CAR, seperti faktor makroekonomi (tingkat inflasi, suku bunga, pertumbuhan ekonomi) atau faktor spesifik perusahaan (struktur kepemilikan, kualitas manajemen risiko). Penelitian lanjutan juga dapat menginvestigasi pengaruh variabel moderasi, seperti ukuran bank atau kompleksitas operasional, terhadap hubungan antara LDR, NIM, ROA, dan CAR. Hal ini akan memberikan pemahaman yang lebih komprehensif mengenai dinamika yang terjadi dalam industri perbankan Indonesia. Terakhir, penelitian dapat menggunakan metode analisis yang lebih canggih, seperti analisis time series atau model ekonometrika yang lebih kompleks, untuk mengidentifikasi hubungan kausalitas yang lebih akurat dan memprediksi tren di masa depan. Dengan demikian, hasil penelitian dapat memberikan kontribusi yang lebih signifikan bagi para pembuat kebijakan, manajer bank, dan akademisi.

| File size | 416.98 KB |

| Pages | 13 |

| DMCA | ReportReport |

Related /

DINASTIPUBDINASTIPUB Sampel ditentukan dengan metode purposif sebanyak 60 perusahaan. Teknik analisis meliputi uji t statistik serta uji asumsi klasik (uji normalitas, multikolinearitas,Sampel ditentukan dengan metode purposif sebanyak 60 perusahaan. Teknik analisis meliputi uji t statistik serta uji asumsi klasik (uji normalitas, multikolinearitas,

DINASTIPUBDINASTIPUB Untuk menerapkan model, pertimbangan dilakukan melalui konsep lag produksi yang tersedia serta keberadaan harga yang diharapkan dan pendapatan kotor karenaUntuk menerapkan model, pertimbangan dilakukan melalui konsep lag produksi yang tersedia serta keberadaan harga yang diharapkan dan pendapatan kotor karena

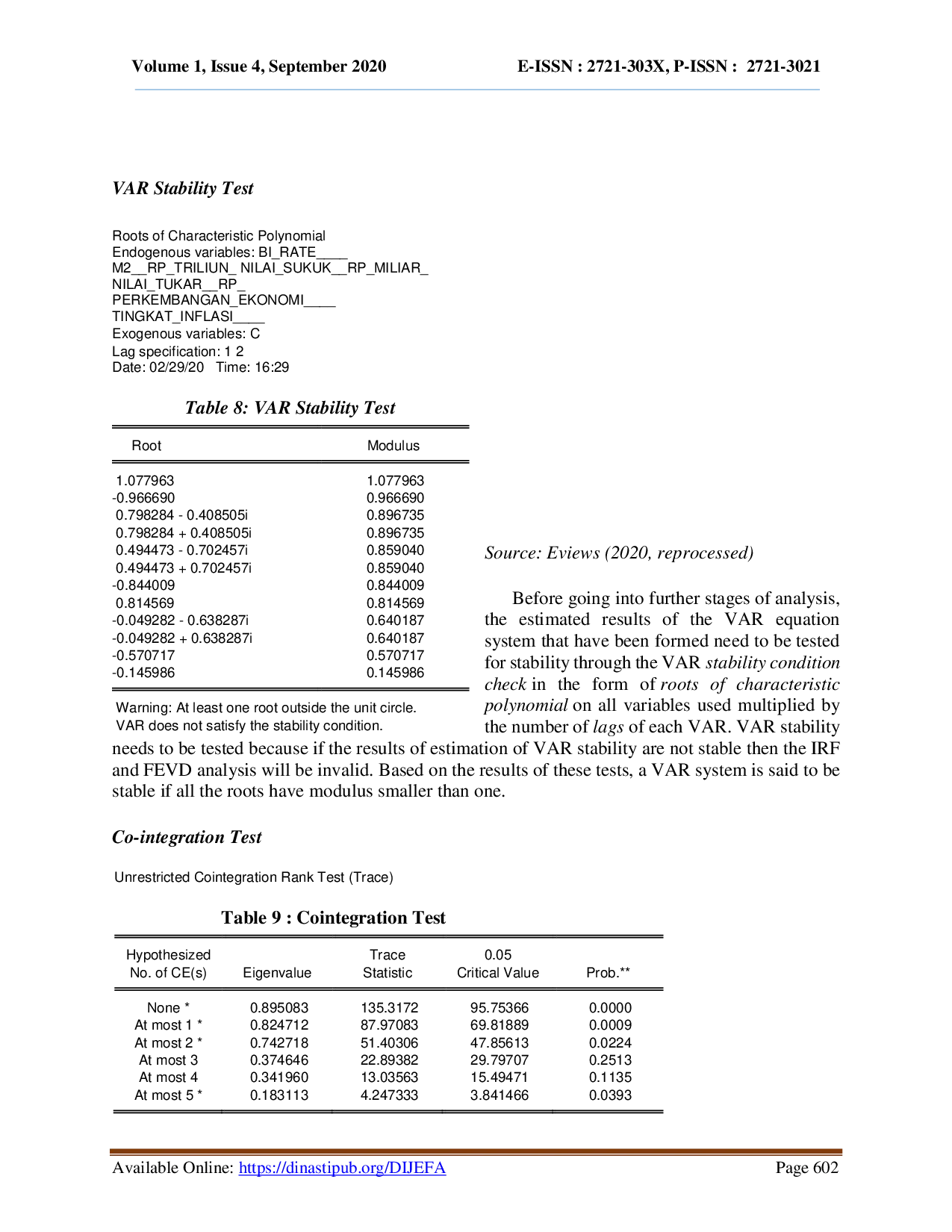

DINASTIPUBDINASTIPUB Variabel bebas dalam penelitian ini adalah inflasi, pertumbuhan ekonomi, total uang beredar, nilai tukar, dan suku bunga acuan Bank Indonesia (BI), sedangkanVariabel bebas dalam penelitian ini adalah inflasi, pertumbuhan ekonomi, total uang beredar, nilai tukar, dan suku bunga acuan Bank Indonesia (BI), sedangkan

DINASTIPUBDINASTIPUB Hasil analisis regresi simultan menyatakan bahwa profitabilitas, likuiditas, pertumbuhan struktur aset, dan ukuran memengaruhi struktur modal. Hasil analisisHasil analisis regresi simultan menyatakan bahwa profitabilitas, likuiditas, pertumbuhan struktur aset, dan ukuran memengaruhi struktur modal. Hasil analisis

Useful /

IAI TABAHIAI TABAH Hasil yang diperoleh menunjukkan bahwa Islam Ahmadiyah selaras dengan teori yang diungkapkan oleh Axel Honneth, namun sebagian besar respon masyarakatHasil yang diperoleh menunjukkan bahwa Islam Ahmadiyah selaras dengan teori yang diungkapkan oleh Axel Honneth, namun sebagian besar respon masyarakat

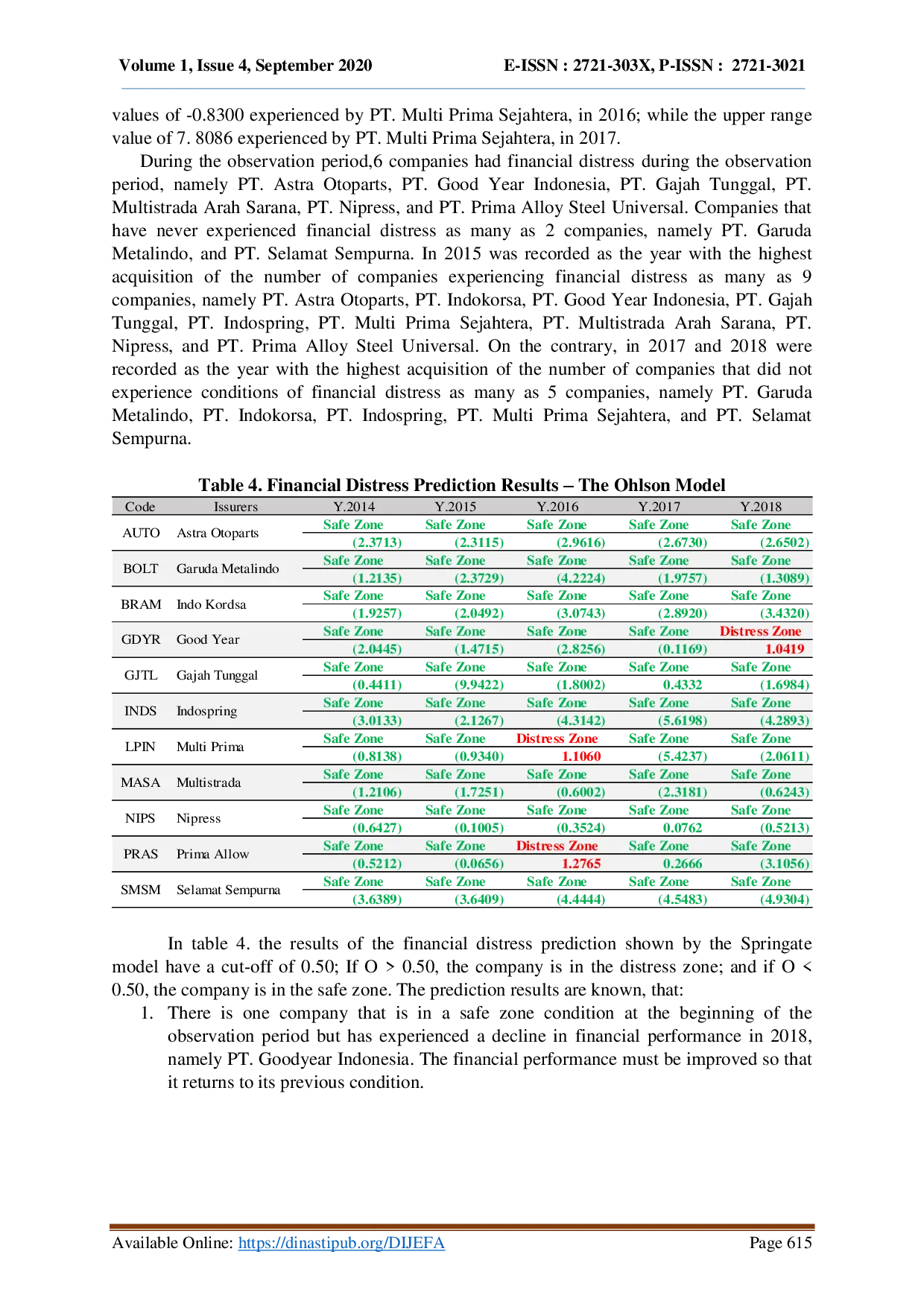

DINASTIPUBDINASTIPUB Hasilnya keempat model dapat memprediksi kesulitan keuangan: model Altman menemukan 8 titik zona distress, 16 zona abu-abu, dan 31 zona aman; SpringateHasilnya keempat model dapat memprediksi kesulitan keuangan: model Altman menemukan 8 titik zona distress, 16 zona abu-abu, dan 31 zona aman; Springate

DINASTIPUBDINASTIPUB Bank pemerintah terdiri atas empat bank, yaitu Bank Rakyat Indonesia, Bank Negara Indonesia, Bank Mandiri, dan Bank Tabungan Negara. Salah satu rasio yangBank pemerintah terdiri atas empat bank, yaitu Bank Rakyat Indonesia, Bank Negara Indonesia, Bank Mandiri, dan Bank Tabungan Negara. Salah satu rasio yang

DINASTIPUBDINASTIPUB Selain itu, dapat juga dilakukan analisis komparatif antara perusahaan tekstil dan garment yang berkinerja tinggi dengan perusahaan berkinerja rendah untukSelain itu, dapat juga dilakukan analisis komparatif antara perusahaan tekstil dan garment yang berkinerja tinggi dengan perusahaan berkinerja rendah untuk